The California tax landscape can be complex and overwhelming, especially when it comes to understanding the various forms and regulations that govern tax filing in the state. One crucial form that California taxpayers need to be familiar with is the CA Form 8453. In this article, we will delve into the essential facts about CA Form 8453, exploring its purpose, requirements, and benefits.

What is CA Form 8453?

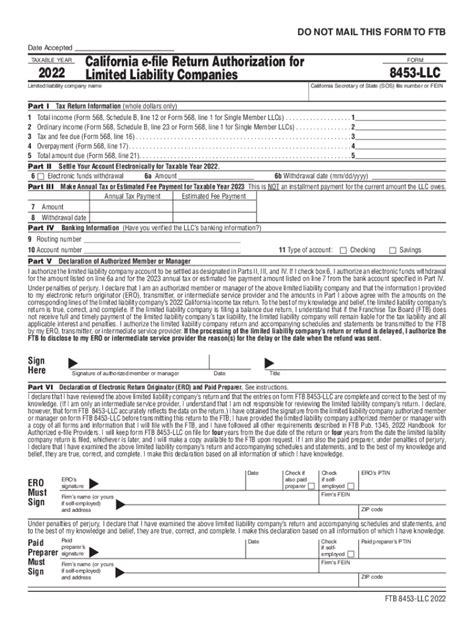

CA Form 8453, also known as the California Individual Income Tax Declaration for an e-filed Return, is a tax form required by the California Franchise Tax Board (FTB) for taxpayers who file their state income tax returns electronically. This form serves as a declaration that the taxpayer has filed their return electronically and has provided accurate and truthful information.

Why is CA Form 8453 Important?

CA Form 8453 plays a vital role in the electronic filing process, as it helps the FTB verify the authenticity and accuracy of the taxpayer's return. By signing and submitting this form, taxpayers acknowledge that they have reviewed their return and confirm that the information provided is true and correct.

Who Needs to File CA Form 8453?

Not all California taxpayers need to file CA Form 8453. This form is specifically required for individuals who file their state income tax returns electronically, either through a tax professional or using tax preparation software. Taxpayers who file a paper return do not need to complete this form.

What Information is Required on CA Form 8453?

CA Form 8453 requires taxpayers to provide specific information, including:

- Taxpayer's name and Social Security number or Individual Taxpayer Identification Number (ITIN)

- Spouse's name and Social Security number or ITIN (if applicable)

- Date of birth

- Electronic filing identification number (EFIN) or preparer tax identification number (PTIN) of the tax professional or software used to file the return

- Declaration that the taxpayer has reviewed their return and confirms the accuracy of the information provided

How to Complete and Submit CA Form 8453

Taxpayers can obtain CA Form 8453 from the FTB website or through their tax professional or software provider. To complete the form, taxpayers will need to provide the required information and sign the declaration. The completed form can be submitted electronically through the FTB's website or by mail to the address listed on the form.

Benefits of Filing CA Form 8453

Filing CA Form 8453 provides several benefits, including:

- Expedited processing of the taxpayer's return

- Reduced risk of errors or discrepancies

- Enhanced security and verification of the taxpayer's identity

- Compliance with California tax regulations

Common Mistakes to Avoid When Filing CA Form 8453

To avoid delays or rejection of their return, taxpayers should be aware of common mistakes to avoid when filing CA Form 8453, including:

- Incomplete or inaccurate information

- Failure to sign the declaration

- Incorrect or missing EFIN or PTIN

- Failure to submit the form electronically or by mail

Consequences of Not Filing CA Form 8453

Taxpayers who fail to file CA Form 8453 or provide incomplete or inaccurate information may face consequences, including:

- Delayed processing of their return

- Rejection of their return

- Penalties and fines

- Potential audit or examination by the FTB

Conclusion: Stay Informed and Compliant with CA Form 8453

In conclusion, CA Form 8453 is a critical component of the electronic filing process in California. By understanding the essential facts about this form, taxpayers can ensure compliance with state tax regulations and avoid potential consequences. Remember to carefully review and complete the form, providing accurate and truthful information, and submit it electronically or by mail to the FTB.

Invite readers to comment, share, or take specific actions

If you have any questions or concerns about CA Form 8453, please leave a comment below. Share this article with others who may benefit from this information. Stay informed and compliant with California tax regulations by visiting the FTB website or consulting with a tax professional.

FAQ Section

What is the purpose of CA Form 8453?

+CA Form 8453 is a declaration that the taxpayer has filed their state income tax return electronically and has provided accurate and truthful information.

Who needs to file CA Form 8453?

+Individuals who file their state income tax returns electronically, either through a tax professional or using tax preparation software, need to file CA Form 8453.

What information is required on CA Form 8453?

+CA Form 8453 requires taxpayers to provide specific information, including their name, Social Security number or ITIN, date of birth, and EFIN or PTIN of the tax professional or software used to file the return.