The world of employment and benefits can be complex and overwhelming, especially when it comes to compliance with various regulations. One crucial aspect of this compliance is the submission of Form 5500, a critical document that employers must file annually with the U.S. Department of Labor. If you're an employer or a plan administrator, understanding the ins and outs of Form 5500 is essential to avoid penalties and ensure you're meeting your obligations. In this article, we'll delve into five key facts about Form 5500, providing you with a comprehensive overview of its importance, components, and filing requirements.

What is Form 5500?

Form 5500 is a yearly report that employers must submit to the U.S. Department of Labor's Employee Benefits Security Administration (EBSA) if they offer employee benefit plans, such as 401(k), health insurance, or other welfare benefit plans. The form serves as a compliance tool, enabling the EBSA to monitor and enforce the Employee Retirement Income Security Act of 1974 (ERISA) regulations. By filing Form 5500, employers demonstrate their adherence to ERISA's requirements, ensuring the protection of plan participants and beneficiaries.

Filing Requirements and Deadlines

The filing deadline for Form 5500 is typically July 31st of each year, with the option to request a two-and-a-half-month extension. Employers must file the form electronically through the EBSA's EFAST2 system, which provides a secure online platform for submitting the required information. It's essential to note that the EBSA may impose penalties for late or incomplete filings, making it crucial to meet the deadline and ensure the accuracy of the submitted information.

Components of Form 5500

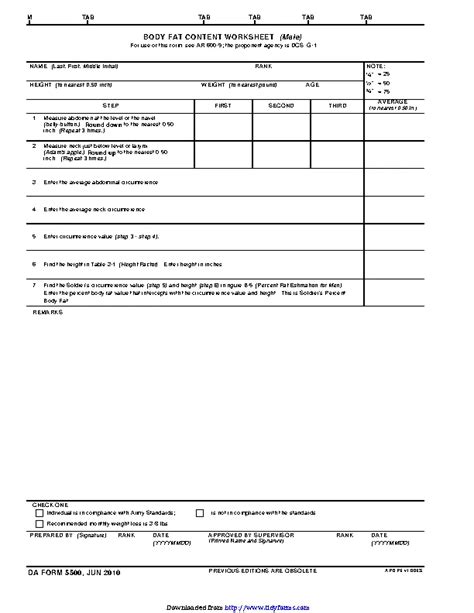

Form 5500 consists of several components, including:

- Form 5500: The main form, which provides general information about the plan, such as its name, employer identification number (EIN), and plan number.

- Schedules: These supplementary forms provide detailed information about the plan's financial condition, investments, and operations.

- Attachments: Employers may need to include additional documentation, such as the plan's summary annual report (SAR), trust agreements, or insurance contracts.

Types of Schedules

There are several types of schedules that employers may need to complete, depending on the specific requirements of their plan. Some common schedules include:

- Schedule A: Insurance Information

- Schedule C: Service Provider Information

- Schedule D: DFE/Participating Plan Information

- Schedule G: Financial Transaction Schedules

- Schedule H: Financial Information

Audits and Penalties

The EBSA may conduct audits to ensure compliance with ERISA regulations. If an employer fails to file Form 5500 or submits incomplete or inaccurate information, they may be subject to penalties, which can range from $1,100 to $10,000 or more, depending on the severity of the noncompliance.

Best Practices for Filing Form 5500

To avoid penalties and ensure a smooth filing process, employers should:

- Review and understand the filing requirements and deadlines

- Gather all necessary information and documentation before starting the filing process

- Use the EFAST2 system to file the form electronically

- Verify the accuracy and completeness of the submitted information

- Keep records of the filing, including the confirmation number and a copy of the submitted form

In conclusion, Form 5500 is a critical document that employers must file annually to demonstrate their compliance with ERISA regulations. By understanding the key facts about Form 5500, including its components, filing requirements, and potential penalties, employers can ensure a smooth and accurate filing process. Remember to take the necessary steps to prepare for the filing, and don't hesitate to seek professional guidance if needed.

We invite you to share your experiences or ask questions about Form 5500 in the comments section below. Your input will help others better understand the complexities of this important compliance requirement.

What is the purpose of Form 5500?

+Form 5500 is a yearly report that employers must submit to the U.S. Department of Labor's Employee Benefits Security Administration (EBSA) to demonstrate their compliance with ERISA regulations and ensure the protection of plan participants and beneficiaries.

What is the filing deadline for Form 5500?

+The filing deadline for Form 5500 is typically July 31st of each year, with the option to request a two-and-a-half-month extension.

What are the consequences of failing to file Form 5500?

+Employers who fail to file Form 5500 or submit incomplete or inaccurate information may be subject to penalties, which can range from $1,100 to $10,000 or more, depending on the severity of the noncompliance.