Applying for a PAN (Permanent Account Number) card is a crucial step for individuals and businesses in India, as it is required for various financial transactions and tax-related purposes. The CSF (Common Service Form) PAN form is a simplified application form introduced by the Income Tax Department to make the PAN application process more convenient and accessible. However, filling out the CSF PAN form correctly is essential to avoid delays or rejection of the application. Here are five ways to fill out the CSF PAN form correctly:

Understanding the CSF PAN Form Structure

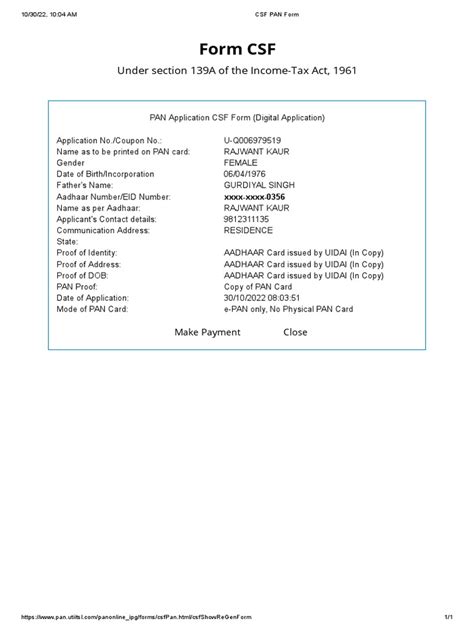

Before filling out the CSF PAN form, it is essential to understand its structure and the information required. The form is divided into several sections, including:

- Applicant's information

- Address and contact details

- Proof of identity and address

- PAN card details (for renewal or correction)

Section 1: Applicant's Information

In this section, you need to provide your personal details, including:

- Full name (as per proof of identity)

- Date of birth

- Gender

- Father's name (for individuals)

- Mother's name (for individuals)

Ensure that you fill in your name exactly as it appears on your proof of identity, and the date of birth should match the one mentioned on your birth certificate or passport.

Section 2: Address and Contact Details

In this section, you need to provide your current address and contact details, including:

- Residential address

- Email address

- Mobile number

Ensure that you provide a valid email address and mobile number, as the Income Tax Department will use these to communicate with you regarding your PAN application.

Section 3: Proof of Identity and Address

In this section, you need to provide proof of your identity and address. You can use any of the following documents as proof:

- Aadhaar card

- Passport

- Voter ID card

- Driving license

- Ration card

Ensure that you attach a photocopy of the selected document with the application form.

Section 4: PAN Card Details (for Renewal or Correction)

If you are applying for a renewal or correction of your PAN card, you need to provide your existing PAN number and details of the correction required.

Section 5: Declaration and Signature

In this section, you need to sign and declare that the information provided is true and accurate. Ensure that you sign the form in the presence of the authorized person, and the signature should match the one on your proof of identity.

Additional Tips for Filling Out the CSF PAN Form

Here are some additional tips to ensure that you fill out the CSF PAN form correctly:

- Use a black ink pen to fill out the form.

- Write in block letters.

- Avoid using abbreviations or initials.

- Ensure that you fill in all the required fields.

- Attach all the required documents.

- Verify the information before submitting the form.

By following these tips and understanding the structure of the CSF PAN form, you can ensure that you fill out the form correctly and avoid any delays or rejection of your application.

We hope this article has been informative and helpful in guiding you through the process of filling out the CSF PAN form correctly. If you have any further questions or concerns, please feel free to comment below.

What is the CSF PAN form?

+The CSF PAN form is a simplified application form introduced by the Income Tax Department to make the PAN application process more convenient and accessible.

What documents are required as proof of identity and address?

+You can use any of the following documents as proof of identity and address: Aadhaar card, Passport, Voter ID card, Driving license, Ration card.

How do I sign the CSF PAN form?

+You need to sign the form in the presence of the authorized person, and the signature should match the one on your proof of identity.