Creating a comprehensive estate plan involves several key documents, including a California durable power of attorney. This document allows you to appoint someone you trust to manage your financial affairs if you become incapacitated. In this guide, we will explore the California durable power of attorney fillable form and provide you with a step-by-step guide on how to complete it.

What is a California Durable Power of Attorney?

A California durable power of attorney is a legal document that grants someone you trust, known as the attorney-in-fact or agent, the authority to manage your financial affairs if you become incapacitated. This document is called "durable" because it remains in effect even if you become incapacitated. Without a durable power of attorney, your loved ones may need to go to court to obtain the authority to manage your finances, which can be a time-consuming and costly process.

Benefits of Having a California Durable Power of Attorney

Having a California durable power of attorney provides several benefits, including:

- Convenience: A durable power of attorney allows your agent to manage your financial affairs without the need for court intervention.

- Cost savings: Avoiding court intervention can save your loved ones time and money.

- Peace of mind: Knowing that someone you trust has the authority to manage your finances can provide peace of mind.

How to Choose an Agent

Choosing the right agent is crucial when creating a California durable power of attorney. Consider the following factors when selecting an agent:

- Trust: Choose someone you trust to act in your best interests.

- Financial management skills: Select someone with experience managing finances.

- Availability: Choose someone who is available to serve as your agent.

California Durable Power of Attorney Fillable Form

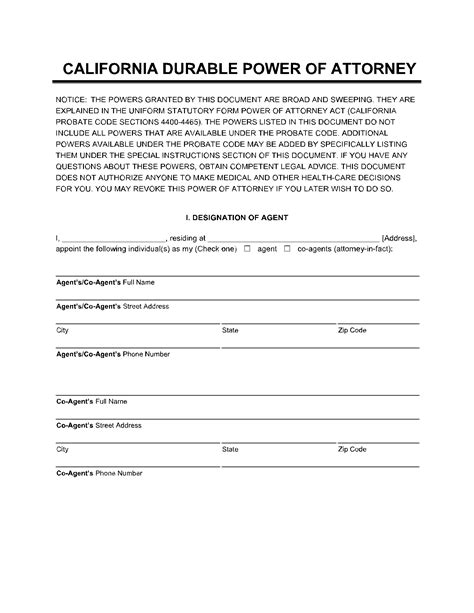

The California durable power of attorney fillable form is a standardized document that allows you to grant someone the authority to manage your financial affairs. The form typically includes the following sections:

- Introduction: Identifies the principal (you) and the agent.

- Grant of authority: Outlines the powers granted to the agent.

- Agent's duties: Describes the agent's responsibilities.

- Termination: Specifies when the power of attorney terminates.

Completing the California Durable Power of Attorney Fillable Form

To complete the California durable power of attorney fillable form, follow these steps:

- Download the form: Obtain the California durable power of attorney fillable form from a reliable source.

- Fill in the introduction: Identify yourself as the principal and your agent.

- Grant of authority: Specify the powers you are granting to your agent.

- Agent's duties: Describe the agent's responsibilities.

- Termination: Specify when the power of attorney terminates.

- Sign the form: Sign the form in the presence of a notary public.

- Notarize the form: Have the form notarized by a notary public.

Conclusion

Creating a California durable power of attorney is an essential part of comprehensive estate planning. By following the steps outlined in this guide, you can ensure that your financial affairs are managed by someone you trust if you become incapacitated. Remember to review and update your durable power of attorney regularly to ensure it remains effective.

What is the difference between a durable power of attorney and a general power of attorney?

+A durable power of attorney remains in effect even if the principal becomes incapacitated, while a general power of attorney terminates if the principal becomes incapacitated.

Can I revoke a California durable power of attorney?

+Yes, you can revoke a California durable power of attorney by signing a revocation form and delivering it to your agent.

Is a California durable power of attorney valid in other states?

+A California durable power of attorney may be valid in other states, but it's best to consult with an attorney to ensure its validity.