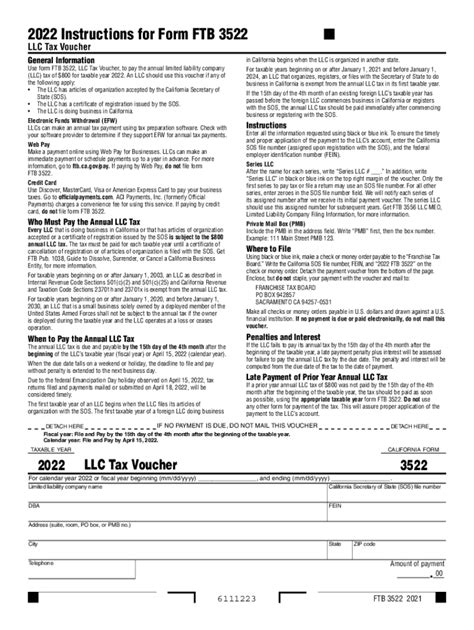

California Form FTB 3522, also known as the Limited Liability Company (LLC) Tax Voucher, is a crucial document for businesses operating in the state. As a responsible business owner, it's essential to understand the importance of filing this form accurately and on time. In this article, we'll provide you with 7 valuable tips to help you navigate the process of filing California Form FTB 3522.

Tip 1: Understand the Purpose of Form FTB 3522

Before we dive into the nitty-gritty of filing, it's essential to understand the purpose of Form FTB 3522. This form is used by the California Franchise Tax Board (FTB) to collect taxes from LLCs operating in the state. The form is used to report the LLC's income, deductions, and credits, as well as to calculate the amount of tax owed.

What is the California Franchise Tax Board (FTB)?

The California Franchise Tax Board (FTB) is a state agency responsible for collecting taxes from businesses operating in California. The FTB is responsible for administering the state's tax laws, including the collection of taxes from LLCs.

Tip 2: Determine if You Need to File Form FTB 3522

Not all LLCs operating in California need to file Form FTB 3522. To determine if you need to file, you'll need to check if your LLC meets the following criteria:

- Your LLC is registered to do business in California

- Your LLC has a California tax ID number

- Your LLC has income or losses that need to be reported

If your LLC meets these criteria, you'll need to file Form FTB 3522.

Tip 3: Gather Required Documents and Information

Before you start filing, you'll need to gather the required documents and information. This includes:

- Your LLC's tax ID number

- Your LLC's financial statements (income statement and balance sheet)

- Your LLC's federal tax return (Form 1065 or Form 1120)

- Any supporting schedules and attachments

Make sure you have all the necessary documents and information before starting the filing process.

What is a Tax ID Number?

A tax ID number, also known as an Employer Identification Number (EIN), is a unique number assigned to your LLC by the IRS. You'll need this number to file Form FTB 3522.

Tip 4: Choose the Correct Filing Status

When filing Form FTB 3522, you'll need to choose the correct filing status for your LLC. The filing status will determine the tax rate and any applicable credits or deductions. The most common filing statuses for LLCs in California are:

- Single-member LLC ( taxed as a sole proprietorship)

- Multi-member LLC (taxed as a partnership)

- LLC taxed as a corporation

Choose the correct filing status for your LLC to avoid any errors or penalties.

Tip 5: Calculate the Tax Owed

Once you've determined the correct filing status, you'll need to calculate the tax owed. This involves calculating the LLC's taxable income, deductions, and credits. You can use the FTB's tax calculator or consult with a tax professional to ensure accuracy.

What is the California LLC Tax Rate?

The California LLC tax rate varies depending on the LLC's taxable income. The tax rate ranges from 1.5% to 3.3% of the LLC's taxable income.

Tip 6: File Form FTB 3522 On Time

The deadline for filing Form FTB 3522 is typically April 15th of each year. However, if you need an extension, you can file Form FTB 3536 (LLC Tax Extension) by the original deadline. Late filing can result in penalties and interest, so make sure to file on time.

What are the Consequences of Late Filing?

Late filing can result in penalties and interest, which can add up quickly. The FTB may also impose additional penalties for failure to file or pay taxes on time.

Tip 7: Seek Professional Help if Needed

Filing Form FTB 3522 can be complex, especially for new LLCs or those with complex financial situations. If you're unsure about any aspect of the filing process, consider seeking professional help from a tax accountant or attorney.

What are the Benefits of Hiring a Tax Professional?

Hiring a tax professional can help ensure accuracy and compliance with California tax laws. A tax professional can also help you navigate any complex issues or disputes with the FTB.

By following these 7 tips, you'll be well on your way to filing California Form FTB 3522 accurately and on time. Remember to seek professional help if needed, and don't hesitate to reach out to the FTB if you have any questions or concerns.

Share your experiences or questions about filing California Form FTB 3522 in the comments below. Let's work together to ensure compliance and accuracy in our tax filings!

What is the deadline for filing California Form FTB 3522?

+The deadline for filing California Form FTB 3522 is typically April 15th of each year.

Do I need to file Form FTB 3522 if my LLC has no income?

+Yes, you still need to file Form FTB 3522 even if your LLC has no income. You'll need to report zero income and pay the annual LLC tax.

Can I file Form FTB 3522 electronically?

+Yes, you can file Form FTB 3522 electronically through the FTB's website. You'll need to create an account and follow the online instructions.