If you're a current or former employee of Burger King, accessing your W2 form is an essential step in completing your tax return. The W2 form, also known as the Wage and Tax Statement, provides a detailed breakdown of your income and taxes withheld from your paycheck. In this article, we'll guide you through the process of accessing your Burger King W2 form, highlighting the various methods available and troubleshooting common issues.

Understanding the Importance of Your W2 Form

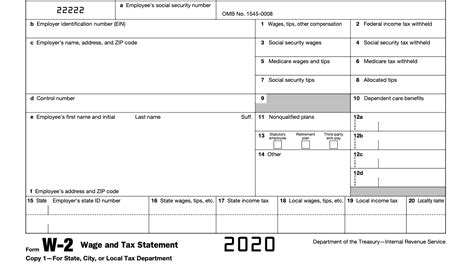

Your W2 form is a crucial document that provides vital information about your income and taxes. It includes details such as your gross income, federal income tax withheld, Social Security tax withheld, and Medicare tax withheld. The W2 form is typically used to complete your individual tax return (Form 1040) and is required by the Internal Revenue Service (IRS) to verify your income and tax withholding.

Methods for Accessing Your Burger King W2 Form

Burger King provides several methods for accessing your W2 form, making it convenient for employees to obtain the document. Here are the available methods:

- Online Access: Burger King employees can access their W2 form online through the company's HR portal or the ADP Employee Self-Service website. To access your W2 form online, follow these steps:

- Visit the Burger King HR portal or the ADP Employee Self-Service website.

- Log in to your account using your employee ID and password.

- Click on the "W2" or "Tax Documents" tab.

- Select the tax year for which you want to access your W2 form.

- Print or download your W2 form.

- Mail: Burger King will mail your W2 form to your address on file by January 31st of each year. If you haven't received your W2 form by February 15th, you can contact the Burger King HR department to request a replacement.

- In-Person: You can also visit your local Burger King restaurant or the HR department to request a paper copy of your W2 form.

Troubleshooting Common Issues

If you're experiencing issues accessing your Burger King W2 form, here are some troubleshooting tips:

- Incorrect Employee ID or Password: Verify that you're using the correct employee ID and password to log in to the HR portal or ADP Employee Self-Service website.

- Outdated Address: Ensure that your address on file is up-to-date, as Burger King will mail your W2 form to this address.

- Technical Issues: If you're experiencing technical issues while trying to access your W2 form online, try clearing your browser cache or contacting the Burger King HR department for assistance.

FAQs

Here are some frequently asked questions about accessing your Burger King W2 form:

- What if I haven't received my W2 form?: If you haven't received your W2 form by February 15th, contact the Burger King HR department to request a replacement.

- Can I access my W2 form online?: Yes, Burger King employees can access their W2 form online through the company's HR portal or the ADP Employee Self-Service website.

- How do I correct errors on my W2 form?: If you notice errors on your W2 form, contact the Burger King HR department to request corrections.

Additional Tips

- Verify Your Information: Ensure that your name, address, and Social Security number are accurate on your W2 form.

- Keep a Copy: Keep a copy of your W2 form for your records, as you may need to refer to it when completing your tax return.

- Contact the IRS: If you have questions or concerns about your W2 form or tax return, contact the IRS for assistance.

By following these steps and troubleshooting tips, you can easily access your Burger King W2 form and complete your tax return with confidence.

What is the deadline for Burger King to mail W2 forms?

+Burger King must mail W2 forms to employees by January 31st of each year.

Can I access my W2 form online if I'm a former employee?

+Yes, former employees can access their W2 form online through the Burger King HR portal or the ADP Employee Self-Service website.

What if I notice errors on my W2 form?

+If you notice errors on your W2 form, contact the Burger King HR department to request corrections.