As a homeowner or a resident, you may have come across the term "BCPS Shared Domicile Form" while dealing with property-related matters. But what exactly is this form, and why is it important? In this article, we will delve into the world of shared domicile and explore the intricacies of the BCPS Shared Domicile Form.

Understanding Shared Domicile

Shared domicile refers to a situation where two or more individuals share a common residence or living space. This can be a result of various circumstances, such as marriage, partnership, or even shared ownership of a property. The concept of shared domicile is crucial in determining tax liability, property rights, and other legal implications.

Importance of Shared Domicile in Property Matters

Shared domicile plays a significant role in property-related matters, particularly when it comes to taxation and property rights. For instance, when a property is jointly owned, the tax implications can be complex, and the shared domicile status can affect how taxes are levied. Similarly, in cases of divorce or separation, the shared domicile status can influence the distribution of property assets.

What is the BCPS Shared Domicile Form?

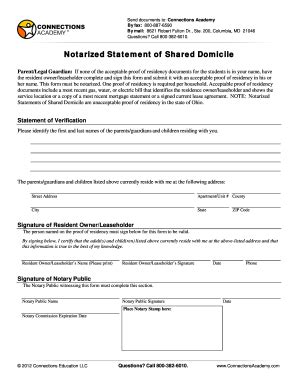

The BCPS Shared Domicile Form is a document used to declare the shared domicile status of two or more individuals. This form is typically required for property-related transactions, such as buying or selling a property, or when applying for tax benefits. The form is designed to provide proof of shared domicile, which can have significant implications for tax liability, property rights, and other legal matters.

Key Components of the BCPS Shared Domicile Form

The BCPS Shared Domicile Form typically includes the following key components:

- Personal details of the individuals sharing the domicile, including names, addresses, and dates of birth

- Proof of shared residence, such as utility bills or rental agreements

- Declaration of shared domicile status, including the start date and duration of shared residence

- Signature of both parties, confirming the shared domicile status

Benefits of the BCPS Shared Domicile Form

The BCPS Shared Domicile Form offers several benefits, including:

- Clarifies tax liability: By declaring shared domicile status, individuals can ensure they are taxed correctly, avoiding potential penalties or disputes.

- Establishes property rights: The form provides proof of shared ownership, which can influence property distribution in cases of divorce or separation.

- Streamlines property transactions: The form can facilitate property-related transactions, such as buying or selling a property, by providing clear evidence of shared domicile status.

How to Complete the BCPS Shared Domicile Form

To complete the BCPS Shared Domicile Form, individuals should follow these steps:

- Gather required documents, including proof of shared residence and personal identification.

- Fill out the form accurately, ensuring all details are correct and up-to-date.

- Sign the form, confirming the shared domicile status.

- Submit the form to the relevant authorities, such as the local tax office or property registry.

Common Mistakes to Avoid When Completing the BCPS Shared Domicile Form

When completing the BCPS Shared Domicile Form, individuals should avoid the following common mistakes:

- Incomplete or inaccurate information

- Failure to provide required documentation

- Incorrect signature or authorization

- Delayed submission of the form, which can result in penalties or disputes

Conclusion

In conclusion, the BCPS Shared Domicile Form is a crucial document that plays a significant role in property-related matters. By understanding the importance of shared domicile and completing the form accurately, individuals can ensure they are taxed correctly, establish property rights, and streamline property transactions. Remember to avoid common mistakes and seek professional advice if needed.

Call to Action

If you are dealing with property-related matters and require assistance with the BCPS Shared Domicile Form, we encourage you to seek professional advice from a qualified expert. Share your experiences or ask questions in the comments below, and don't forget to share this article with others who may benefit from this information.

What is the purpose of the BCPS Shared Domicile Form?

+The BCPS Shared Domicile Form is used to declare the shared domicile status of two or more individuals, providing proof of shared residence and influencing tax liability, property rights, and other legal matters.

Who needs to complete the BCPS Shared Domicile Form?

+Individuals who share a common residence or living space, including married couples, partners, or joint property owners, may need to complete the BCPS Shared Domicile Form for property-related transactions or tax purposes.

What are the consequences of not completing the BCPS Shared Domicile Form?

+Failure to complete the BCPS Shared Domicile Form can result in penalties, disputes, or incorrect tax liability, highlighting the importance of accurate and timely completion of the form.