Are you one of the many Californians who have received a notice from the California Franchise Tax Board (FTB) stating that there's an issue with your tax return? Or perhaps you've realized that you made an error on your taxes and want to correct it? If so, you'll likely need to file a CA Form 3532, also known as the Amended Individual Income Tax Return. In this article, we'll take a closer look at what CA Form 3532 is, why you might need to file it, and how to do so correctly.

What is CA Form 3532?

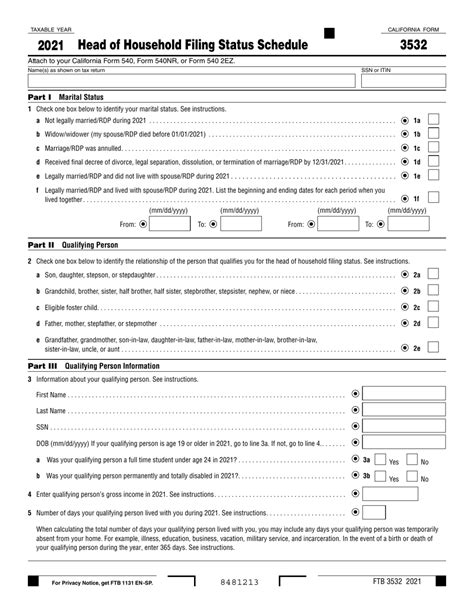

CA Form 3532 is the official form used by the California Franchise Tax Board (FTB) for amending individual income tax returns. The form is used to report changes to your original tax return, such as income, deductions, or credits. If you've already filed your original tax return and need to make corrections, you'll need to file a CA Form 3532.

Why do I need to file CA Form 3532?

There are several reasons why you might need to file a CA Form 3532. Here are a few common scenarios:

- You received a notice from the FTB stating that there's an issue with your tax return.

- You realized that you made an error on your original tax return, such as forgetting to report income or claim a deduction.

- You need to report a change in your income, deductions, or credits.

- You're responding to an audit or examination by the FTB.

Who needs to file CA Form 3532?

If you're a California resident and have already filed your original tax return, you may need to file a CA Form 3532 if you need to make corrections or report changes. This includes:

- Individuals who have filed a Form 540, California Resident Income Tax Return.

- Individuals who have filed a Form 540NR, California Nonresident or Part-Year Resident Income Tax Return.

How do I file CA Form 3532?

Filing CA Form 3532 is a relatively straightforward process. Here are the steps to follow:

- Gather necessary documents: You'll need to gather all relevant documents, including your original tax return, any notices from the FTB, and any supporting documentation for the changes you're making.

- Complete the form: Fill out CA Form 3532, making sure to include all required information, such as your name, address, and Social Security number.

- Attach supporting documentation: Attach all supporting documentation, such as receipts, invoices, or bank statements, to the form.

- Sign and date the form: Sign and date the form, making sure to include your name and title (if applicable).

- Submit the form: Submit the form to the FTB, either by mail or electronically.

What information do I need to include on CA Form 3532?

When completing CA Form 3532, you'll need to include the following information:

- Your name, address, and Social Security number.

- The tax year and filing status for which you're amending your return.

- A detailed explanation of the changes you're making, including any corrections or additions.

- Supporting documentation for the changes you're making.

What are the benefits of filing CA Form 3532?

Filing CA Form 3532 can have several benefits, including:

- Correcting errors: Filing CA Form 3532 allows you to correct errors or omissions on your original tax return, which can help you avoid penalties and interest.

- Reducing tax liability: If you're reporting a decrease in income or an increase in deductions, filing CA Form 3532 can help reduce your tax liability.

- Avoiding audits: Filing CA Form 3532 can help you avoid audits or examinations by the FTB, which can be time-consuming and costly.

Common mistakes to avoid when filing CA Form 3532

When filing CA Form 3532, there are several common mistakes to avoid, including:

- Incomplete or inaccurate information: Make sure to include all required information and ensure that it's accurate.

- Missing supporting documentation: Make sure to attach all required supporting documentation.

- Failing to sign and date the form: Make sure to sign and date the form, as this is required for processing.

Conclusion

Filing CA Form 3532 is an important step in correcting errors or reporting changes on your California tax return. By following the steps outlined in this article, you can ensure that you're filing the form correctly and avoiding common mistakes. Remember to gather all necessary documents, complete the form accurately, and attach supporting documentation. If you're unsure about any aspect of the process, consider consulting with a tax professional or contacting the FTB directly.

Take action today!

Don't wait any longer to correct errors or report changes on your California tax return. Take action today by gathering all necessary documents, completing CA Form 3532, and submitting it to the FTB. Remember to avoid common mistakes and seek help if you need it.

What is the deadline for filing CA Form 3532?

+The deadline for filing CA Form 3532 is typically 2 years from the original due date of the tax return.

Can I file CA Form 3532 electronically?

+Yes, you can file CA Form 3532 electronically through the FTB's website.

What if I need help filing CA Form 3532?

+If you need help filing CA Form 3532, consider consulting with a tax professional or contacting the FTB directly.