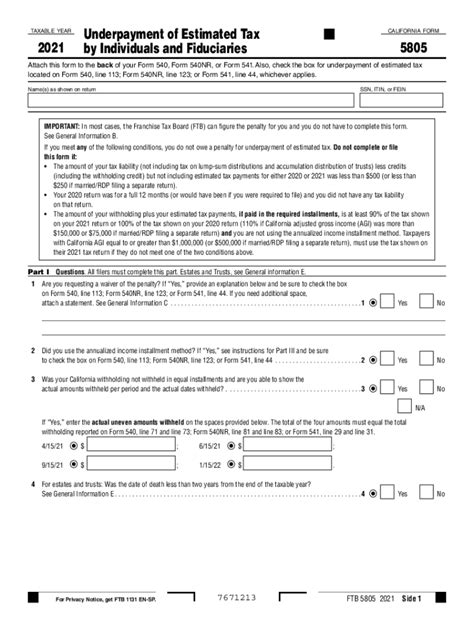

Filling out the CA Form 5805, also known as the "California Withholding Exemption Certificate," is a crucial step for California employers and employees to ensure accurate state income tax withholding. In this article, we will guide you through the process of filling out the CA Form 5805, highlighting five essential ways to complete it correctly.

Understanding the CA Form 5805

The CA Form 5805 is used to certify an employee's withholding exemption status for California state income tax purposes. This form is typically completed by employees who are exempt from California state income tax withholding or who wish to claim a specific number of allowances.

Who Needs to Fill Out the CA Form 5805?

The CA Form 5805 is required for:

- New employees who are exempt from California state income tax withholding

- Employees who wish to change their withholding exemption status

- Employees who are claiming a specific number of allowances

5 Ways to Fill Out the CA Form 5805

1. Gather Required Information

Before filling out the CA Form 5805, ensure you have the following information:

- Employee's name and address

- Employee's Social Security number or Individual Taxpayer Identification Number (ITIN)

- Employee's marital status

- Number of allowances claimed

- Employee's signature and date

2. Complete the Employee Information Section

Fill out the employee information section with the required details, including name, address, Social Security number or ITIN, and marital status.

Employee Information Section Example:

| Employee Information | Details |

|---|---|

| Name | John Doe |

| Address | 123 Main Street, Anytown, CA 12345 |

| Social Security Number | 123-45-6789 |

| Marital Status | Single |

3. Determine the Withholding Exemption Status

Determine the employee's withholding exemption status by selecting one of the following options:

- Exempt from California state income tax withholding

- Not exempt from California state income tax withholding

4. Claim Allowances (If Applicable)

If the employee is not exempt from California state income tax withholding, claim the number of allowances they are eligible for. The number of allowances claimed will affect the amount of California state income tax withheld.

Allowances Claimed Example:

| Allowances Claimed | Details |

|---|---|

| Number of Allowances | 2 |

5. Sign and Date the Form

Finally, have the employee sign and date the CA Form 5805. This certifies that the information provided is accurate and complete.

Signature and Date Example:

| Signature and Date | Details |

|---|---|

| Signature | John Doe |

| Date | February 22, 2023 |

Additional Tips and Reminders

- Ensure the employee understands the implications of claiming exemptions or allowances on their California state income tax withholding.

- Keep a copy of the completed CA Form 5805 for your records.

- Update the employee's withholding information in your payroll system accordingly.

Common Mistakes to Avoid

- Incomplete or inaccurate employee information

- Incorrect withholding exemption status

- Incorrect number of allowances claimed

- Unsigned or undated form

Conclusion

Filling out the CA Form 5805 is a straightforward process that requires attention to detail and accurate information. By following these five essential ways to complete the form, you can ensure accurate California state income tax withholding for your employees.

Who is required to fill out the CA Form 5805?

+The CA Form 5805 is required for new employees who are exempt from California state income tax withholding, employees who wish to change their withholding exemption status, and employees who are claiming a specific number of allowances.

What information is required to fill out the CA Form 5805?

+The required information includes employee's name and address, Social Security number or ITIN, marital status, number of allowances claimed, and employee's signature and date.

How often does the CA Form 5805 need to be updated?

+The CA Form 5805 typically needs to be updated when an employee's withholding exemption status changes or when an employee claims a different number of allowances.