The New Jersey Extension Form is a crucial document for individuals and businesses in the state who need more time to file their tax returns. The deadline for filing taxes can be daunting, and the consequences of missing it can be severe. However, with the extension form, taxpayers can breathe a sigh of relief and gain extra time to gather their necessary documents and submit their returns.

In this article, we will provide a comprehensive guide on how to file the New Jersey Extension Form, the benefits of filing for an extension, and the consequences of missing the deadline. We will also provide practical examples and statistical data to help illustrate the importance of filing for an extension.

Understanding the New Jersey Extension Form

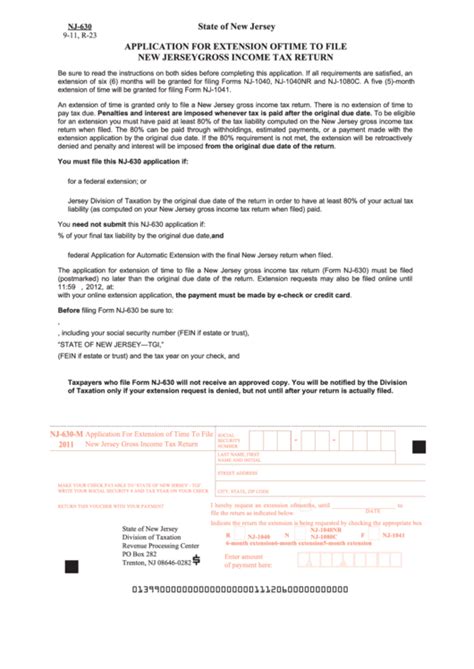

The New Jersey Extension Form, also known as Form NJ-630, is a document that allows taxpayers to request an automatic six-month extension of time to file their New Jersey income tax return. The form is used to extend the deadline for filing the return, but it does not extend the time to pay any taxes owed. Taxpayers who file for an extension must still pay any estimated taxes by the original deadline to avoid penalties and interest.

Who Needs to File the New Jersey Extension Form?

Not everyone needs to file the New Jersey Extension Form. Taxpayers who have already filed their tax return on time do not need to file for an extension. However, taxpayers who need more time to gather their documents, complete their return, or resolve any issues with their return may need to file for an extension.

Some common scenarios where taxpayers may need to file for an extension include:

- Self-employed individuals who need more time to gather business expense records

- Taxpayers who have complex tax situations, such as multiple income sources or investments

- Taxpayers who are waiting for missing forms or documents, such as a W-2 or 1099

- Taxpayers who are experiencing personal or financial difficulties that make it difficult to file on time

Benefits of Filing for an Extension

Filing for an extension can provide several benefits for taxpayers. Some of the benefits include:

- Avoiding penalties and interest: By filing for an extension, taxpayers can avoid the penalties and interest that come with missing the deadline.

- Reducing stress: Filing for an extension can give taxpayers more time to gather their documents and complete their return, reducing stress and anxiety.

- Increasing accuracy: With more time to review and complete their return, taxpayers can reduce the risk of errors and increase the accuracy of their return.

- Improving financial planning: Filing for an extension can give taxpayers more time to plan and budget for their tax liability.

Consequences of Missing the Deadline

Missing the deadline for filing taxes can have severe consequences. Some of the consequences include:

- Penalties: Taxpayers who miss the deadline may be subject to penalties, which can range from 5% to 25% of the unpaid taxes.

- Interest: Taxpayers who miss the deadline may also be subject to interest on the unpaid taxes, which can accrue over time.

- Late filing fees: Taxpayers who miss the deadline may also be subject to late filing fees, which can range from $50 to $100.

How to File the New Jersey Extension Form

Filing the New Jersey Extension Form is a relatively straightforward process. Here are the steps to follow:

- Gather necessary documents: Taxpayers will need to gather their tax-related documents, including their W-2 forms, 1099 forms, and any other relevant documents.

- Complete Form NJ-630: Taxpayers will need to complete Form NJ-630, which can be downloaded from the New Jersey Department of Treasury website.

- Calculate estimated taxes: Taxpayers will need to calculate their estimated taxes owed and pay any amount due by the original deadline.

- File the form: Taxpayers can file the form online or by mail.

- Pay any remaining taxes: Taxpayers will need to pay any remaining taxes owed by the extended deadline.

Common Mistakes to Avoid

When filing the New Jersey Extension Form, taxpayers should avoid the following common mistakes:

- Missing the deadline: Taxpayers should ensure that they file the form by the original deadline to avoid penalties and interest.

- Underestimating taxes owed: Taxpayers should ensure that they accurately calculate their estimated taxes owed to avoid underpayment penalties.

- Not paying estimated taxes: Taxpayers should ensure that they pay any estimated taxes owed by the original deadline to avoid penalties and interest.

Conclusion

In conclusion, the New Jersey Extension Form is a valuable tool for taxpayers who need more time to file their tax return. By filing for an extension, taxpayers can avoid penalties and interest, reduce stress, and increase accuracy. However, taxpayers should be aware of the consequences of missing the deadline and take steps to avoid common mistakes.

If you have any questions or concerns about filing the New Jersey Extension Form, we encourage you to share them in the comments below. Additionally, if you found this article helpful, please share it with your friends and family who may be facing similar tax challenges.

What is the deadline for filing the New Jersey Extension Form?

+The deadline for filing the New Jersey Extension Form is the same as the original deadline for filing taxes, which is typically April 15th.