When it comes to understanding and navigating the complex world of property taxation in California, one of the most important forms to familiarize yourself with is the California Form 571-L. This form is crucial for businesses, landlords, and property owners who need to report their business property and pay taxes on it. Despite its importance, many individuals find the form and its requirements daunting. To help demystify the process and ensure compliance, here are 7 essential facts about California Form 571-L that you need to know.

What is California Form 571-L?

Definition and Purpose

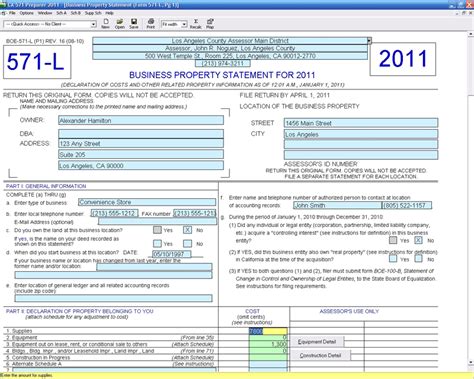

California Form 571-L, also known as the Business Property Statement, is a tax form used by the California State Board of Equalization to assess and collect property taxes from businesses. It is designed to report and assess all taxable business property, including but not limited to equipment, machinery, and leasehold improvements. The form is essential for determining the value of business property for tax purposes.

Who Needs to File California Form 571-L?

Eligibility and Requirements

Any business or individual owning business property in California, including corporations, partnerships, limited liability companies, and sole proprietorships, is required to file Form 571-L. This includes entities that lease property and have made leasehold improvements. The requirement to file applies even if the business has minimal or no property; a zero-report must be filed in such cases. The form must be filed annually by the specified deadline.

What Information is Required on California Form 571-L?

Content and Specifics

The form requires detailed information about the business and its properties, including the business name, address, and account number, as well as specific details about each item of business property, such as its description, year of acquisition, and cost. Separate sections are provided for different types of property, such as equipment, furniture, and leasehold improvements. The form also requires the declaration of any changes or disposals of property since the last filing.

How to File California Form 571-L

Submission and Deadline

Form 571-L is typically due on April 1st for most counties in California. However, it is advisable to check with the county assessor's office for specific deadlines, as these can vary. The form can usually be filed online through the county assessor's website or mailed to the specified address. Late filings may incur penalties and interest, so timely submission is crucial.

Penalties for Non-Compliance

Consequences of Late or Inaccurate Filing

Failure to file Form 571-L by the deadline or providing inaccurate information can result in significant penalties and interest. The penalties can add up quickly, increasing the amount owed. In severe cases, the county assessor may also estimate the value of the business property, which could lead to an overestimation and higher taxes. It is essential to file accurately and on time to avoid these additional costs.

Exemptions and Special Cases

Veterans' Exemption and Other Special Considerations

Some businesses or individuals may be eligible for exemptions from certain taxes or special considerations. For example, eligible veterans may qualify for the Veterans' Exemption. Additionally, some business property may be exempt from taxation, such as inventory or certain types of equipment. Understanding these exemptions and special cases can help minimize tax liability.

How to Seek Assistance

Resources for Filing California Form 571-L

Given the complexity of Form 571-L and the potential consequences of errors or late filing, it is advisable to seek professional assistance if needed. The county assessor's office, tax professionals, and the California State Board of Equalization website are valuable resources for guidance and information. They can provide assistance in understanding the form's requirements, navigating the filing process, and addressing any specific questions or concerns.

Understanding and correctly filing California Form 571-L is crucial for businesses and property owners in California to comply with tax laws and avoid penalties. By recognizing the importance of this form and seeking help when needed, individuals can ensure they fulfill their tax obligations accurately and on time.

We hope this in-depth look at California Form 571-L has provided you with the essential facts you need to navigate this complex aspect of California's tax system. If you have any thoughts or experiences regarding the process, please don't hesitate to share them with us in the comments below. Additionally, if you found this article informative, consider sharing it with others who might benefit from this knowledge.