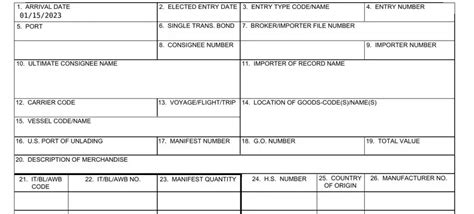

Importing goods into the United States requires careful adherence to regulations and proper documentation. One crucial document in this process is the CBP Form 3461, also known as the Entry/Immediate Delivery. This form serves as a commercial invoice for imported goods and is used by U.S. Customs and Border Protection (CBP) to assess duties, taxes, and fees.

Understanding the Importance of Accurate CBP Form 3461

Filling out the CBP Form 3461 correctly is vital to ensure smooth customs clearance and avoid potential delays or penalties. Inaccurate or incomplete information can lead to costly mistakes, such as incorrect duty payments or even seizure of goods.

In this article, we will guide you through the essential steps to fill out CBP Form 3461 accurately, ensuring a hassle-free import experience.

Step 1: Gather Required Information

Before starting to fill out the form, make sure you have the following information readily available:

- Commercial invoice or bill of sale

- Packing list

- Shipper's Export Declaration (SED) or Automated Export System (AES) filing

- Harmonized System (HS) codes for the imported goods

- Country of origin and manufacturing information

- Importer's and exporter's contact details

Gathering Accurate HS Codes

HS codes are crucial for determining the correct duty rates and ensuring compliance with CBP regulations. You can find the HS codes in the Harmonized Tariff Schedule of the United States (HTSUS) or consult with a qualified trade professional.

Step 2: Complete the Top Portion of the Form

The top portion of the form requires the following information:

- Entry number

- Importer's name and address

- Exporter's name and address

- Country of origin

- Date of export

- Bill of lading or air waybill number

- Customs broker's name and address (if applicable)

Ensure that all information is accurate and matches the corresponding documentation.

Understanding the Country of Origin

The country of origin is the country where the goods were manufactured or produced. This information is critical for determining the correct duty rates and ensuring compliance with CBP regulations.

Step 3: Describe the Imported Goods

In this section, you will need to provide a detailed description of the imported goods, including:

- Quantity and unit of measurement

- Weight and unit of measurement

- Value and currency

- HS code and Schedule B number

- Country of origin

Ensure that the description matches the commercial invoice and packing list.

Using the Correct Unit of Measurement

It is essential to use the correct unit of measurement to avoid errors or discrepancies. Refer to the commercial invoice or packing list to ensure accuracy.

Step 4: Declare Additional Information

In this section, you will need to declare any additional information, such as:

- Quota information (if applicable)

- Special program indicators (e.g., NAFTA, CAFTA)

- Compliance with CBP regulations (e.g., marking, labeling)

Ensure that you provide accurate and complete information to avoid potential issues.

Understanding Quota Information

Quota information is required for goods subject to quota restrictions. Refer to the CBP website or consult with a qualified trade professional for guidance.

Step 5: Sign and Date the Form

Finally, sign and date the form in the designated areas. Ensure that the signature is legible and matches the importer's or exporter's records.

Ensuring Compliance with CBP Regulations

It is essential to ensure compliance with CBP regulations to avoid potential penalties or delays. Consult with a qualified trade professional if you are unsure about any aspect of the form.

By following these steps and ensuring accurate information, you can fill out CBP Form 3461 correctly and avoid potential issues during the import process.

We hope this article has provided you with valuable insights and guidance on filling out CBP Form 3461. If you have any questions or concerns, please feel free to comment below.

What is the purpose of CBP Form 3461?

+CBP Form 3461, also known as the Entry/Immediate Delivery, is a commercial invoice used by U.S. Customs and Border Protection (CBP) to assess duties, taxes, and fees for imported goods.

What information is required to fill out CBP Form 3461?

+To fill out CBP Form 3461, you will need to provide information such as the commercial invoice or bill of sale, packing list, Shipper's Export Declaration (SED) or Automated Export System (AES) filing, Harmonized System (HS) codes, country of origin, and importer's and exporter's contact details.

What are the consequences of inaccurate or incomplete information on CBP Form 3461?

+Inaccurate or incomplete information on CBP Form 3461 can lead to costly mistakes, such as incorrect duty payments or even seizure of goods. It is essential to ensure accurate and complete information to avoid potential issues.