Direct deposit has become a standard practice in the modern banking system, allowing individuals to receive their salaries, benefits, and other payments directly into their bank accounts. Ally Bank, a renowned online bank, offers its customers the convenience of direct deposit, making it easier for them to manage their finances. In this article, we will explore the Ally Bank direct deposit form, its benefits, and how to set it up.

Understanding Direct Deposit

Direct deposit is an electronic payment system that transfers funds directly from the payer's account to the recipient's account. This method eliminates the need for paper checks, reducing the risk of lost or stolen checks, and ensuring faster access to funds. Direct deposit is widely used for various types of payments, including payroll, government benefits, and tax refunds.

Benefits of Ally Bank Direct Deposit

Ally Bank's direct deposit service offers numerous benefits to its customers, including:

- Convenience: Direct deposit eliminates the need to visit a bank branch or ATM to deposit funds.

- Faster Access to Funds: Funds are available in your account on the same day they are deposited, allowing you to access your money sooner.

- Reduced Risk: Direct deposit reduces the risk of lost or stolen checks, ensuring that your funds are safe and secure.

- Environmental Benefits: By reducing the need for paper checks, direct deposit helps minimize waste and promote sustainability.

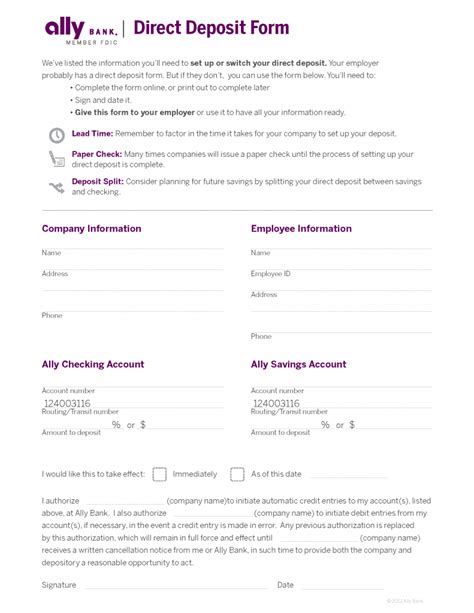

Ally Bank Direct Deposit Form

To set up direct deposit with Ally Bank, you will need to complete a direct deposit form. The form will require the following information:

- Your Name and Address: Your name and address as they appear on your Ally Bank account.

- Account Type: The type of account you want to deposit funds into (e.g., checking or savings).

- Account Number: Your Ally Bank account number.

- Routing Number: Ally Bank's routing number (124003116).

- Deposit Amount: The amount you want to deposit (optional).

You can obtain the direct deposit form by:

- Logging into your Ally Bank account online: You can download and print the form from the Ally Bank website.

- Visiting an Ally Bank branch: You can visit an Ally Bank branch in person to obtain a form.

- Calling Ally Bank customer service: You can call Ally Bank's customer service number to request a form.

How to Set Up Direct Deposit with Ally Bank

Setting up direct deposit with Ally Bank is a straightforward process. Here are the steps to follow:

- Complete the direct deposit form: Fill out the form with the required information, including your name, address, account type, account number, and routing number.

- Submit the form: Submit the completed form to your employer, benefits provider, or other payer.

- Verify your account information: Ensure that your account information is accurate and up-to-date to avoid any delays or issues with your direct deposit.

- Confirm with your payer: Confirm with your payer that they have received your direct deposit form and will begin making deposits into your Ally Bank account.

Common Issues with Ally Bank Direct Deposit

While direct deposit is a convenient and reliable payment method, issues can arise. Here are some common issues and their solutions:

- Incorrect account information: Ensure that your account information is accurate and up-to-date to avoid any delays or issues with your direct deposit.

- Delayed deposits: If your deposit is delayed, contact your payer to confirm that they have sent the payment and check with Ally Bank to ensure that there are no issues with your account.

- Failed deposits: If a deposit fails, contact your payer to resolve the issue and ensure that the payment is re-sent.

Tips for Managing Your Direct Deposit

To get the most out of your Ally Bank direct deposit, follow these tips:

- Monitor your account: Regularly check your account to ensure that deposits are being made correctly and on time.

- Set up account alerts: Set up account alerts to notify you when deposits are made or when there are any issues with your account.

- Keep your account information up-to-date: Ensure that your account information is accurate and up-to-date to avoid any delays or issues with your direct deposit.

Conclusion

Ally Bank's direct deposit service offers a convenient and reliable way to manage your finances. By completing the direct deposit form and following the steps outlined in this article, you can set up direct deposit and start enjoying the benefits of faster access to your funds, reduced risk, and environmental benefits. Remember to monitor your account regularly, set up account alerts, and keep your account information up-to-date to get the most out of your direct deposit.

What is the Ally Bank routing number?

+The Ally Bank routing number is 124003116.

How long does it take for direct deposit to become active?

+Direct deposit typically becomes active within 1-2 pay periods after submitting the direct deposit form.

Can I set up direct deposit for multiple accounts?

+Yes, you can set up direct deposit for multiple accounts, including checking and savings accounts.

We hope this article has helped you understand the Ally Bank direct deposit form and how to set it up. If you have any further questions or concerns, please don't hesitate to comment below.