Navigating the complexities of tax planning can be overwhelming, especially when it comes to maximizing retirement savings. One strategy that has gained popularity in recent years is the Backdoor Roth IRA. This technique allows high-income individuals to contribute to a Roth IRA, even if they exceed the income limits set by the IRS. However, the process involves a series of steps that can be confusing, especially when it comes to filing the necessary tax forms.

In this article, we will delve into the world of Backdoor Roth IRAs, exploring the benefits, steps, and tax implications of this strategy. We will also provide guidance on how to navigate the tax forms required to complete the process.

Understanding the Backdoor Roth IRA

A Backdoor Roth IRA is a strategy that allows high-income individuals to contribute to a Roth IRA, even if they exceed the income limits set by the IRS. The process involves making a non-deductible contribution to a traditional IRA, and then converting those funds to a Roth IRA. This technique is called a "backdoor" Roth because it allows individuals to bypass the income limits that would otherwise prevent them from contributing to a Roth IRA.

Benefits of the Backdoor Roth IRA

There are several benefits to using the Backdoor Roth IRA strategy:

- Tax-free growth and withdrawals: Roth IRAs offer tax-free growth and withdrawals, making them an attractive option for retirement savings.

- No required minimum distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have RMDs, which means you are not required to take withdrawals in retirement.

- Inheritance: Roth IRAs are generally more inheritance-friendly than traditional IRAs.

Step-by-Step Guide to the Backdoor Roth IRA

To complete a Backdoor Roth IRA, follow these steps:

- Determine your eligibility: Check if you are eligible to contribute to a traditional IRA and if you exceed the income limits for a Roth IRA.

- Make a non-deductible contribution: Contribute to a traditional IRA, but do not deduct the contribution on your tax return.

- Convert the funds: Convert the non-deductible contribution to a Roth IRA.

Form 8606: The Nondeductible IRAs and Coverdell ESAs Form

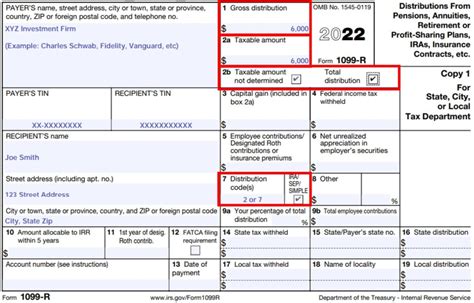

When completing a Backdoor Roth IRA, you will need to file Form 8606 with your tax return. This form is used to report nondeductible contributions to traditional IRAs, as well as conversions from traditional IRAs to Roth IRAs.

To complete Form 8606, follow these steps:

- Report nondeductible contributions: Report the nondeductible contribution to your traditional IRA on Line 1 of Form 8606.

- Report conversions: Report the conversion from your traditional IRA to your Roth IRA on Line 4 of Form 8606.

Tax Implications of the Backdoor Roth IRA

The tax implications of a Backdoor Roth IRA are generally favorable. Since you are making a non-deductible contribution to a traditional IRA, you will not receive a tax deduction for the contribution. However, the funds will grow tax-free in the Roth IRA, and withdrawals will be tax-free in retirement.

Pro-Rata Rule

One important consideration when completing a Backdoor Roth IRA is the pro-rata rule. This rule requires you to aggregate all of your traditional IRA accounts when determining the taxable amount of a conversion.

To avoid the pro-rata rule, it's recommended that you consolidate all of your traditional IRA accounts into a single account before completing a Backdoor Roth IRA.

Conclusion

The Backdoor Roth IRA is a powerful strategy for high-income individuals looking to maximize their retirement savings. By following the steps outlined in this article and completing the necessary tax forms, you can take advantage of the tax-free growth and withdrawals offered by a Roth IRA.

If you have any questions or concerns about the Backdoor Roth IRA, we encourage you to consult with a financial advisor or tax professional. With their guidance, you can navigate the complexities of this strategy and achieve your retirement savings goals.

What is a Backdoor Roth IRA?

+A Backdoor Roth IRA is a strategy that allows high-income individuals to contribute to a Roth IRA, even if they exceed the income limits set by the IRS.

What are the benefits of a Backdoor Roth IRA?

+The benefits of a Backdoor Roth IRA include tax-free growth and withdrawals, no required minimum distributions (RMDs), and inheritance-friendly rules.

What is Form 8606?

+Form 8606 is the Nondeductible IRAs and Coverdell ESAs form, which is used to report nondeductible contributions to traditional IRAs, as well as conversions from traditional IRAs to Roth IRAs.