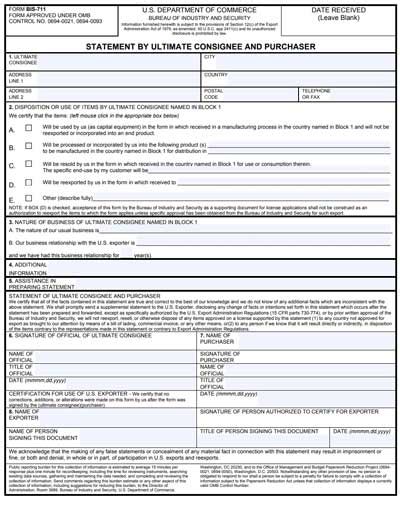

Bis Form 711, also known as the "Application for a Certificate of Authority to Transact Business as a Foreign Limited Liability Company" is a crucial document required for foreign limited liability companies (LLCs) to obtain authorization to operate in the United States. In this article, we will delve into the importance of Bis Form 711, the compliance requirements, and the step-by-step process of filing.

Understanding Bis Form 711

Bis Form 711 is a mandatory document that foreign LLCs must submit to the relevant state authorities to obtain a Certificate of Authority, which is a prerequisite for conducting business in the United States. The form requires essential information about the LLC, its members, and its business activities.

Why is Bis Form 711 Important?

The importance of Bis Form 711 cannot be overstated. Here are a few reasons why:

- Compliance: Bis Form 711 ensures that foreign LLCs comply with state regulations and laws, avoiding potential penalties and fines.

- Authorization: The Certificate of Authority obtained through Bis Form 711 grants foreign LLCs the authority to operate in the United States.

- Business Legitimacy: Filing Bis Form 711 enhances the legitimacy and credibility of a foreign LLC in the eyes of U.S. customers, partners, and suppliers.

Bis Form 711 Compliance Requirements

To ensure compliance, foreign LLCs must meet the following requirements:

Eligibility Criteria

- The LLC must be a foreign entity, meaning it is not registered in the United States.

- The LLC must have a valid business purpose, such as conducting business, owning property, or engaging in other commercial activities.

Required Documents

- A certified copy of the LLC's articles of organization or equivalent documents from its home country.

- A certificate of existence or a similar document from the LLC's home country.

- A copy of the LLC's operating agreement or a similar document.

Step-by-Step Filing Process

Here's a step-by-step guide to filing Bis Form 711:

Step 1: Gather Required Documents

- Collect all necessary documents, including the LLC's articles of organization, certificate of existence, and operating agreement.

Step 2: Fill Out Bis Form 711

- Complete Bis Form 711 accurately, ensuring that all required information is provided.

- Attach the required documents to the form.

Step 3: Submit the Form

- Submit the completed form and attached documents to the relevant state authorities.

- Pay the required filing fee, which varies by state.

Step 4: Receive the Certificate of Authority

- Once the form is processed, the state authorities will issue a Certificate of Authority.

- The Certificate of Authority is usually valid for a specific period, requiring renewal.

Common Mistakes to Avoid

- Inaccurate Information: Ensure that all information provided on Bis Form 711 is accurate and up-to-date.

- Insufficient Documents: Attach all required documents to avoid delays or rejection.

- Late Filing: Submit Bis Form 711 on time to avoid penalties and fines.

Conclusion

Bis Form 711 is a critical document for foreign LLCs to obtain authorization to operate in the United States. By understanding the compliance requirements and following the step-by-step filing process, foreign LLCs can ensure smooth and successful business operations.