The California Form 592-PTE is a crucial document for pass-through entities operating in the state. As a business owner, understanding the intricacies of this tax return is vital to ensure compliance with state regulations and avoid potential penalties. In this article, we will delve into the world of California Form 592-PTE, exploring its purpose, benefits, and step-by-step instructions for filing.

What is California Form 592-PTE?

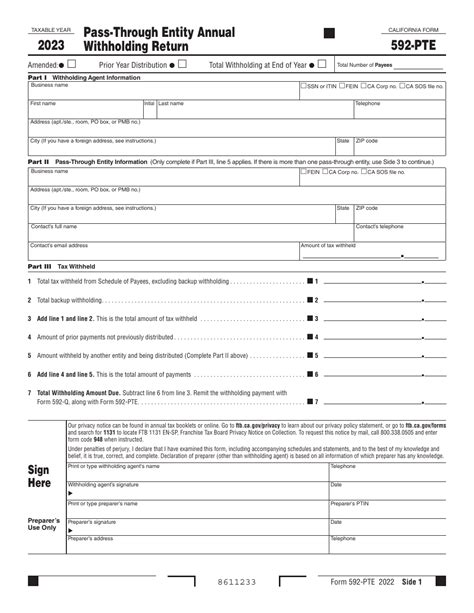

California Form 592-PTE is a tax return specifically designed for pass-through entities (PTEs) operating in California. PTEs include partnerships, limited liability companies (LLCs), and S corporations. The primary purpose of this form is to report the entity's income, deductions, and credits, which are then passed through to the individual owners or shareholders.

Benefits of Filing California Form 592-PTE

Filing California Form 592-PTE offers several benefits to pass-through entities:

- Simplified tax compliance: By filing a single tax return, PTEs can simplify their tax compliance obligations and reduce administrative burdens.

- Accurate tax reporting: The form ensures that PTEs accurately report their income, deductions, and credits, which helps prevent errors and potential audits.

- Compliance with state regulations: Filing California Form 592-PTE demonstrates a PTE's commitment to complying with state tax regulations, reducing the risk of penalties and fines.

Who Needs to File California Form 592-PTE?

The following pass-through entities are required to file California Form 592-PTE:

- Partnerships: General partnerships, limited partnerships, and limited liability partnerships.

- LLCs: Single-member and multi-member LLCs, including those classified as partnerships or S corporations.

- S corporations: S corporations that are required to file a federal income tax return.

Step-by-Step Instructions for Filing California Form 592-PTE

To file California Form 592-PTE, follow these steps:

- Gather necessary documents: Collect all relevant financial statements, including the entity's balance sheet, income statement, and any supporting schedules.

- Complete the form: Fill out the form, ensuring accuracy and completeness.

- Calculate tax liability: Calculate the entity's tax liability, including any applicable credits and deductions.

- Submit the form: File the completed form with the California Franchise Tax Board (FTB) by the required deadline.

Tips and Reminders for Filing California Form 592-PTE

- File electronically: The FTB recommends filing California Form 592-PTE electronically to reduce errors and expedite processing.

- Meet deadlines: Ensure timely filing to avoid penalties and interest.

- Seek professional help: Consult a tax professional or accountant to ensure accurate completion of the form.

Common Errors to Avoid When Filing California Form 592-PTE

- Inaccurate or incomplete information: Ensure all financial statements and supporting schedules are accurate and complete.

- Math errors: Double-check calculations to prevent errors.

- Missing signatures: Ensure all required signatures are included.

California Form 592-PTE FAQs

Here are some frequently asked questions about California Form 592-PTE:

- Q: What is the deadline for filing California Form 592-PTE? A: The deadline is typically April 15th, but may vary depending on the entity's fiscal year.

- Q: Can I file California Form 592-PTE electronically? A: Yes, the FTB recommends electronic filing to reduce errors and expedite processing.

- Q: Who is required to sign California Form 592-PTE? A: The entity's authorized representative, such as a partner, member, or officer, must sign the form.

What is the purpose of California Form 592-PTE?

+California Form 592-PTE is a tax return specifically designed for pass-through entities operating in California. The primary purpose of this form is to report the entity's income, deductions, and credits, which are then passed through to the individual owners or shareholders.

Who needs to file California Form 592-PTE?

+The following pass-through entities are required to file California Form 592-PTE: partnerships, LLCs, and S corporations.

What are the benefits of filing California Form 592-PTE?

+Filing California Form 592-PTE offers several benefits, including simplified tax compliance, accurate tax reporting, and compliance with state regulations.

We hope this comprehensive guide to California Form 592-PTE has provided valuable insights and practical tips for pass-through entities operating in California. By following the instructions and avoiding common errors, you can ensure accurate and timely filing of this critical tax return.