Setting up a direct deposit is a convenient way to receive your paycheck, benefits, or other regular payments directly into your bank account. TD Bank, one of the largest banks in North America, offers a straightforward process for direct deposit setup. In this article, we will walk you through the TD Bank Direct Deposit Authorization Form process, highlighting its benefits, requirements, and steps to complete it.

Benefits of Direct Deposit with TD Bank

Direct deposit offers several advantages, including:

- Faster access to your money: Your funds are deposited directly into your account, making them available sooner.

- Reduced risk of lost or stolen checks: Since payments are made electronically, there's less chance of your funds being misplaced or stolen.

- Increased security: Direct deposit reduces the risk of identity theft and check tampering.

- Environmental benefits: Electronic payments reduce the need for paper checks and envelopes.

TD Bank Direct Deposit Authorization Form Requirements

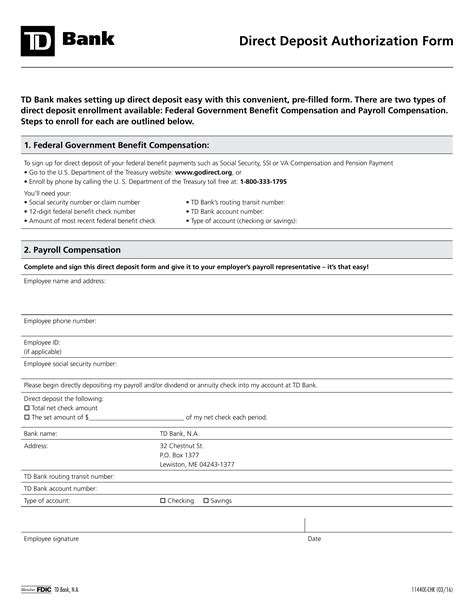

To complete the TD Bank Direct Deposit Authorization Form, you will need to provide the following information:

- Your name and address

- Your TD Bank account number and routing number (found on the bottom of your checks or on your account statement)

- The type of deposit you want to set up (e.g., payroll, Social Security benefits, or other regular payments)

- The amount or percentage of the payment you want to deposit into your account

How to Complete the TD Bank Direct Deposit Authorization Form

To complete the TD Bank Direct Deposit Authorization Form, follow these steps:

- Download or obtain the form: You can download the form from the TD Bank website or pick one up at a local branch.

- Fill out the form: Provide the required information, making sure to sign and date the form.

- Attach a voided check: Include a voided check from your TD Bank account to verify your account information.

- Submit the form: Return the completed form to your employer, benefits provider, or other payer, along with a copy of the voided check.

TD Bank Direct Deposit Authorization Form for Employers

If you are an employer looking to set up direct deposit for your employees, you will need to provide the following information:

- Employee's name and address

- Employee's TD Bank account number and routing number

- Type of deposit (e.g., payroll)

- Frequency of payments (e.g., bi-weekly, monthly)

Common Issues with the TD Bank Direct Deposit Authorization Form

Some common issues that may arise when completing the TD Bank Direct Deposit Authorization Form include:

- Incorrect account information: Double-check your account number and routing number to ensure accuracy.

- Missing or incomplete information: Make sure to fill out all required fields and attach a voided check.

- Delayed or rejected payments: Verify that your employer or benefits provider has received and processed the form correctly.

Tips for Completing the TD Bank Direct Deposit Authorization Form

To ensure a smooth direct deposit setup process:

- Read the form carefully: Understand the requirements and instructions before filling out the form.

- Use black ink: Sign the form with black ink to ensure it scans correctly.

- Make a copy: Keep a copy of the completed form for your records.

Conclusion and Next Steps

Setting up direct deposit with TD Bank is a straightforward process that offers numerous benefits. By following the steps outlined in this article and providing the required information, you can enjoy faster access to your money, reduced risk of lost or stolen checks, and increased security. If you have any questions or concerns, don't hesitate to reach out to TD Bank's customer support team.

What's your experience with direct deposit? Share your thoughts in the comments below!

What is the TD Bank routing number?

+The TD Bank routing number is 031201360.

How long does it take to set up direct deposit with TD Bank?

+It typically takes 1-2 pay periods to set up direct deposit with TD Bank.

Can I set up direct deposit for multiple accounts with TD Bank?

+Yes, you can set up direct deposit for multiple accounts with TD Bank.