As the Affordable Care Act (ACA) continues to play a significant role in the US healthcare system, it's essential to understand the various forms and documents associated with it. One such crucial form is the Ambetter Form 1095-A, which serves as proof of health insurance coverage. If you're an Ambetter health insurance policyholder or have been in the past, it's vital to grasp the significance of this form and how it impacts your tax filing process.

For many, navigating the complexities of health insurance and tax compliance can be overwhelming. That's why we've put together this comprehensive guide to help you understand the ins and outs of Ambetter Form 1095-A. From its purpose and importance to how to obtain and use it, we'll cover everything you need to know.

What is Ambetter Form 1095-A?

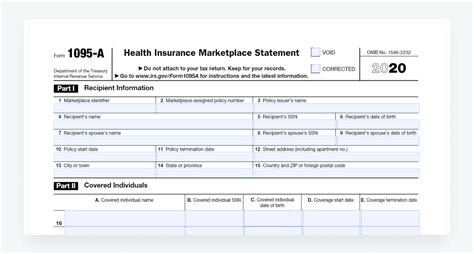

The Ambetter Form 1095-A is an official document issued by Ambetter, a health insurance company, to its policyholders. This form serves as proof of health insurance coverage and is used to verify compliance with the ACA's individual mandate. The form provides details about the policyholder's coverage, including the name of the policyholder, their dependents, and the coverage dates.

Why is Ambetter Form 1095-A Important?

The Ambetter Form 1095-A plays a crucial role in the tax filing process. When filing taxes, policyholders are required to report their health insurance coverage using Form 1095-A. This form helps the IRS verify that policyholders have met the ACA's minimum essential coverage requirements. Without this form, policyholders may face penalties or fines.

How to Obtain Ambetter Form 1095-A

Ambetter policyholders can obtain their Form 1095-A in several ways:

- Online: Policyholders can log in to their Ambetter account and download a copy of their Form 1095-A.

- Mail: Ambetter will mail a copy of the form to policyholders by January 31st of each year.

- Phone: Policyholders can call Ambetter's customer service to request a copy of their Form 1095-A.

What Information is Included on Ambetter Form 1095-A?

The Ambetter Form 1095-A includes the following information:

- Policyholder's name and address

- Policyholder's dependents

- Coverage dates

- Premium amounts

- Any applicable subsidies or tax credits

How to Use Ambetter Form 1095-A When Filing Taxes

When filing taxes, policyholders will need to use the information provided on their Form 1095-A to complete their tax return. Here's how:

- Form 8962: Policyholders will use the information on their Form 1095-A to complete Form 8962, which reports their premium tax credit.

- Form 1040: Policyholders will report their health insurance coverage on Form 1040, using the information provided on their Form 1095-A.

Common Errors to Avoid When Using Ambetter Form 1095-A

When using the Ambetter Form 1095-A to file taxes, it's essential to avoid common errors, such as:

- Incorrect information: Ensure that the information on your Form 1095-A is accurate and matches your tax return.

- Missing information: Double-check that you have all the necessary information from your Form 1095-A to complete your tax return.

Ambetter Form 1095-A FAQ

Q: What is the deadline for receiving my Ambetter Form 1095-A? A: Ambetter is required to mail Form 1095-A to policyholders by January 31st of each year.

Q: Can I use my Ambetter Form 1095-A to report my health insurance coverage on my tax return? A: Yes, the information on your Form 1095-A is used to report your health insurance coverage on your tax return.

Q: What if I don't receive my Ambetter Form 1095-A? A: If you don't receive your Form 1095-A, contact Ambetter's customer service to request a copy.

Q: Can I file my taxes without my Ambetter Form 1095-A? A: No, you'll need to wait until you receive your Form 1095-A to file your taxes accurately.

Q: How do I correct errors on my Ambetter Form 1095-A? A: Contact Ambetter's customer service to report any errors or discrepancies on your Form 1095-A.

Q: Can I use my Ambetter Form 1095-A to apply for subsidies or tax credits? A: Yes, the information on your Form 1095-A is used to determine your eligibility for subsidies or tax credits.

What is the purpose of Ambetter Form 1095-A?

+Ambetter Form 1095-A serves as proof of health insurance coverage and is used to verify compliance with the ACA's individual mandate.

How do I obtain a copy of my Ambetter Form 1095-A?

+Ambetter policyholders can obtain their Form 1095-A online, by mail, or by calling customer service.

What information is included on Ambetter Form 1095-A?

+The form includes policyholder's name and address, dependents, coverage dates, premium amounts, and any applicable subsidies or tax credits.

In conclusion, the Ambetter Form 1095-A is a vital document that plays a significant role in the tax filing process. By understanding its importance, how to obtain it, and how to use it, policyholders can ensure compliance with the ACA's individual mandate and avoid any potential penalties or fines. If you have any questions or concerns, don't hesitate to reach out to Ambetter's customer service or a tax professional for assistance.

Share your thoughts and experiences with Ambetter Form 1095-A in the comments below!