For businesses operating in multiple states, managing taxes can be a daunting task. With the complexity of state tax laws and regulations, it's easy to get overwhelmed. One crucial aspect of multi-state taxation is the Copart Multi-State Tax Form. If you're a business owner or tax professional dealing with Copart's operations across multiple states, understanding this form is vital. In this article, we'll break down the Copart Multi-State Tax Form, providing a step-by-step guide to help you navigate this essential tax requirement.

The importance of accurate tax compliance cannot be overstated. Failure to comply with state tax regulations can result in severe penalties, fines, and reputational damage. As a business owner, it's crucial to stay on top of tax obligations, especially when operating in multiple states. The Copart Multi-State Tax Form is a critical component of this process, ensuring that your business remains compliant with state tax laws.

Understanding the Copart Multi-State Tax Form

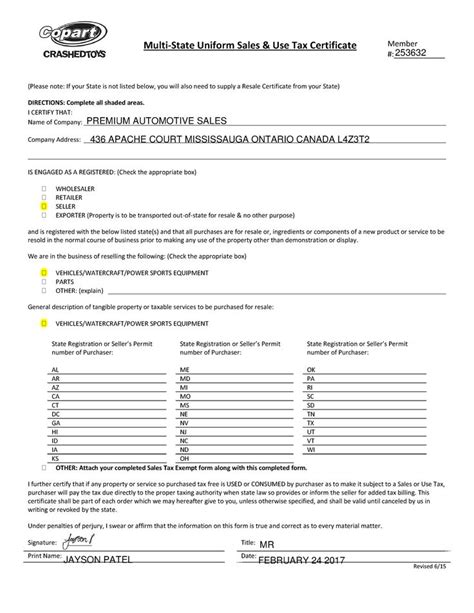

The Copart Multi-State Tax Form is a document required by Copart, a leading provider of online vehicle auctions, to facilitate tax compliance for businesses operating in multiple states. This form is used to collect essential tax information, ensuring that Copart can accurately report and remit taxes on behalf of its clients.

Key Components of the Copart Multi-State Tax Form

Before diving into the step-by-step guide, it's essential to understand the key components of the Copart Multi-State Tax Form:

- Business information: This section requires details about your business, including your company name, address, and tax identification number.

- State tax registration: This section asks for information about your business's tax registration status in each state where you operate.

- Tax rates and exemptions: This section requires details about the tax rates and exemptions applicable to your business in each state.

Step-by-Step Guide to Completing the Copart Multi-State Tax Form

Now that we've covered the key components of the Copart Multi-State Tax Form, let's walk through the step-by-step process of completing the form:

Step 1: Gather Essential Business Information

Before starting the form, ensure you have the following business information readily available:

- Company name and address

- Tax identification number (EIN)

- Business type (e.g., sole proprietorship, corporation, partnership)

Step 2: Complete the Business Information Section

Fill in the business information section, providing the required details:

- Company name

- Address

- Tax identification number (EIN)

- Business type

Step 3: Identify States Where Your Business Operates

List all the states where your business operates, including:

- State name

- State tax registration status (e.g., registered, exempt, not registered)

- Tax rates and exemptions applicable to your business in each state

Step 4: Complete the Tax Rates and Exemptions Section

Fill in the tax rates and exemptions section, providing details about the tax rates and exemptions applicable to your business in each state:

- Tax rates (e.g., sales tax, use tax, income tax)

- Exemptions (e.g., tax-exempt status, exempt products or services)

Step 5: Review and Verify Information

Carefully review and verify the information provided on the form, ensuring accuracy and completeness.

Step 6: Submit the Form

Once completed, submit the Copart Multi-State Tax Form to Copart, either electronically or by mail, as instructed.

Common Challenges and Solutions

When completing the Copart Multi-State Tax Form, you may encounter challenges. Here are some common issues and solutions:

- Challenge: Inaccurate or incomplete information Solution: Double-check and verify information before submitting the form.

- Challenge: Uncertainty about tax rates and exemptions Solution: Consult with a tax professional or seek guidance from Copart's support team.

- Challenge: Difficulty understanding state tax regulations Solution: Research state tax laws and regulations or consult with a tax professional.

Best Practices for Copart Multi-State Tax Form Compliance

To ensure compliance and avoid common challenges, follow these best practices:

- Regularly review and update your business information

- Stay informed about state tax laws and regulations

- Consult with a tax professional or seek guidance from Copart's support team when needed

Conclusion and Next Steps

Completing the Copart Multi-State Tax Form is a crucial step in ensuring tax compliance for your business. By following the step-by-step guide and best practices outlined in this article, you'll be well on your way to navigating this essential tax requirement. Remember to stay informed about state tax laws and regulations, and don't hesitate to seek guidance when needed.

We hope this article has provided valuable insights and guidance on completing the Copart Multi-State Tax Form. If you have any further questions or concerns, please don't hesitate to reach out. Share your thoughts and experiences in the comments below, and don't forget to share this article with your colleagues and peers.

What is the Copart Multi-State Tax Form?

+The Copart Multi-State Tax Form is a document required by Copart to facilitate tax compliance for businesses operating in multiple states.

What information is required on the Copart Multi-State Tax Form?

+The form requires business information, state tax registration status, and tax rates and exemptions applicable to your business in each state.

How do I submit the Copart Multi-State Tax Form?

+Submit the form to Copart, either electronically or by mail, as instructed.