As a business owner in Colorado, it's essential to understand the importance of filing the right forms with the state government to ensure compliance and avoid penalties. One such form is the Colorado Uitr-1 form, which is a crucial document for businesses that need to report their unemployment insurance contributions. In this article, we will provide a step-by-step guide on how to file the Colorado Uitr-1 form, making it easier for you to navigate the process.

The Colorado Uitr-1 form is used by employers to report their quarterly unemployment insurance contributions to the Colorado Department of Labor and Employment (CDLE). This form is required for all employers who have paid wages to employees during the quarter, regardless of the amount of wages paid. Failure to file the Uitr-1 form on time can result in penalties and fines, which can be costly for your business.

Understanding the Colorado Uitr-1 Form

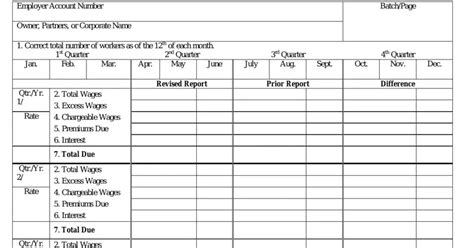

Before we dive into the step-by-step guide, let's take a closer look at the Colorado Uitr-1 form and what it entails. The form is divided into several sections, including:

- Employer information: This section requires you to provide your business name, address, and contact information.

- Quarterly wages: This section requires you to report the total wages paid to employees during the quarter, including gross wages and taxable wages.

- Unemployment insurance contributions: This section requires you to calculate and report your unemployment insurance contributions based on the wages paid.

Step 1: Gather Required Information

To file the Colorado Uitr-1 form, you will need to gather the following information:- Your business name and address

- Your employer account number (EAN)

- The quarter being reported (e.g., January 1 - March 31)

- The total wages paid to employees during the quarter

- The taxable wages paid to employees during the quarter

- The unemployment insurance contributions due

Filing the Colorado Uitr-1 Form: A Step-By-Step Guide

Now that we have gathered the required information, let's move on to the step-by-step guide on how to file the Colorado Uitr-1 form.

Step 2: Log in to Your Account

To file the Uitr-1 form, you will need to log in to your account on the CDLE website. If you don't have an account, you can create one by following the registration process.

Step 3: Select the Quarter Being Reported

Once you have logged in to your account, select the quarter being reported from the dropdown menu.

Step 4: Enter Employer Information

Enter your business name, address, and contact information in the required fields.

Step 5: Report Quarterly Wages

Report the total wages paid to employees during the quarter, including gross wages and taxable wages.

Step 6: Calculate Unemployment Insurance Contributions

Calculate your unemployment insurance contributions based on the wages paid. You can use the CDLE's contribution rate chart to determine your contribution rate.

Step 7: Pay Unemployment Insurance Contributions

Pay your unemployment insurance contributions online or by mail. Make sure to pay by the due date to avoid penalties and fines.

Step 8: Submit the Uitr-1 Form

Once you have completed all the required fields and paid your unemployment insurance contributions, submit the Uitr-1 form.

Tips and Reminders

Here are some tips and reminders to keep in mind when filing the Colorado Uitr-1 form:

- File the Uitr-1 form on time to avoid penalties and fines.

- Make sure to report accurate information to avoid errors and discrepancies.

- Keep a copy of the filed Uitr-1 form for your records.

- If you need help or have questions, contact the CDLE or a qualified tax professional.

Conclusion

Filing the Colorado Uitr-1 form is a crucial step in ensuring compliance with state regulations and avoiding penalties and fines. By following the step-by-step guide outlined in this article, you can ensure that you file the Uitr-1 form accurately and on time. Remember to gather all required information, log in to your account, select the quarter being reported, enter employer information, report quarterly wages, calculate unemployment insurance contributions, pay contributions, and submit the Uitr-1 form.What is the Colorado Uitr-1 form?

+The Colorado Uitr-1 form is a quarterly unemployment insurance contribution report that employers must file with the Colorado Department of Labor and Employment (CDLE).

Who needs to file the Colorado Uitr-1 form?

+All employers who have paid wages to employees during the quarter must file the Uitr-1 form, regardless of the amount of wages paid.

What is the deadline for filing the Colorado Uitr-1 form?

+The deadline for filing the Uitr-1 form is the last day of the month following the end of the quarter being reported.