Understanding the intricacies of tax-related documents can be a daunting task, especially for individuals who are not familiar with the process. The Consent Form 4506-C is one such document that plays a crucial role in the mortgage lending and tax verification process. In this article, we will delve into the world of Form 4506-C, exploring its importance, benefits, and steps to complete it accurately.

What is Consent Form 4506-C?

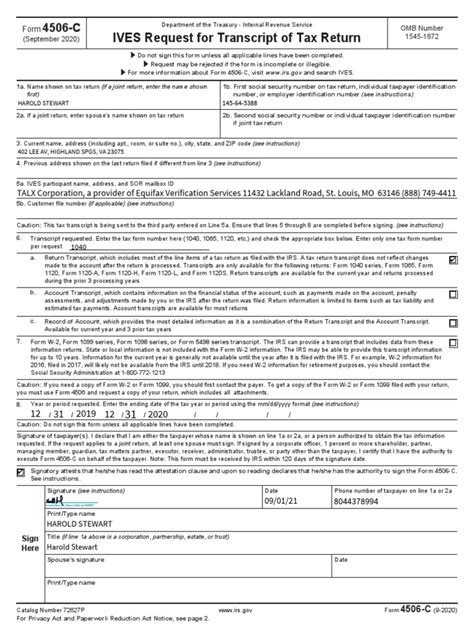

The Consent Form 4506-C, also known as the IVES (Income Verification Express Service) Consent Form, is a document used by lenders to verify an individual's income with the Internal Revenue Service (IRS). This form is typically required during the mortgage lending process, as it helps lenders assess the borrower's creditworthiness. By signing this form, individuals authorize the IRS to disclose their tax return information to the lender, which is then used to verify their income.

Why is Consent Form 4506-C Important?

The Consent Form 4506-C is essential in the mortgage lending process, as it allows lenders to verify the borrower's income and ensure that they can afford the loan repayments. This form provides lenders with a secure and reliable way to obtain tax return information from the IRS, reducing the risk of fraud and inaccuracies.

Benefits of Using Consent Form 4506-C

Using the Consent Form 4506-C offers several benefits, including:

- Improved accuracy: By obtaining tax return information directly from the IRS, lenders can ensure that the borrower's income is accurately verified, reducing the risk of errors or misrepresentation.

- Enhanced security: The Consent Form 4506-C provides a secure way to obtain sensitive tax information, reducing the risk of identity theft or fraud.

- Streamlined process: The IVES Consent Form simplifies the income verification process, reducing the need for manual documentation and minimizing the risk of delays.

Steps to Complete Consent Form 4506-C

To complete the Consent Form 4506-C accurately, follow these steps:

- Obtain the form: The lender or mortgage broker will typically provide the Consent Form 4506-C.

- Read and understand the form: Carefully read the form and understand the purpose and scope of the consent.

- Complete the required information: Fill in the required information, including your name, Social Security number, and tax year.

- Sign and date the form: Sign and date the form, authorizing the IRS to disclose your tax return information to the lender.

- Return the form: Return the completed form to the lender or mortgage broker.

Tips for Completing Consent Form 4506-C

To ensure that you complete the Consent Form 4506-C accurately, follow these tips:

- Use black ink: Use black ink to sign and date the form, as this will help prevent any issues with the document.

- Double-check information: Double-check the information you provide to ensure accuracy and completeness.

- Keep a copy: Keep a copy of the completed form for your records.

Common Mistakes to Avoid When Completing Consent Form 4506-C

When completing the Consent Form 4506-C, avoid the following common mistakes:

- Inaccurate information: Ensure that the information you provide is accurate and complete, as inaccuracies can lead to delays or rejected applications.

- Incomplete form: Ensure that you complete all required fields and sign and date the form, as incomplete forms can be rejected.

- Using white-out: Avoid using white-out to correct mistakes, as this can be seen as tampering with the document.

Conclusion

In conclusion, the Consent Form 4506-C is a critical document in the mortgage lending process, allowing lenders to verify an individual's income with the IRS. By understanding the importance of this form and following the steps to complete it accurately, you can ensure a smooth and efficient mortgage application process. Remember to keep a copy of the completed form for your records and avoid common mistakes that can lead to delays or rejected applications.

We hope this article has provided you with a comprehensive understanding of the Consent Form 4506-C. If you have any further questions or concerns, please don't hesitate to comment below.

What is the purpose of the Consent Form 4506-C?

+The Consent Form 4506-C is used by lenders to verify an individual's income with the IRS, allowing them to assess the borrower's creditworthiness.

Who provides the Consent Form 4506-C?

+The lender or mortgage broker typically provides the Consent Form 4506-C.

What information is required on the Consent Form 4506-C?

+The required information includes your name, Social Security number, and tax year.