As a responsible individual, it's essential to plan for the unexpected and ensure that your affairs are in order, even if you're unable to manage them yourself. One way to do this is by utilizing a power of attorney (POA) form, which grants someone you trust the authority to make decisions on your behalf. Allstate, a well-known insurance company, offers a power of attorney form that can be used in various situations. In this article, we'll explore five ways to use the Allstate power of attorney form and provide guidance on its benefits and usage.

Understanding the Allstate Power of Attorney Form

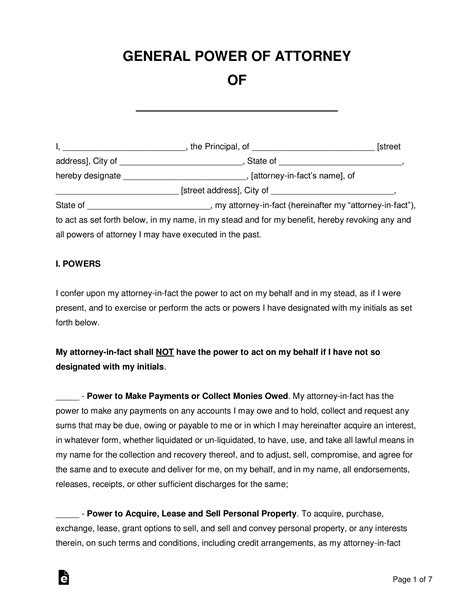

Before we dive into the ways to use the Allstate power of attorney form, it's essential to understand what it is and how it works. A power of attorney is a legal document that grants someone, known as the agent or attorney-in-fact, the authority to make decisions on behalf of the principal (you). This can include financial, medical, or other personal decisions. The Allstate power of attorney form is a specific type of POA that is designed to be used in conjunction with Allstate insurance policies.

1. Granting Financial Authority

One of the most common uses of the Allstate power of attorney form is to grant financial authority to an agent. This can be particularly useful if you're unable to manage your finances due to illness, injury, or other circumstances. By granting financial authority, your agent can:

- Manage your bank accounts and investments

- Pay bills and debts

- Make financial decisions on your behalf

This can provide peace of mind, knowing that your financial affairs are being handled by someone you trust.

Benefits of Granting Financial Authority

- Ensures continuity of financial management

- Allows for swift decision-making in emergency situations

- Provides protection against financial exploitation

2. Making Medical Decisions

Another way to use the Allstate power of attorney form is to grant medical authority to an agent. This can be particularly important if you're unable to make medical decisions for yourself due to illness or injury. By granting medical authority, your agent can:

- Make decisions regarding your medical treatment

- Consent to or refuse medical procedures

- Access your medical records

This can provide reassurance, knowing that your medical needs are being met by someone who understands your wishes.

Benefits of Granting Medical Authority

- Ensures that your medical wishes are respected

- Allows for swift decision-making in emergency situations

- Provides protection against medical exploitation

3. Managing Real Estate Transactions

The Allstate power of attorney form can also be used to grant authority for real estate transactions. This can be useful if you're unable to manage your real estate affairs due to distance or other circumstances. By granting real estate authority, your agent can:

- Buy or sell property on your behalf

- Manage rental properties

- Handle real estate transactions

This can provide flexibility, knowing that your real estate affairs are being handled by someone you trust.

Benefits of Granting Real Estate Authority

- Ensures continuity of real estate management

- Allows for swift decision-making in emergency situations

- Provides protection against real estate exploitation

4. Handling Insurance Claims

The Allstate power of attorney form can also be used to grant authority for handling insurance claims. This can be particularly useful if you're unable to manage your insurance claims due to illness or injury. By granting insurance authority, your agent can:

- File insurance claims on your behalf

- Manage insurance policies

- Handle insurance-related decisions

This can provide peace of mind, knowing that your insurance claims are being handled by someone you trust.

Benefits of Granting Insurance Authority

- Ensures continuity of insurance management

- Allows for swift decision-making in emergency situations

- Provides protection against insurance exploitation

5. Planning for End-of-Life Care

Finally, the Allstate power of attorney form can be used to plan for end-of-life care. This can be a difficult but important aspect of planning for the future. By granting authority for end-of-life care, your agent can:

- Make decisions regarding your end-of-life care

- Consent to or refuse medical procedures

- Ensure that your wishes are respected

This can provide reassurance, knowing that your end-of-life care is being handled by someone who understands your wishes.

Benefits of Granting End-of-Life Care Authority

- Ensures that your end-of-life wishes are respected

- Allows for swift decision-making in emergency situations

- Provides protection against end-of-life exploitation

As you can see, the Allstate power of attorney form can be used in a variety of situations to grant authority to an agent. Whether you're looking to grant financial, medical, real estate, insurance, or end-of-life care authority, this form can provide peace of mind and ensure that your affairs are in order.

If you're considering using the Allstate power of attorney form, we encourage you to take the next step and start planning for your future today. Don't hesitate to reach out to a trusted professional or seek guidance from a qualified attorney to ensure that your wishes are respected.

What is a power of attorney?

+A power of attorney is a legal document that grants someone the authority to make decisions on behalf of another person.

What is the Allstate power of attorney form?

+The Allstate power of attorney form is a specific type of power of attorney that is designed to be used in conjunction with Allstate insurance policies.

How do I use the Allstate power of attorney form?

+The Allstate power of attorney form can be used to grant authority for financial, medical, real estate, insurance, or end-of-life care decisions.