The DD Form 1861, also known as the Substitute W-9, is a crucial tax-related document used by the United States Department of Defense (DoD) and other federal agencies. This form serves as a substitute for the standard W-9 form, which is used to certify a taxpayer's identification number and to claim exemption from backup withholding.

The Importance of the DD Form 1861

The DD Form 1861 plays a vital role in ensuring that federal agencies comply with tax laws and regulations. By providing this form, individuals and businesses can verify their tax identification number and certify their exemption from backup withholding. This information is essential for federal agencies to accurately report income and taxes.

Who Needs to Fill Out the DD Form 1861?

The DD Form 1861 is required for individuals and businesses that provide services or goods to federal agencies, including:

- Independent contractors

- Consultants

- Freelancers

- Small businesses

- Large corporations

These entities must provide a completed DD Form 1861 to the federal agency they are working with, usually as part of the contracting process.

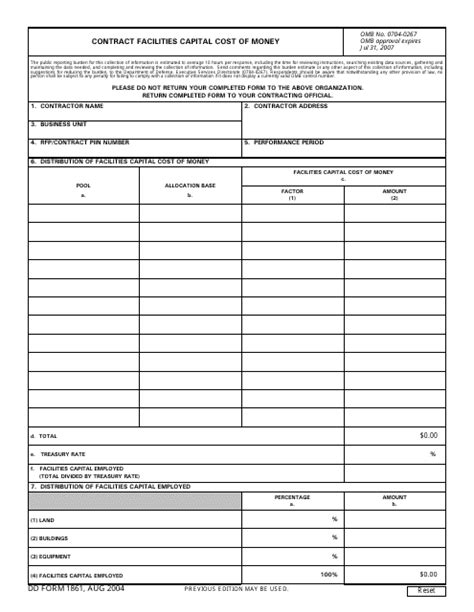

How to Fill Out the DD Form 1861

Filling out the DD Form 1861 is a straightforward process. Here's a step-by-step guide:

- Name and Address: Enter your name and address as it appears on your tax return.

- Taxpayer Identification Number: Provide your Employer Identification Number (EIN) or Social Security Number (SSN).

- Business Entity Type: Select the type of business entity you represent (e.g., individual, sole proprietor, corporation, etc.).

- Exemption from Backup Withholding: Check the box if you are exempt from backup withholding.

- Certification: Sign and date the form to certify that the information provided is accurate.

Common Mistakes to Avoid

When filling out the DD Form 1861, it's essential to avoid common mistakes that can lead to delays or rejection. Some of these mistakes include:

- Providing incorrect or incomplete information

- Failing to sign and date the form

- Not checking the correct box for exemption from backup withholding

- Not using the correct form version

Benefits of Using the DD Form 1861

Using the DD Form 1861 provides several benefits, including:

- Compliance with Tax Laws: The form ensures that federal agencies comply with tax laws and regulations.

- Accurate Reporting: The form helps federal agencies accurately report income and taxes.

- Streamlined Contracting Process: The form simplifies the contracting process by providing essential tax information upfront.

Conclusion

In conclusion, the DD Form 1861 is a critical tax-related document used by federal agencies to certify a taxpayer's identification number and claim exemption from backup withholding. By understanding the importance of this form and how to fill it out accurately, individuals and businesses can ensure compliance with tax laws and regulations, streamline the contracting process, and avoid common mistakes.

Get the Latest Information

To get the latest information on the DD Form 1861, including updates and revisions, visit the official website of the United States Department of Defense or consult with a tax professional.

What is the purpose of the DD Form 1861?

+The DD Form 1861 is used to certify a taxpayer's identification number and claim exemption from backup withholding.

Who needs to fill out the DD Form 1861?

+Individuals and businesses that provide services or goods to federal agencies need to fill out the DD Form 1861.

What are the benefits of using the DD Form 1861?

+The benefits of using the DD Form 1861 include compliance with tax laws, accurate reporting, and a streamlined contracting process.