Chase Bank is one of the largest and most reputable banks in the United States, offering a wide range of financial products and services to its customers. One of the services they offer is loan applications, which can be a bit overwhelming for some individuals. In this article, we will break down the Chase Bank loan application form into 5 easy steps, making it simpler for you to understand and apply for a loan.

Applying for a loan can be a daunting task, especially if you are not familiar with the process. However, with the right guidance, you can navigate the application process with ease. Chase Bank offers various types of loans, including personal loans, mortgages, auto loans, and business loans, among others. Before we dive into the 5 easy steps, let's first understand the importance of having a good understanding of the loan application process.

Having a clear understanding of the loan application process can save you time, effort, and even money. It can also help you make informed decisions about your financial situation and avoid potential pitfalls. By knowing what to expect, you can prepare the necessary documents, avoid common mistakes, and increase your chances of getting approved for a loan.

In this article, we will provide you with a comprehensive guide on how to fill out the Chase Bank loan application form in 5 easy steps. We will also include some tips and tricks to help you navigate the process smoothly.

Step 1: Choose the Right Loan Type

Choosing the Right Loan Type

The first step in filling out the Chase Bank loan application form is to choose the right loan type. Chase Bank offers various types of loans, each with its own set of requirements and benefits. You need to determine which type of loan is best for your financial needs.

Some of the most common types of loans offered by Chase Bank include:

- Personal loans: These loans are designed for personal use, such as consolidating debt, financing a wedding, or covering unexpected expenses.

- Mortgages: These loans are designed for purchasing a home or refinancing an existing mortgage.

- Auto loans: These loans are designed for purchasing a new or used vehicle.

- Business loans: These loans are designed for small businesses or entrepreneurs who need funding to grow their business.

Step 2: Gather Required Documents

Gathering Required Documents

The second step in filling out the Chase Bank loan application form is to gather the required documents. The documents required may vary depending on the type of loan you are applying for and your individual circumstances.

Some of the common documents required for a Chase Bank loan application include:

- Identification documents: driver's license, passport, or state ID

- Income documents: pay stubs, W-2 forms, or tax returns

- Employment documents: proof of employment, job offer letter, or business license

- Credit documents: credit reports, credit scores, or credit history

- Asset documents: bank statements, investment accounts, or property deeds

Step 3: Fill Out the Application Form

Filling Out the Application Form

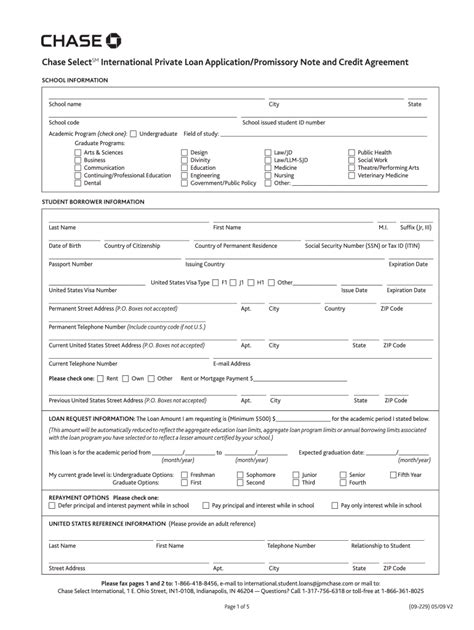

The third step in filling out the Chase Bank loan application form is to fill out the application form itself. The form will require you to provide personal, financial, and employment information.

Some of the information you will need to provide includes:

- Personal information: name, address, phone number, and email address

- Financial information: income, expenses, debts, and credit history

- Employment information: job title, employer, and length of employment

Step 4: Review and Submit the Application

Reviewing and Submitting the Application

The fourth step in filling out the Chase Bank loan application form is to review and submit the application. Before submitting the application, make sure to review it carefully to ensure that all the information is accurate and complete.

Once you have reviewed the application, you can submit it to Chase Bank for processing. You can submit the application online, by phone, or in person at a Chase Bank branch.

Step 5: Wait for Approval

Waiting for Approval

The final step in filling out the Chase Bank loan application form is to wait for approval. After submitting the application, Chase Bank will review it and make a decision.

The approval process may take several days or weeks, depending on the type of loan and the complexity of the application. Once the application is approved, you will receive a loan offer, which will include the terms and conditions of the loan.

In conclusion, filling out the Chase Bank loan application form can be a straightforward process if you follow the 5 easy steps outlined above. By choosing the right loan type, gathering required documents, filling out the application form, reviewing and submitting the application, and waiting for approval, you can increase your chances of getting approved for a loan.

We hope this article has been helpful in guiding you through the Chase Bank loan application process. If you have any further questions or concerns, please feel free to comment below.

FAQ Section:

What types of loans does Chase Bank offer?

+Chase Bank offers various types of loans, including personal loans, mortgages, auto loans, and business loans.

What documents do I need to provide for a Chase Bank loan application?

+The documents required may vary depending on the type of loan and your individual circumstances. Common documents required include identification documents, income documents, employment documents, credit documents, and asset documents.

How long does it take to get approved for a Chase Bank loan?

+The approval process may take several days or weeks, depending on the type of loan and the complexity of the application.