Are you an employee looking to set up direct deposit with your employer, or an employer seeking to provide this convenient payment option to your staff? Either way, filling out a Direct Deposit Form Intuit is a straightforward process that can be completed in just a few easy steps. In this article, we will guide you through the process, providing you with the information you need to get started.

The Importance of Direct Deposit

Before we dive into the steps, let's take a look at why direct deposit is such a popular payment option. Direct deposit allows employers to deposit funds directly into an employee's bank account, eliminating the need for paper checks. This not only saves time and reduces the risk of lost or stolen checks, but it also provides employees with faster access to their pay.

Step 1: Gather Required Information

To fill out a Direct Deposit Form Intuit, you will need to gather some basic information. This includes:

- Your name and address

- Your bank account number and routing number

- The type of account you want to use for direct deposit (checking or savings)

- Your employer's name and address

Where to Find Your Bank Account Information

If you're not sure where to find your bank account information, don't worry. You can usually find your account number and routing number on:

- Your check or deposit slip

- Your bank statement

- Your online banking profile

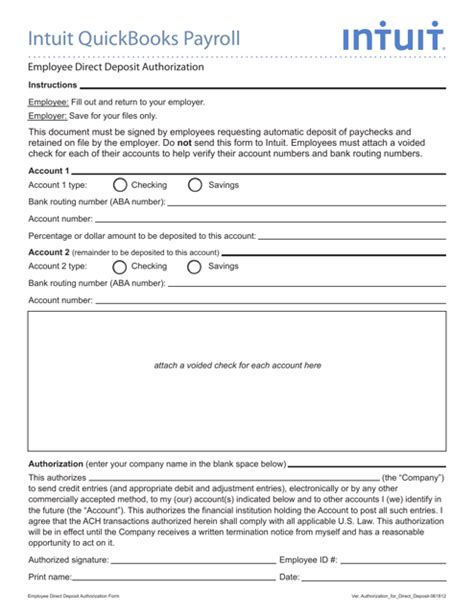

Step 2: Fill Out the Direct Deposit Form

Now that you have all the required information, it's time to fill out the Direct Deposit Form Intuit. The form will typically ask for the following information:

- Your name and address

- Your bank account number and routing number

- The type of account you want to use for direct deposit

- Your employer's name and address

- The amount you want to deposit (if you're setting up partial direct deposit)

Be sure to fill out the form accurately and completely, as any errors may delay the processing of your direct deposit.

Tips for Filling Out the Form

- Use a black or blue pen to fill out the form

- Make sure to sign the form in the designated area

- If you're setting up partial direct deposit, be sure to specify the amount you want to deposit

Step 3: Attach a Voided Check (If Required)

Some employers may require you to attach a voided check to the Direct Deposit Form Intuit. This is to verify your bank account information. If you're required to attach a voided check, make sure to:

- Use a check from the same bank account you're setting up for direct deposit

- Void the check by writing "VOID" across the front

- Attach the voided check to the form

Step 4: Submit the Form

Once you've completed the form and attached a voided check (if required), it's time to submit it to your employer. You can usually do this by:

- Handing it in to your HR representative

- Mailing it to your employer's payroll department

- Submitting it electronically through your employer's online portal

What to Expect Next

After submitting the form, your employer will review it and verify your bank account information. This may take a few days to a week, depending on your employer's payroll processing schedule. Once your direct deposit is set up, you'll receive your pay directly into your bank account.

Step 5: Confirm Your Direct Deposit

Finally, it's a good idea to confirm your direct deposit with your employer and bank. You can do this by:

- Checking your bank statement to ensure the direct deposit was made

- Contacting your employer's payroll department to confirm the setup

- Verifying the direct deposit amount and frequency

By following these 5 easy steps, you can set up direct deposit with your employer and enjoy the convenience of having your pay deposited directly into your bank account.

We hope this article has been helpful in guiding you through the process of filling out a Direct Deposit Form Intuit. If you have any further questions or concerns, please don't hesitate to reach out to your employer's payroll department or your bank.

What is direct deposit?

+Direct deposit is a payment option that allows employers to deposit funds directly into an employee's bank account.

How do I find my bank account number and routing number?

+You can usually find your account number and routing number on your check or deposit slip, bank statement, or online banking profile.

How long does it take to set up direct deposit?

+The setup time may vary depending on your employer's payroll processing schedule, but it's usually a few days to a week.