As a customer of Wells Fargo Bank, you may need to complete a bank authorization form to grant permission for a third party to access your account information or conduct transactions on your behalf. This form is an essential document that ensures your financial security and prevents unauthorized access to your accounts. In this article, we will provide a step-by-step guide on how to complete a Wells Fargo Bank authorization form.

Why Do You Need a Bank Authorization Form?

A bank authorization form is required when you want to allow someone else to access your account information or conduct transactions on your behalf. This can include situations such as:

- Granting power of attorney to a family member or friend to manage your finances

- Allowing a third-party service provider to access your account information for payment processing

- Authorizing a financial advisor to manage your investments

By completing a bank authorization form, you can ensure that only authorized individuals have access to your account information and can conduct transactions on your behalf.

What Information Do You Need to Provide?

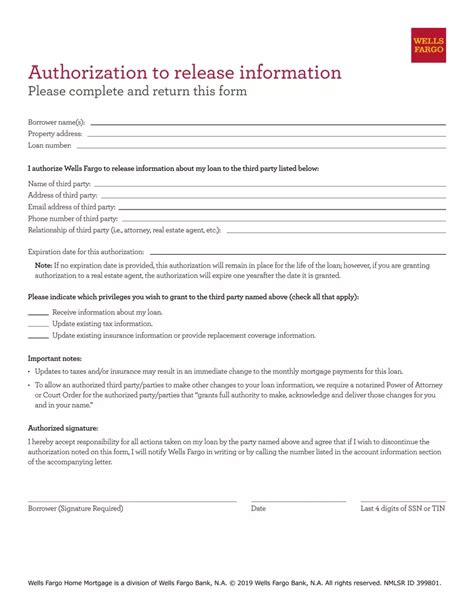

To complete a Wells Fargo Bank authorization form, you will need to provide the following information:

- Your name and account number

- The name and contact information of the authorized individual or third-party service provider

- The specific accounts that you want to authorize access to

- The type of access you want to grant (e.g., read-only, transactional, etc.)

- The duration of the authorization

You may also need to provide additional documentation, such as a power of attorney or a court order, depending on the specific circumstances.

Types of Bank Authorization Forms

Wells Fargo Bank offers different types of authorization forms, including:

- Authorization for Automatic Transfers: This form allows you to authorize automatic transfers between your accounts or to a third-party account.

- Authorization for Account Access: This form allows you to grant access to your account information to a third-party individual or service provider.

- Power of Attorney: This form allows you to grant power of attorney to a family member or friend to manage your finances.

Step-by-Step Guide to Completing a Wells Fargo Bank Authorization Form

Here is a step-by-step guide to completing a Wells Fargo Bank authorization form:

- Download the form: You can download the authorization form from the Wells Fargo Bank website or obtain a copy from your local branch.

- Read the instructions: Carefully read the instructions on the form to ensure you understand what information is required.

- Provide your account information: Enter your name and account number on the form.

- Provide the authorized individual's information: Enter the name and contact information of the authorized individual or third-party service provider.

- Specify the accounts: Identify the specific accounts that you want to authorize access to.

- Specify the type of access: Indicate the type of access you want to grant (e.g., read-only, transactional, etc.).

- Specify the duration: Indicate the duration of the authorization.

- Sign the form: Sign the form in the presence of a notary public, if required.

- Submit the form: Submit the completed form to Wells Fargo Bank by mail, fax, or in person.

Tips for Completing a Bank Authorization Form

Here are some tips to keep in mind when completing a Wells Fargo Bank authorization form:

- Read the form carefully: Make sure you understand what information is required and what you are authorizing.

- Use a notary public: If required, use a notary public to sign the form.

- Keep a copy: Keep a copy of the completed form for your records.

- Review and update: Review and update the authorization form as necessary to ensure that it remains accurate and up-to-date.

Frequently Asked Questions

Here are some frequently asked questions about Wells Fargo Bank authorization forms:

- Q: Can I authorize access to my account online? A: Yes, you can authorize access to your account online through the Wells Fargo Bank website.

- Q: Do I need to use a notary public to sign the form? A: Yes, you may need to use a notary public to sign the form, depending on the specific circumstances.

- Q: Can I revoke an authorization? A: Yes, you can revoke an authorization at any time by submitting a written request to Wells Fargo Bank.

Conclusion

Completing a Wells Fargo Bank authorization form is an important step in ensuring that your financial security is protected. By following the step-by-step guide outlined in this article, you can ensure that you complete the form accurately and effectively. Remember to read the form carefully, use a notary public if required, and keep a copy of the completed form for your records.

What is a bank authorization form?

+A bank authorization form is a document that grants permission for a third party to access your account information or conduct transactions on your behalf.

Why do I need a bank authorization form?

+You need a bank authorization form to grant permission for a third party to access your account information or conduct transactions on your behalf.

How do I complete a Wells Fargo Bank authorization form?

+Follow the step-by-step guide outlined in this article to complete a Wells Fargo Bank authorization form.

We hope this article has provided you with a comprehensive guide to completing a Wells Fargo Bank authorization form. If you have any further questions or concerns, please don't hesitate to comment below.