Filing taxes can be a daunting task, especially for those who are new to the process or are unsure of the specific requirements for their city. In Detroit, residents are required to file a city tax form in addition to their federal and state taxes. In this article, we will break down the 5 steps to filing the Detroit city tax form, making it easier for you to navigate the process.

The importance of filing city taxes cannot be overstated. Not only is it a requirement by law, but it also helps to fund essential city services such as public safety, transportation, and education. By filing your city taxes, you are contributing to the well-being of your community and helping to make Detroit a better place to live.

In recent years, the city of Detroit has made significant strides in improving its tax filing process, making it easier and more convenient for residents to file their taxes. However, it is still important to understand the steps involved and to take the necessary precautions to ensure that your taxes are filed correctly.

Step 1: Determine Your Filing Status

The first step in filing your Detroit city tax form is to determine your filing status. This will depend on your marital status, age, and other factors. The city of Detroit offers several filing statuses, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er). You will need to choose the filing status that best applies to you.

It is also important to note that the city of Detroit has a unique filing status for residents who are 62 years or older. If you are a senior citizen, you may be eligible for a reduced tax rate or exemption.

Detroit City Tax Filing Statuses

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

- Senior citizen (62 years or older)

Step 2: Gather Required Documents

Once you have determined your filing status, the next step is to gather the required documents. You will need to have the following documents ready:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your federal tax return (Form 1040)

- Your state tax return (Form MI-1040)

- Any W-2 forms from your employer(s)

- Any 1099 forms for self-employment income

- Any other relevant tax documents

It is also a good idea to have a copy of your previous year's tax return, as this can help you to identify any changes or updates that you need to make.

Required Documents for Detroit City Tax Form

- Social Security number or ITIN

- Federal tax return (Form 1040)

- State tax return (Form MI-1040)

- W-2 forms

- 1099 forms

- Other relevant tax documents

Step 3: Choose a Filing Method

The city of Detroit offers several filing methods for residents to choose from. You can file your taxes online, by mail, or in person.

- Online filing: The city of Detroit offers an online tax filing system that allows you to file your taxes electronically. This is the fastest and most convenient way to file your taxes.

- Mail filing: You can also file your taxes by mail by sending your completed tax form to the city of Detroit.

- In-person filing: If you prefer to file your taxes in person, you can visit one of the city's tax offices.

Detroit City Tax Filing Methods

- Online filing

- Mail filing

- In-person filing

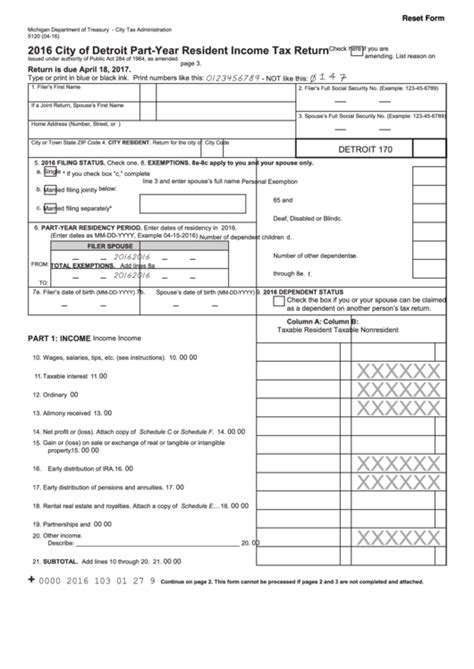

Step 4: Complete the Tax Form

Once you have chosen a filing method, the next step is to complete the tax form. The city of Detroit tax form is a relatively simple form that requires you to provide information about your income, deductions, and credits.

You will need to complete the following sections of the form:

- Income: You will need to report your income from all sources, including wages, salaries, tips, and self-employment income.

- Deductions: You will need to claim any deductions that you are eligible for, such as the standard deduction or itemized deductions.

- Credits: You will need to claim any credits that you are eligible for, such as the earned income tax credit or the child tax credit.

Completing the Detroit City Tax Form

- Income

- Deductions

- Credits

Step 5: Submit Your Tax Form

The final step is to submit your tax form to the city of Detroit. If you are filing online, you will need to submit your form electronically. If you are filing by mail, you will need to send your form to the city's tax office. If you are filing in person, you will need to bring your form to one of the city's tax offices.

It is also a good idea to keep a copy of your tax form for your records.

Submitting Your Detroit City Tax Form

- Online filing: Submit your form electronically

- Mail filing: Send your form to the city's tax office

- In-person filing: Bring your form to one of the city's tax offices

By following these 5 steps, you can easily file your Detroit city tax form and avoid any potential penalties or fines. Remember to take your time and carefully review your tax form before submitting it to ensure that it is accurate and complete.

If you have any questions or concerns about the tax filing process, you can contact the city of Detroit's tax office for assistance. They are available to help you with any questions or issues you may have.

What is the deadline for filing the Detroit city tax form?

+The deadline for filing the Detroit city tax form is typically April 15th of each year. However, this deadline may be extended in certain circumstances, such as if you are filing for an extension or if you are a resident of a foreign country.

Do I need to file a Detroit city tax form if I don't have any income?

+Yes, even if you don't have any income, you may still need to file a Detroit city tax form. This is because the city of Detroit requires all residents to file a tax form, regardless of income level.

Can I file my Detroit city tax form electronically?

+Yes, the city of Detroit offers an online tax filing system that allows you to file your taxes electronically. This is the fastest and most convenient way to file your taxes.