The complexities of tax compliance can be overwhelming, especially when it comes to navigating the numerous forms and regulations. One such form that plays a crucial role in ensuring tax compliance is the CF 1040 form. In this article, we will delve into the details of the CF 1040 form, its significance, and provide a comprehensive guide to help you understand its intricacies.

As a responsible taxpayer, it is essential to be familiar with the various tax forms and their purposes. The CF 1040 form is a critical component of the tax compliance process, and understanding its requirements can help you avoid potential pitfalls and penalties. Whether you are an individual taxpayer or a business owner, this article aims to provide you with a thorough understanding of the CF 1040 form and its importance in maintaining tax compliance.

What is the CF 1040 Form?

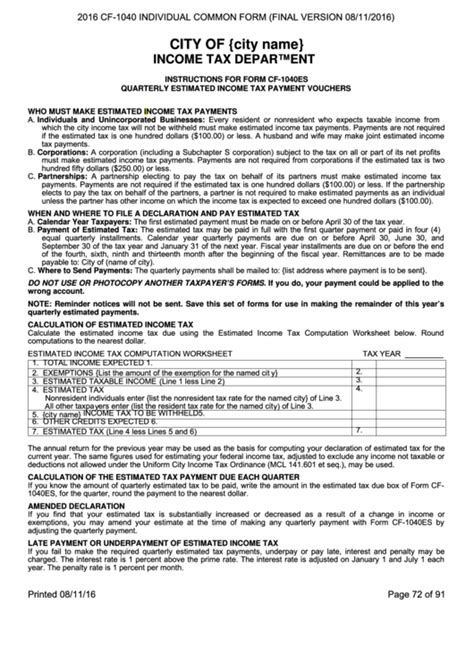

The CF 1040 form is a standard tax form used by the Internal Revenue Service (IRS) to report an individual's or business's income, deductions, and credits. The form is used to calculate the taxpayer's tax liability and determine the amount of taxes owed or refunded. The CF 1040 form is a critical document that helps the IRS ensure tax compliance and verify the accuracy of tax returns.

Importance of the CF 1040 Form

The CF 1040 form plays a vital role in maintaining tax compliance. By accurately completing and submitting the form, taxpayers can ensure that they are meeting their tax obligations and avoiding potential penalties. The form also helps the IRS to:

- Verify the accuracy of tax returns

- Identify potential tax evasion or fraud

- Calculate tax liability and determine the amount of taxes owed or refunded

- Provide essential information for tax planning and forecasting

Components of the CF 1040 Form

The CF 1040 form consists of several sections and schedules that require specific information. The main components of the form include:

- Identification: Taxpayer's name, address, and Social Security number or Employer Identification Number (EIN)

- Income: Wages, salaries, tips, and other forms of income

- Deductions: Standard or itemized deductions, including charitable donations, mortgage interest, and medical expenses

- Credits: Tax credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit

- Tax Liability: Calculation of tax liability based on income, deductions, and credits

- Payment: Payment options, including check, money order, or electronic payment

Schedules and Attachments

The CF 1040 form requires several schedules and attachments to provide additional information. These include:

- Schedule A: Itemized deductions, such as medical expenses, mortgage interest, and charitable donations

- Schedule B: Interest and dividend income

- Schedule C: Business income and expenses

- Schedule D: Capital gains and losses

- Form 8949: Sales and other dispositions of capital assets

- Form W-2: Wage and tax statement

- Form 1099: Miscellaneous income, including freelance work or interest income

Benefits of Accurate CF 1040 Form Completion

Accurate completion of the CF 1040 form is crucial for maintaining tax compliance and avoiding potential penalties. The benefits of accurate completion include:

- Reduced risk of audit: Accurate completion reduces the risk of audit and potential penalties

- Increased refund: Accurate completion ensures that taxpayers receive the correct refund amount

- Improved tax planning: Accurate completion provides essential information for tax planning and forecasting

- Compliance with tax regulations: Accurate completion ensures compliance with tax regulations and avoids potential penalties

Common Mistakes to Avoid

Common mistakes to avoid when completing the CF 1040 form include:

- Inaccurate or incomplete information: Failing to provide accurate or complete information can lead to delays or penalties

- Math errors: Math errors can lead to incorrect tax liability calculations and potential penalties

- Failure to report income: Failing to report income can lead to penalties and interest

- Incorrect deduction or credit claims: Incorrect deduction or credit claims can lead to penalties and interest

Best Practices for CF 1040 Form Completion

Best practices for CF 1040 form completion include:

- Gather all necessary documentation: Gather all necessary documentation, including W-2s, 1099s, and receipts for deductions and credits

- Use tax preparation software: Use tax preparation software to ensure accuracy and reduce math errors

- Seek professional assistance: Seek professional assistance if unsure about specific tax laws or regulations

- Review and proofread: Review and proofread the form for accuracy and completeness

Conclusion

Understanding the CF 1040 form is crucial for maintaining tax compliance and avoiding potential penalties. By accurately completing and submitting the form, taxpayers can ensure that they are meeting their tax obligations and avoiding potential pitfalls. Remember to gather all necessary documentation, use tax preparation software, seek professional assistance if needed, and review and proofread the form for accuracy and completeness.

Now that you have a comprehensive understanding of the CF 1040 form, take the necessary steps to ensure accurate completion and submission. Share your thoughts and experiences with tax compliance in the comments below.

What is the purpose of the CF 1040 form?

+The CF 1040 form is used to report an individual's or business's income, deductions, and credits, and to calculate tax liability and determine the amount of taxes owed or refunded.

What are the main components of the CF 1040 form?

+The main components of the CF 1040 form include identification, income, deductions, credits, tax liability, and payment.

What are the benefits of accurate CF 1040 form completion?

+Accurate completion of the CF 1040 form reduces the risk of audit and potential penalties, increases refund accuracy, improves tax planning, and ensures compliance with tax regulations.