The complexity of tax filing can be overwhelming, especially when it comes to specific forms like the Form 1041. As an individual or a business entity, understanding the intricacies of tax law and compliance can be daunting. However, with the advancement of technology, tax software has emerged as a game-changer in simplifying the tax filing process. In this article, we will delve into the world of tax software and explore the best options for Form 1041 filing, making the process easier and more efficient.

The Importance of Form 1041

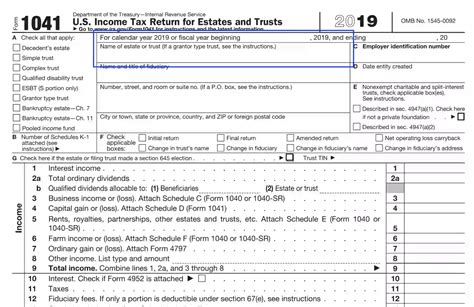

Before we dive into the world of tax software, it's essential to understand the significance of Form 1041. This form is used to report the income, deductions, and credits of a domestic trust or estate. The form is typically filed by the trustee or executor of the trust or estate, and it's crucial to ensure accuracy and compliance with tax laws to avoid any penalties or fines.

Benefits of Using Tax Software for Form 1041 Filing

Tax software has revolutionized the way we file taxes, and Form 1041 is no exception. By using tax software, you can enjoy several benefits, including:

- Accuracy: Tax software ensures that your return is accurate and complete, reducing the risk of errors and penalties.

- Efficiency: Tax software automates the tax filing process, saving you time and effort.

- Convenience: Tax software allows you to file your taxes from the comfort of your own home, at any time.

- Cost-effectiveness: Tax software can help you save money by avoiding costly mistakes and penalties.

Top Tax Software for Form 1041 Filing

Now that we've explored the benefits of using tax software for Form 1041 filing, let's take a look at the top options available in the market:

1. TurboTax

TurboTax is one of the most popular tax software options available, and it's an excellent choice for Form 1041 filing. With its user-friendly interface and comprehensive guidance, TurboTax ensures that your return is accurate and complete.

- Pricing: Starting at $0 for simple returns, with additional fees for more complex returns

- Features: Accuracy guarantee, maximum refund guarantee, and free audit support

2. H&R Block

H&R Block is another well-established tax software option that offers comprehensive support for Form 1041 filing. With its robust features and expert guidance, H&R Block ensures that your return is accurate and complete.

- Pricing: Starting at $0 for simple returns, with additional fees for more complex returns

- Features: Accuracy guarantee, maximum refund guarantee, and free audit support

3. TaxAct

TaxAct is a popular tax software option that offers comprehensive support for Form 1041 filing. With its user-friendly interface and expert guidance, TaxAct ensures that your return is accurate and complete.

- Pricing: Starting at $14.99 for simple returns, with additional fees for more complex returns

- Features: Accuracy guarantee, maximum refund guarantee, and free audit support

4. Credit Karma Tax

Credit Karma Tax is a free tax software option that offers comprehensive support for Form 1041 filing. With its user-friendly interface and expert guidance, Credit Karma Tax ensures that your return is accurate and complete.

- Pricing: Free for all returns

- Features: Accuracy guarantee, maximum refund guarantee, and free audit support

5. Drake Tax

Drake Tax is a professional tax software option that offers comprehensive support for Form 1041 filing. With its robust features and expert guidance, Drake Tax ensures that your return is accurate and complete.

- Pricing: Starting at $695 for a single-user license

- Features: Accuracy guarantee, maximum refund guarantee, and free audit support

Key Features to Consider When Choosing Tax Software

When choosing tax software for Form 1041 filing, there are several key features to consider:

1. Accuracy and Compliance

Ensure that the tax software you choose has a strong track record of accuracy and compliance. Look for features such as automatic error checking and compliance with IRS regulations.

2. User-Friendly Interface

Choose a tax software with a user-friendly interface that's easy to navigate. This will make the tax filing process less overwhelming and more efficient.

3. Comprehensive Guidance

Look for tax software that offers comprehensive guidance and support. This may include features such as expert advice, tutorials, and customer support.

4. Pricing and Fees

Consider the pricing and fees associated with the tax software. Look for options that offer transparent pricing and no hidden fees.

5. Integration with Other Tax Forms

If you need to file other tax forms, such as the Form 1040, look for tax software that offers integration with these forms.

Conclusion

Filing Form 1041 can be a complex and overwhelming process, but with the right tax software, it can be made easier. By choosing a tax software that offers accuracy, efficiency, and comprehensive guidance, you can ensure that your return is accurate and complete. Remember to consider key features such as accuracy and compliance, user-friendly interface, comprehensive guidance, pricing and fees, and integration with other tax forms.

Share your experiences with tax software for Form 1041 filing in the comments below! Have any questions or need further guidance? Ask us, and we'll be happy to help.

What is Form 1041 used for?

+Form 1041 is used to report the income, deductions, and credits of a domestic trust or estate.

Can I file Form 1041 electronically?

+Yes, you can file Form 1041 electronically using tax software or the IRS's Electronic Filing System.

What is the deadline for filing Form 1041?

+The deadline for filing Form 1041 is typically April 15th, but it may vary depending on the specific circumstances of the trust or estate.