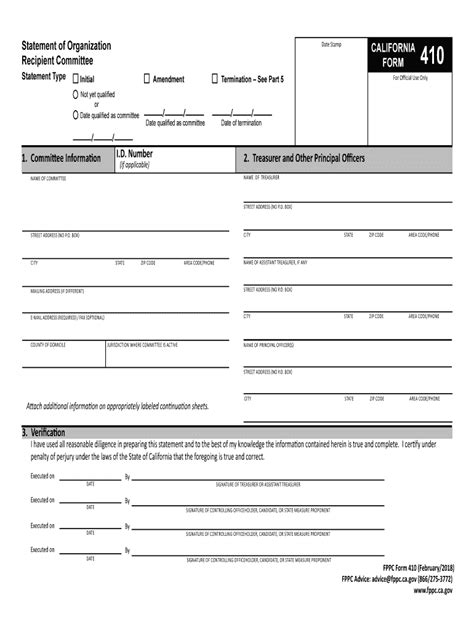

As a resident of California, it's essential to stay informed about the various tax forms and requirements that come with living in the Golden State. One of the most critical forms for California residents is the Form 410, also known as the Withholding Exemption Certificate. In this article, we'll delve into the world of California Form 410 and explore its importance, benefits, and key facts that you need to know.

What is California Form 410?

California Form 410, also known as the Withholding Exemption Certificate, is a tax form used by California residents to claim an exemption from state income tax withholding. This form is typically used by individuals who have a low income or are exempt from paying state income tax due to their age, disability, or other factors.

Benefits of Filing California Form 410

Filing California Form 410 can have several benefits for California residents. By claiming an exemption from state income tax withholding, individuals can:

- Reduce the amount of taxes withheld from their paycheck

- Increase their take-home pay

- Avoid overpayment of taxes, which can result in a larger refund

- Simplify their tax filing process

Eligibility Requirements for California Form 410

To be eligible to file California Form 410, individuals must meet certain requirements. These requirements include:

- Being a resident of California

- Having a low income, typically below the federal poverty level

- Being 65 years or older, blind, or disabled

- Being a non-resident alien

- Having a valid Social Security number or Individual Taxpayer Identification Number (ITIN)

How to File California Form 410

Filing California Form 410 is a relatively straightforward process. Individuals can file the form online or by mail. To file online, individuals will need to create an account on the California Franchise Tax Board (FTB) website and follow the instructions provided. To file by mail, individuals can download the form from the FTB website, complete it, and mail it to the address listed on the form.

Key Facts About California Form 410

Here are some key facts about California Form 410 that you should know:

- The form must be filed annually to maintain exemption status

- Individuals can only file the form if they meet the eligibility requirements

- The form can be filed online or by mail

- Individuals can claim an exemption from state income tax withholding for up to 12 months

- The form must be signed and dated by the individual filing it

Common Mistakes to Avoid When Filing California Form 410

When filing California Form 410, there are several common mistakes to avoid. These mistakes include:

- Failing to meet the eligibility requirements

- Filing the form incorrectly or incompletely

- Failing to sign and date the form

- Filing the form too late or too early

Penalties for Not Filing California Form 410

Individuals who fail to file California Form 410 or who file the form incorrectly may be subject to penalties. These penalties can include:

- A fine of up to $100

- Interest on any unpaid taxes

- A penalty of up to 40% of the unpaid taxes

How to Avoid Penalties

To avoid penalties, individuals should ensure that they file California Form 410 correctly and on time. This includes:

- Meeting the eligibility requirements

- Filing the form annually

- Filing the form correctly and completely

- Signing and dating the form

Conclusion

In conclusion, California Form 410 is an essential tax form for California residents who want to claim an exemption from state income tax withholding. By understanding the benefits, eligibility requirements, and key facts about the form, individuals can ensure that they file it correctly and avoid penalties. If you're a California resident who is eligible to file California Form 410, don't hesitate to take advantage of this opportunity to reduce your tax liability and increase your take-home pay.

We hope this article has provided you with valuable information about California Form 410. If you have any questions or need further assistance, please don't hesitate to ask. Share your thoughts and experiences with us in the comments section below.

What is California Form 410?

+California Form 410, also known as the Withholding Exemption Certificate, is a tax form used by California residents to claim an exemption from state income tax withholding.

Who is eligible to file California Form 410?

+To be eligible to file California Form 410, individuals must meet certain requirements, including being a resident of California, having a low income, being 65 years or older, blind, or disabled, or being a non-resident alien.

What are the benefits of filing California Form 410?

+By filing California Form 410, individuals can reduce the amount of taxes withheld from their paycheck, increase their take-home pay, avoid overpayment of taxes, and simplify their tax filing process.