Acquiring and maintaining insurance is a crucial aspect of risk management for businesses and individuals alike. One of the most widely recognized and respected forms of proof of liability insurance is the ACORD Certificate of Liability Insurance. This form serves as a standardized document that provides evidence of liability insurance coverage to third parties, such as clients, vendors, or government agencies. In this article, we will delve into the world of ACORD certificates, exploring their purpose, benefits, and key components.

What is an ACORD Certificate of Liability Insurance?

An ACORD Certificate of Liability Insurance is a document that certifies an individual or organization has liability insurance coverage. The form is issued by the insurance company or broker and provides proof of insurance to third parties. The certificate is typically required in various business transactions, such as contracting, leasing, or licensing.

Why is an ACORD Certificate of Liability Insurance Important?

An ACORD Certificate of Liability Insurance serves several purposes:

- Provides proof of insurance coverage to third parties

- Helps establish credibility and trust with clients, vendors, or partners

- Demonstrates compliance with regulatory requirements

- Offers protection against potential lawsuits or claims

Key Components of an ACORD Certificate of Liability Insurance

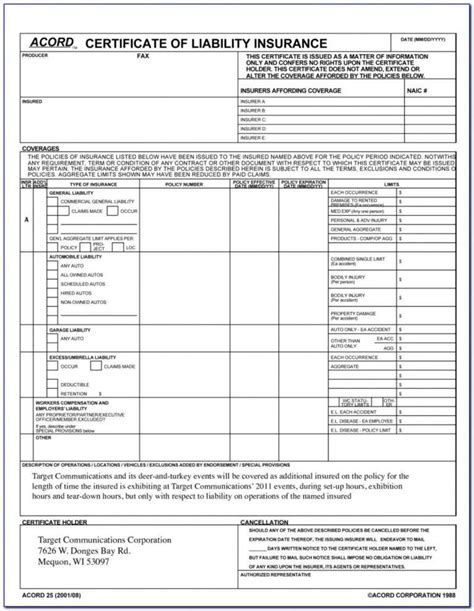

An ACORD Certificate of Liability Insurance typically includes the following key components:

- Producer's Information: The name, address, and contact details of the insurance producer or broker who issued the certificate.

- Insured's Information: The name, address, and contact details of the individual or organization covered by the insurance policy.

- Policy Information: The policy number, policy period, and type of insurance coverage.

- Coverage Details: A description of the liability insurance coverage, including the limits of liability and any exclusions or endorsements.

- Certificate Holder's Information: The name and address of the third party to whom the certificate is being issued.

How to Obtain an ACORD Certificate of Liability Insurance

To obtain an ACORD Certificate of Liability Insurance, follow these steps:

- Contact Your Insurance Provider: Reach out to your insurance company or broker to request a certificate of liability insurance.

- Provide Required Information: Provide the necessary information, including your business name, address, and contact details.

- Specify the Certificate Holder: Identify the third party to whom the certificate will be issued.

- Review and Verify the Certificate: Carefully review the certificate to ensure accuracy and completeness.

Common Uses of an ACORD Certificate of Liability Insurance

An ACORD Certificate of Liability Insurance is commonly used in various situations, including:

- Contracting and Bidding: Contractors and vendors often require proof of liability insurance to participate in bidding processes or to secure contracts.

- Licensing and Permitting: Many government agencies and regulatory bodies require proof of liability insurance as a condition of licensing or permitting.

- Business Partnerships and Collaborations: Companies may require proof of liability insurance from partners or collaborators to protect against potential risks.

Best Practices for Managing ACORD Certificates

To ensure efficient management of ACORD certificates, follow these best practices:

- Maintain Accurate Records: Keep accurate and up-to-date records of all certificates, including the certificate holder's information and policy details.

- Monitor Expiration Dates: Regularly review and update certificates to ensure they remain valid and effective.

- Communicate with Stakeholders: Clearly communicate with stakeholders, including clients, vendors, and partners, about the requirements and benefits of ACORD certificates.

Conclusion: The Importance of ACORD Certificates in Risk Management

In conclusion, an ACORD Certificate of Liability Insurance is a vital document that provides proof of liability insurance coverage to third parties. By understanding the key components, benefits, and common uses of ACORD certificates, businesses and individuals can better manage risk and protect against potential lawsuits or claims. As a responsible and informed individual or organization, take the necessary steps to obtain and maintain an ACORD certificate to ensure a secure and successful future.

We'd love to hear from you! Share your thoughts and experiences with ACORD certificates in the comments below.

What is the purpose of an ACORD Certificate of Liability Insurance?

+The purpose of an ACORD Certificate of Liability Insurance is to provide proof of liability insurance coverage to third parties, such as clients, vendors, or government agencies.

What information is typically included on an ACORD Certificate of Liability Insurance?

+An ACORD Certificate of Liability Insurance typically includes the producer's information, insured's information, policy information, coverage details, and certificate holder's information.

How do I obtain an ACORD Certificate of Liability Insurance?

+To obtain an ACORD Certificate of Liability Insurance, contact your insurance provider, provide the required information, specify the certificate holder, and review and verify the certificate.