California is known for its thriving business landscape, attracting entrepreneurs and companies from all over the world. However, with the numerous benefits of doing business in the Golden State comes a range of tax obligations. One crucial aspect of California taxation is the franchise tax, which affects many businesses operating in the state. To navigate this complex area of taxation, the California Franchise Tax Board (FTB) requires businesses to file Form 3537, the Corporation Franchise or Income Tax Return. In this article, we will delve into the world of California Form 3537, exploring its purpose, who needs to file, and the key components of the form.

Understanding the Purpose of California Form 3537

California Form 3537 serves as the primary document for corporations to report their franchise tax obligations to the FTB. The form is designed to capture the financial activities of corporations, allowing the FTB to assess the correct amount of franchise tax owed. By filing Form 3537, corporations provide the FTB with essential information about their income, deductions, and credits, which are used to determine their tax liability.

Who Needs to File California Form 3537?

Not all businesses operating in California are required to file Form 3537. The obligation to file this form typically applies to corporations, including:

- C corporations

- S corporations

- Limited liability companies (LLCs) electing to be taxed as corporations

- Limited partnerships

- Limited liability partnerships (LLPs)

However, certain entities are exempt from filing Form 3537, such as:

- Sole proprietorships

- Single-member LLCs (unless electing to be taxed as a corporation)

- Partnerships (unless electing to be taxed as a corporation)

Key Components of California Form 3537

Form 3537 consists of multiple sections, each designed to gather specific information about the corporation's financial activities. The key components of the form include:

- Identification Information: This section requires the corporation to provide its name, address, and tax ID number.

- Income and Deductions: This section is where the corporation reports its income, deductions, and credits.

- Franchise Tax Computation: This section is used to calculate the corporation's franchise tax liability.

- Payment and Credits: This section allows the corporation to report any payments made or credits claimed.

Calculating Franchise Tax Liability

The franchise tax liability is calculated based on the corporation's net income, which is determined by subtracting deductions and credits from gross income. The franchise tax rate in California is 8.84% of net income, with a minimum tax of $800. However, corporations with net income below $25,000 are exempt from the minimum tax.

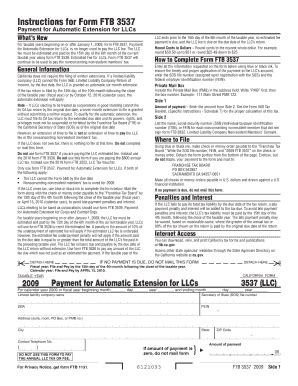

Penalties and Interest for Late Filing or Non-Payment

Corporations that fail to file Form 3537 or pay their franchise tax liability on time may be subject to penalties and interest. The FTB imposes a penalty of 5% of the unpaid tax for each month or part of a month that the tax remains unpaid, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax at a rate of 13% per annum.

Amending a Previously Filed Return

If a corporation needs to make changes to a previously filed return, it must file an amended return using Form 3537. The amended return should include the corrected information and an explanation of the changes made.

Conclusion: Navigating the Complex World of California Form 3537

Filing California Form 3537 is a critical aspect of maintaining compliance with the state's tax laws. By understanding the purpose, key components, and filing requirements of the form, corporations can ensure they meet their franchise tax obligations and avoid potential penalties and interest. If you have any questions or concerns about Form 3537, we encourage you to share them in the comments below.

What is the deadline for filing California Form 3537?

+The deadline for filing California Form 3537 is the 15th day of the 3rd month after the close of the tax year.

Can I file an extension for California Form 3537?

+Yes, you can file an extension for California Form 3537 using Form 3539.

How do I calculate the franchise tax liability on California Form 3537?

+The franchise tax liability is calculated by multiplying the corporation's net income by the franchise tax rate of 8.84%.