The BMC 91X insurance form is a crucial document in the world of transportation and logistics. It's a must-have for anyone involved in hauling goods, whether it's a small business or a large corporation. But what exactly is the BMC 91X form, and why is it so important? In this article, we'll delve into the details of the BMC 91X form, its significance, and how to use it correctly.

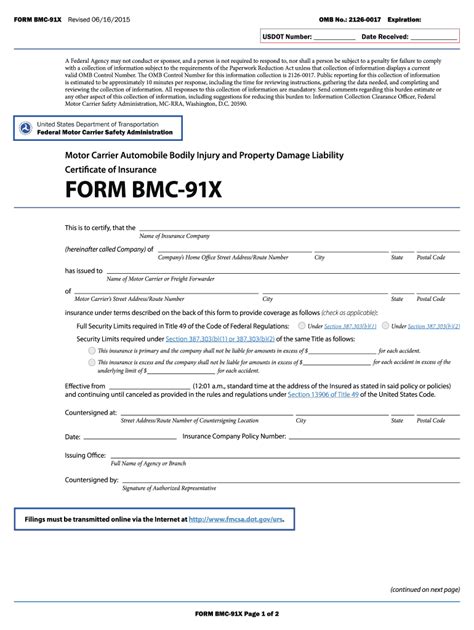

The BMC 91X form is a type of insurance endorsement that provides liability coverage for motor carriers. It's a Federal Motor Carrier Safety Administration (FMCSA) requirement for all motor carriers to have this type of insurance. The BMC 91X form is issued by insurance companies and serves as proof of insurance coverage.

What Does the BMC 91X Form Cover?

The BMC 91X form provides coverage for liability claims that may arise from the transportation of goods. This includes coverage for bodily injury, property damage, and cargo damage. The form also provides coverage for liability claims that may arise from the maintenance and operation of vehicles.

Types of Coverage

The BMC 91X form provides several types of coverage, including:

- Bodily Injury Liability: Covers damages or injuries to people involved in an accident.

- Property Damage Liability: Covers damages to property, including buildings, vehicles, and other structures.

- Cargo Liability: Covers damages or losses to the goods being transported.

- General Liability: Covers liability claims that may arise from the maintenance and operation of vehicles.

Who Needs the BMC 91X Form?

The BMC 91X form is required for all motor carriers, including:

- For-Hire Carriers: Carriers that transport goods for hire.

- Private Carriers: Carriers that transport goods for their own business or organization.

- Exempt Carriers: Carriers that are exempt from FMCSA regulations, but still require liability coverage.

Benefits of the BMC 91X Form

The BMC 91X form provides several benefits, including:

- Compliance with FMCSA Regulations: The BMC 91X form ensures compliance with FMCSA regulations, reducing the risk of fines and penalties.

- Liability Coverage: The form provides liability coverage, protecting motor carriers from financial losses in the event of an accident or cargo damage.

- Increased Credibility: Having the BMC 91X form can increase credibility with shippers, brokers, and other industry partners.

How to Fill Out the BMC 91X Form

Filling out the BMC 91X form requires careful attention to detail. Here are the steps to follow:

- Section 1: Carrier Information: Provide the carrier's name, address, and US DOT number.

- Section 2: Insurance Information: Provide the insurance company's name, policy number, and policy limits.

- Section 3: Coverage Types: Indicate the types of coverage selected (bodily injury liability, property damage liability, cargo liability, and general liability).

- Section 4: Limits of Liability: Provide the policy limits for each type of coverage.

- Section 5: Effective Date: Provide the effective date of the policy.

Common Mistakes to Avoid

When filling out the BMC 91X form, it's essential to avoid common mistakes, including:

- Incomplete Information: Failing to provide complete information can lead to delays or rejection of the form.

- Incorrect Coverage Types: Selecting the wrong coverage types can lead to inadequate coverage.

- Insufficient Policy Limits: Failing to provide sufficient policy limits can lead to financial losses in the event of a claim.

Conclusion

The BMC 91X form is a critical document for motor carriers, providing liability coverage and ensuring compliance with FMCSA regulations. By understanding the benefits and requirements of the BMC 91X form, motor carriers can ensure they have the necessary coverage to protect their business and assets.

We hope this article has provided valuable insights into the BMC 91X form. If you have any questions or comments, please feel free to share them below.

What is the BMC 91X form?

+The BMC 91X form is a type of insurance endorsement that provides liability coverage for motor carriers.

Who needs the BMC 91X form?

+The BMC 91X form is required for all motor carriers, including for-hire carriers, private carriers, and exempt carriers.

What types of coverage does the BMC 91X form provide?

+The BMC 91X form provides coverage for bodily injury liability, property damage liability, cargo liability, and general liability.