California, known for its stunning beaches, scenic mountains, and iconic cities, is also a hub for businesses and individuals alike. As a non-resident of California, filing taxes can be a complex process, especially when it comes to the California 540NR form. In this article, we will delve into the world of California state taxes, exploring the 540NR form and providing you with 7 essential filing tips to ensure a smooth and stress-free tax season.

Understanding the California 540NR Form

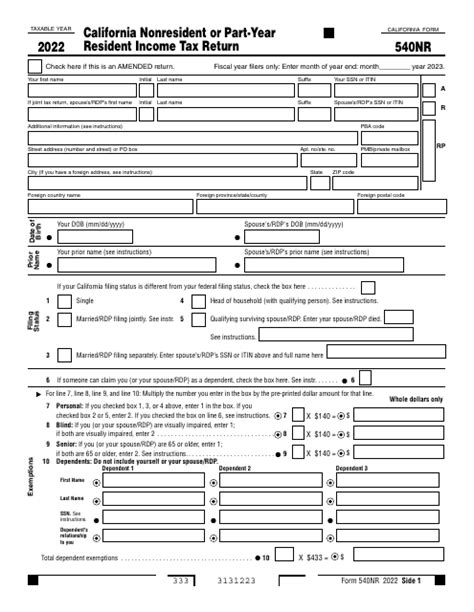

The California 540NR form, also known as the Non-Resident or Part-Year Resident Income Tax Return, is used by individuals who have income sourced from California but are not residents of the state. This form is used to report income earned from sources such as rental properties, businesses, and investments within California.

Who Needs to File the 540NR Form?

If you are a non-resident of California and have income sourced from the state, you may need to file the 540NR form. This includes individuals who:

- Own rental properties in California

- Have business interests in the state

- Earn income from investments in California

- Are part-year residents of California

7 Essential Filing Tips for the California 540NR Form

-

Determine Your Filing Status: Before starting the filing process, it's essential to determine your filing status. If you are a non-resident, you will need to file the 540NR form. If you are a part-year resident, you may need to file both the 540NR and the 540 form.

-

Gather Required Documents: To ensure a smooth filing process, gather all required documents, including:

- W-2 forms for California-sourced income

- 1099 forms for freelance work or investments

- Rental income statements

- Business income statements

-

Understand California Tax Laws: Familiarize yourself with California tax laws, including the state's tax rates and deductions. California has a progressive tax system, with tax rates ranging from 1% to 13.3%.

-

Report All California-Sourced Income: Report all income sourced from California, including income from rental properties, businesses, and investments. Failure to report all income can result in penalties and fines.

-

Claim All Eligible Deductions: Claim all eligible deductions, including the California standard deduction, mortgage interest deduction, and charitable contributions deduction.

-

File Electronically: File your 540NR form electronically to ensure timely processing and to reduce the risk of errors. The California Franchise Tax Board (FTB) offers free e-file options for eligible taxpayers.

-

Seek Professional Help: If you are unsure about the filing process or have complex tax situations, consider seeking professional help from a certified tax professional or accountant.

Common Mistakes to Avoid When Filing the 540NR Form

When filing the 540NR form, avoid common mistakes, such as:

- Failing to report all California-sourced income

- Claiming ineligible deductions

- Filing late or missing the deadline

- Not signing the form or including required documentation

FAQs About the California 540NR Form

Still have questions about the California 540NR form? Here are some frequently asked questions:

-

Q: What is the deadline for filing the 540NR form? A: The deadline for filing the 540NR form is typically April 15th, but may vary depending on your specific tax situation.

-

Q: Can I file the 540NR form electronically? A: Yes, the California FTB offers free e-file options for eligible taxpayers.

-

Q: Do I need to file the 540NR form if I have no California-sourced income? A: No, if you have no California-sourced income, you do not need to file the 540NR form.

Conclusion: Take Control of Your California Taxes

Filing the California 540NR form can be a complex process, but with the right knowledge and preparation, you can take control of your California taxes. By following these 7 essential filing tips and avoiding common mistakes, you can ensure a smooth and stress-free tax season.

We encourage you to share your thoughts and experiences with the California 540NR form in the comments below. Don't forget to share this article with your friends and family who may be filing the 540NR form.

What is the California 540NR form?

+The California 540NR form is used by individuals who have income sourced from California but are not residents of the state.

Who needs to file the 540NR form?

+Individuals who have income sourced from California, including rental properties, businesses, and investments, may need to file the 540NR form.

What is the deadline for filing the 540NR form?

+The deadline for filing the 540NR form is typically April 15th, but may vary depending on your specific tax situation.