When it comes to managing finances and making transactions, understanding the basics of an Automated Clearing House (ACH) form is crucial. An ACH form is a crucial document used for direct deposit, direct payment, and e-check transactions. In this article, we'll delve into the five essential parts of a basic ACH form, providing you with a comprehensive understanding of its components and significance.

ACH transactions have become increasingly popular due to their efficiency, convenience, and cost-effectiveness. They enable individuals and businesses to transfer funds electronically, reducing the need for paper checks and other traditional payment methods. With the rise of online banking and digital payment systems, ACH transactions have become an essential part of modern financial operations.

Understanding the ACH Network

Before diving into the essential parts of an ACH form, it's essential to understand the ACH network. The ACH network is a batch processing system that enables financial institutions to exchange electronic transactions. The network is governed by the National Automated Clearing House Association (NACHA) and is used for various types of transactions, including direct deposit, direct payment, and e-checks.

How ACH Transactions Work

ACH transactions involve several parties, including the originator (the entity initiating the transaction), the receiver (the entity receiving the funds), and the financial institutions involved. Here's a simplified overview of the ACH transaction process:

- The originator initiates the transaction by creating an ACH file, which contains the necessary information for the transaction.

- The ACH file is sent to the originator's financial institution, which forwards it to the ACH operator.

- The ACH operator sorts and batches the transactions, which are then sent to the receiver's financial institution.

- The receiver's financial institution processes the transaction and updates the receiver's account.

The 5 Essential Parts of a Basic ACH Form

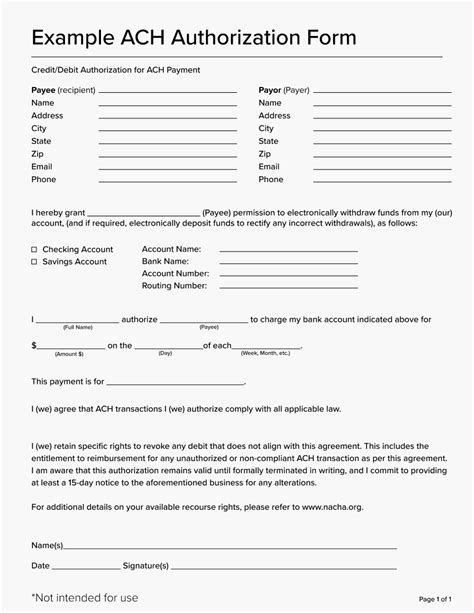

Now that we've covered the basics of the ACH network and transaction process, let's explore the five essential parts of a basic ACH form:

1. Originator Information

The originator information section is the first essential part of an ACH form. This section includes the originator's name, address, and identification number (also known as the originator ID). The originator ID is a unique identifier assigned to the originator by the ACH operator.

2. Receiver Information

The receiver information section is the second essential part of an ACH form. This section includes the receiver's name, address, and account number. The account number is crucial, as it ensures the funds are deposited into the correct account.

3. Transaction Information

The transaction information section is the third essential part of an ACH form. This section includes the transaction type (e.g., direct deposit, direct payment, or e-check), the transaction amount, and the settlement date. The settlement date is the date when the transaction is expected to settle.

4. Routing Information

The routing information section is the fourth essential part of an ACH form. This section includes the routing number of the originator's financial institution and the receiver's financial institution. The routing number is a unique identifier that helps the ACH operator route the transaction to the correct financial institution.

5. Authentication Information

The authentication information section is the fifth essential part of an ACH form. This section includes the authentication code, which is used to verify the transaction. The authentication code is typically a unique code generated by the originator's financial institution.

Benefits of ACH Transactions

ACH transactions offer numerous benefits, including:

- Convenience: ACH transactions can be initiated online or through mobile banking apps, making it easy to manage finances on-the-go.

- Efficiency: ACH transactions are faster than traditional payment methods, with most transactions settling within one to two business days.

- Cost-effectiveness: ACH transactions are often cheaper than traditional payment methods, with lower fees for both the originator and receiver.

Common ACH Transaction Errors

While ACH transactions are generally reliable, errors can occur. Common ACH transaction errors include:

- Incorrect account numbers or routing numbers

- Insufficient funds

- Unauthorized transactions

- Duplicate transactions

To minimize errors, it's essential to verify the accuracy of the ACH form and ensure that all parties involved have the necessary information.

Best Practices for ACH Transactions

To ensure smooth ACH transactions, follow these best practices:

- Verify the accuracy of the ACH form

- Use secure online platforms for initiating ACH transactions

- Monitor transactions regularly to detect any errors or suspicious activity

- Keep records of ACH transactions for future reference

In conclusion, understanding the five essential parts of a basic ACH form is crucial for managing finances and making transactions efficiently. By following best practices and being aware of common errors, you can ensure smooth ACH transactions and take advantage of the benefits they offer.

What is an ACH form?

+An ACH form is a document used for direct deposit, direct payment, and e-check transactions. It contains essential information, including originator and receiver details, transaction information, routing information, and authentication information.

What are the benefits of ACH transactions?

+ACH transactions offer numerous benefits, including convenience, efficiency, cost-effectiveness, and reliability. They also reduce the need for paper checks and other traditional payment methods.

How do I initiate an ACH transaction?

+To initiate an ACH transaction, you can use online banking platforms, mobile banking apps, or work with a financial institution. You'll need to provide the necessary information, including the ACH form, to complete the transaction.