California Form MC-030, also known as the "Preliminary Notice" or "Pre-Lien Notice," is a crucial document in the construction industry, particularly in the state of California. This form plays a significant role in protecting the rights of contractors, subcontractors, and suppliers who work on private construction projects. Here are five essential facts about California Form MC-030 that you should know:

What is California Form MC-030?

California Form MC-030 is a preliminary notice that must be served on the property owner or prime contractor within 20 days of first furnishing labor, services, or materials to a private construction project. This notice is a prerequisite for filing a mechanics lien in California. The form serves as a warning to the property owner or prime contractor that a lien may be filed if payment is not made.

Why is California Form MC-030 important?

Serving California Form MC-030 is essential for contractors, subcontractors, and suppliers to preserve their lien rights. If this notice is not served within the required timeframe, the claimant may forfeit their right to file a mechanics lien. The form also provides an opportunity for the property owner or prime contractor to resolve any payment disputes before a lien is filed.

Who needs to serve California Form MC-030?

The following parties are required to serve California Form MC-030:

- Contractors: General contractors, subcontractors, and specialty contractors who work on private construction projects.

- Subcontractors: Subcontractors who provide labor, services, or materials to a project.

- Suppliers: Suppliers who provide materials to a project.

- Laborers: Laborers who work on a project.

How to serve California Form MC-030?

California Form MC-030 must be served by certified mail, return receipt requested, or by personal service. The notice must be served on the property owner or prime contractor within 20 days of first furnishing labor, services, or materials to the project.

What are the consequences of not serving California Form MC-030?

Failure to serve California Form MC-030 within the required timeframe can result in the loss of lien rights. If a contractor, subcontractor, or supplier fails to serve this notice, they may not be able to file a mechanics lien, which can limit their ability to collect payment for their work.

How to fill out California Form MC-030?

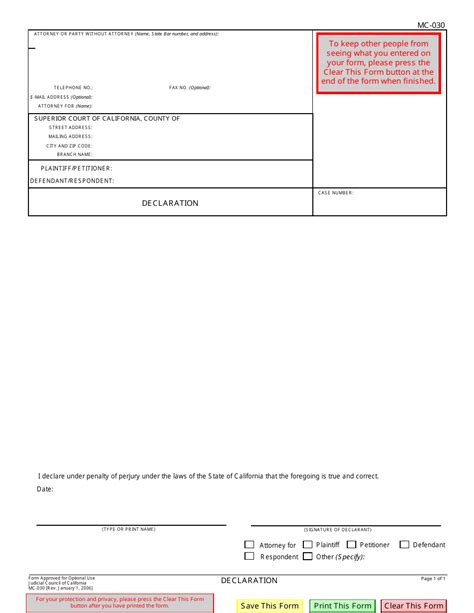

To fill out California Form MC-030, you will need to provide the following information:

- Project information: project name, address, and county

- Claimant information: name, address, and contact information

- Property owner or prime contractor information: name and address

- Description of labor, services, or materials furnished

- Amount of claim

It is essential to ensure that the form is accurately completed and served within the required timeframe to preserve lien rights.

Additional Tips and Best Practices

- Serve California Form MC-030 promptly: Serve the notice within 20 days of first furnishing labor, services, or materials to the project.

- Keep accurate records: Maintain accurate records of all labor, services, or materials furnished to the project.

- Verify property owner or prime contractor information: Ensure that the property owner or prime contractor information is accurate before serving the notice.

- Use certified mail: Use certified mail, return receipt requested, to serve the notice.

By following these best practices, contractors, subcontractors, and suppliers can ensure that they preserve their lien rights and protect their interests in the construction project.

If you have any questions or concerns about California Form MC-030, please don't hesitate to reach out. Share your thoughts and experiences in the comments section below.

What is the purpose of California Form MC-030?

+The purpose of California Form MC-030 is to serve as a preliminary notice to the property owner or prime contractor that a lien may be filed if payment is not made.

Who needs to serve California Form MC-030?

+Contractors, subcontractors, suppliers, and laborers who work on private construction projects need to serve California Form MC-030.

What are the consequences of not serving California Form MC-030?

+Failure to serve California Form MC-030 can result in the loss of lien rights, which can limit the ability to collect payment for work performed.