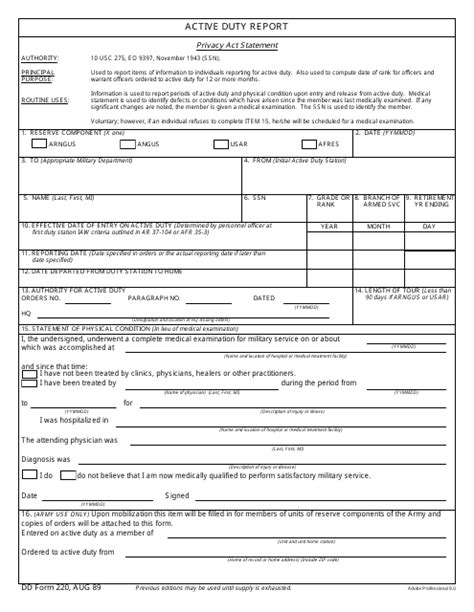

Filling out the DD Form 220, also known as the "Notification of Estimated Earnings (For Service Members)" form, can be a straightforward process if you understand what information is required and how to provide it accurately. The DD Form 220 is typically used by members of the United States Armed Forces to report their estimated earnings to the Defense Finance and Accounting Service (DFAS) or to their respective service branches' finance offices. This form is crucial for ensuring that service members receive accurate compensation, including allowances and deductions. Here's a step-by-step guide on how to fill out the DD Form 220 correctly:

Understanding the DD Form 220

Before you begin filling out the form, it's essential to understand what it entails. The DD Form 220 is divided into sections that require different types of information, including personal details, estimated earnings, allowances, and deductions.

Section 1: Personal Information

In this section, you will need to provide your personal details, including:

- Full name

- Social Security Number

- Military Service Number (if applicable)

- Pay grade

- Branch of service

- Unit or organization

Ensure that all the information provided is accurate and up-to-date, as any discrepancies could lead to delays in processing your estimated earnings.

Filling Out the Form

Now that you have a basic understanding of what the form requires, let's break down the process into manageable steps:

Step 1: Personal Information

- Full Name: Write your full name as it appears on your military ID or other official documents.

- Social Security Number: Provide your correct Social Security Number.

- Military Service Number: If you have a Military Service Number, fill it in. Otherwise, leave it blank.

- Pay Grade: Indicate your current pay grade.

- Branch of Service: Specify the branch of the military you are serving in.

- Unit or Organization: Provide the name of your unit or organization.

Step 2: Estimated Earnings

- Basic Pay: Estimate your basic pay based on your pay grade and years of service.

- Allowances: Calculate any allowances you are entitled to, such as housing allowance (BAH) or food allowance (BAS).

- Deductions: List any deductions you have, including health insurance, life insurance, or other deductions.

Step 3: Special Pays and Allowances

- Hazardous Duty Pay: If applicable, estimate any hazardous duty pay you are entitled to.

- Jump Pay: If you receive jump pay, include it in your estimates.

- Diving Duty Pay: For service members who receive diving duty pay, estimate this amount as well.

Step 4: Dependents and Other Information

- Dependents: List any dependents you have, including spouses and children.

- Residence: Specify your state of residence for tax purposes.

Step 5: Certification and Submission

- Signature: Sign the form to certify that the information provided is accurate.

- Date: Include the date you signed the form.

- Submission: Submit the form to your finance office or DFAS as directed.

Tips for Accuracy

To ensure accuracy and avoid delays, consider the following tips:

- Double-check your information: Make sure all personal details and estimates are accurate.

- Use the most current pay charts: Ensure you are using the latest pay charts for your estimates.

- Keep records: Keep a copy of the completed form for your records.

Conclusion

Filling out the DD Form 220 requires attention to detail and an understanding of your military compensation. By following these steps and tips, you can accurately estimate your earnings and ensure that your compensation is processed correctly. Remember, accuracy is key to avoiding delays or discrepancies in your pay.

Final Check

Before submitting the form, review it carefully to ensure:

- All sections are completed accurately.

- You have included all necessary documents or attachments.

- Your signature is legible and dated.

By taking the time to fill out the DD Form 220 correctly, you can ensure that your estimated earnings are accurate and processed efficiently.

What is the DD Form 220 used for?

+The DD Form 220 is used by members of the United States Armed Forces to report their estimated earnings to the Defense Finance and Accounting Service (DFAS) or to their respective service branches' finance offices.

How often do I need to fill out the DD Form 220?

+The frequency of filling out the DD Form 220 may vary depending on your service branch's policies and your individual circumstances. It's typically required when there's a change in your compensation or when requested by your finance office.

Can I submit the DD Form 220 electronically?

+Check with your finance office or DFAS for the most current submission guidelines. Some service branches may offer electronic submission options, while others may require a hard copy.