The deadline for filing your company's tax return is approaching, and you're not ready to submit it yet. Don't worry, you can breathe a sigh of relief. The IRS allows businesses to request an automatic six-month extension to file their tax returns, and it's relatively easy to do so.

What is Form 7004?

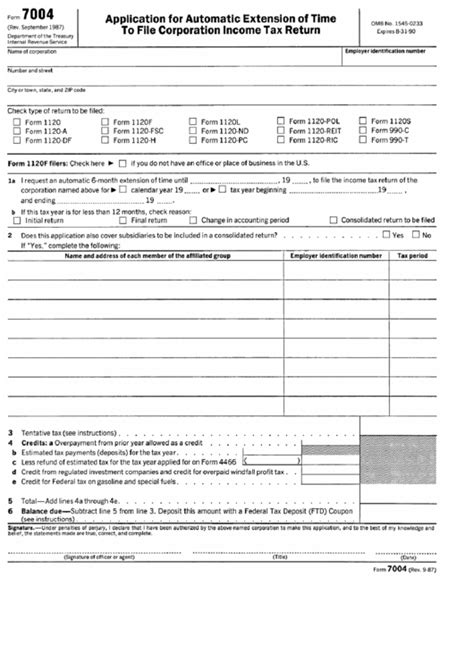

Form 7004 is the Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns. It's used by businesses to request an automatic six-month extension to file their tax returns, including Form 1120 (C Corp), Form 1120S (S Corp), and Form 1065 (Partnership). The form is typically due on the original deadline for filing the tax return.

Why File Form 7004?

Filing Form 7004 can give your business some extra time to gather all the necessary documents and information to complete your tax return accurately. It's essential to note that this extension is only for filing the tax return, not for paying any taxes owed. You'll still need to make an estimated tax payment by the original deadline to avoid penalties and interest.

Who Can File Form 7004?

Form 7004 can be filed by the following types of businesses:

- C Corporations (Form 1120)

- S Corporations (Form 1120S)

- Partnerships (Form 1065)

- Estates and Trusts (Form 1041)

- Real Estate Mortgage Investment Conduits (REMICs)

- Employee Stock Ownership Plans (ESOPs)

How to File Form 7004

Filing Form 7004 is a relatively straightforward process. You can file the form electronically or by mail.

Electronic Filing:

- Go to the IRS website and log in to your account.

- Select the "File" tab and choose "Form 7004."

- Fill out the form and submit it.

- You'll receive an email confirmation once the form is accepted.

Mail Filing:

- Download and complete Form 7004 from the IRS website.

- Sign the form and attach any required documentation.

- Mail the form to the address listed in the instructions.

What Information is Required on Form 7004?

To complete Form 7004, you'll need to provide the following information:

- Business name and address

- Employer Identification Number (EIN)

- Tax year and type of return (e.g., Form 1120, Form 1120S, etc.)

- Reason for requesting the extension (optional)

- Estimated tax liability and payment information

Common Mistakes to Avoid

When filing Form 7004, make sure to avoid the following common mistakes:

- Failing to sign the form

- Providing incorrect or incomplete information

- Missing the deadline for filing the form

- Not making an estimated tax payment

Benefits of Filing Form 7004 Online

Filing Form 7004 online offers several benefits, including:

- Convenience: File the form from anywhere with an internet connection.

- Speed: Receive instant confirmation once the form is accepted.

- Accuracy: Reduce errors and ensure the form is complete.

- Security: Protect your business's sensitive information with secure online filing.

Conclusion

Filing Form 7004 can give your business some extra time to complete your tax return accurately. By understanding the requirements and benefits of filing Form 7004, you can ensure a smooth and stress-free process. Don't wait until the last minute – file Form 7004 online today and take advantage of the automatic six-month extension.

We invite you to comment below and share your experiences with filing Form 7004. If you have any questions or need further assistance, please don't hesitate to ask.

What is the deadline for filing Form 7004?

+The deadline for filing Form 7004 is the original deadline for filing the tax return. For C Corporations, this is typically March 15th for calendar-year filers.

Can I file Form 7004 by mail?

+Yes, you can file Form 7004 by mail. However, electronic filing is recommended as it's faster and more secure.

What happens if I don't make an estimated tax payment with Form 7004?

+If you don't make an estimated tax payment with Form 7004, you may be subject to penalties and interest on the unpaid amount.