The Allstate Critical Illness Claim Form is a vital document for individuals who have purchased critical illness insurance through Allstate. This type of insurance provides financial protection in the event of a serious illness or medical condition, helping policyholders cover unexpected expenses. In this comprehensive guide, we will walk you through the process of filling out the Allstate Critical Illness Claim Form, highlighting the necessary steps and required documentation.

Understanding the Allstate Critical Illness Claim Form

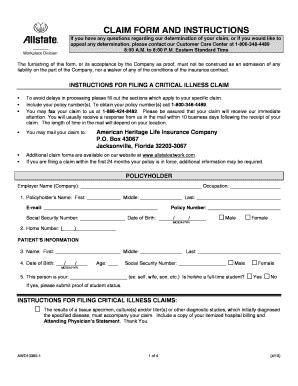

The Allstate Critical Illness Claim Form is designed to help policyholders notify the insurance company of a critical illness diagnosis and initiate the claims process. The form typically requires personal and medical information, as well as documentation from a licensed physician.

Why is the Allstate Critical Illness Claim Form Important?

The Allstate Critical Illness Claim Form is essential for policyholders to access the benefits of their critical illness insurance policy. By submitting the form, policyholders can:

- Notify Allstate of a critical illness diagnosis

- Initiate the claims process

- Receive financial assistance to cover unexpected medical expenses

- Reduce financial stress during a challenging time

Steps to Complete the Allstate Critical Illness Claim Form

To complete the Allstate Critical Illness Claim Form, follow these steps:

- Review the policy: Before starting the claims process, review your critical illness insurance policy to understand the coverage, benefits, and requirements.

- Gather required documentation: Collect the necessary documents, including:

- A licensed physician's statement confirming the critical illness diagnosis

- Medical records and test results

- Proof of identity and policy ownership

- Complete the claim form: Fill out the Allstate Critical Illness Claim Form, providing accurate and detailed information about the critical illness diagnosis, medical treatment, and expenses incurred.

- Submit the claim form: Send the completed claim form, along with the required documentation, to Allstate's designated claims address.

Required Documentation for the Allstate Critical Illness Claim Form

To support the claim, policyholders will need to provide documentation from a licensed physician, including:

- A diagnosis of a covered critical illness

- Medical records and test results

- A statement confirming the policyholder's inability to work due to the illness (if applicable)

Additional documentation may be required, such as:

- Proof of identity and policy ownership

- Receipts for medical expenses incurred

- Correspondence from the policyholder's employer (if applicable)

Tips for Completing the Allstate Critical Illness Claim Form

To ensure a smooth claims process, keep the following tips in mind:

- Read the policy carefully: Understand the coverage, benefits, and requirements before submitting the claim.

- Provide accurate information: Complete the claim form with accurate and detailed information to avoid delays or denials.

- Submit required documentation: Include all necessary documentation, as specified in the policy and claim form.

- Follow up with Allstate: If there are any issues or concerns, contact Allstate's claims department to resolve them promptly.

Common Mistakes to Avoid When Completing the Allstate Critical Illness Claim Form

To avoid delays or denials, steer clear of the following common mistakes:

- Inaccurate or incomplete information: Ensure all information is accurate and complete to avoid delays or denials.

- Missing documentation: Include all required documentation to support the claim.

- Delays in submission: Submit the claim form and documentation promptly to ensure timely processing.

What to Expect After Submitting the Allstate Critical Illness Claim Form

After submitting the Allstate Critical Illness Claim Form, policyholders can expect:

- Acknowledge of receipt: Allstate will acknowledge receipt of the claim form and documentation.

- Review and processing: The claims department will review the claim and verify the information provided.

- Notification of decision: Allstate will notify the policyholder of the claims decision, which may include approval, denial, or request for additional information.

What If the Allstate Critical Illness Claim Form is Denied?

If the claim is denied, policyholders have the right to appeal the decision. To appeal, policyholders should:

- Review the denial letter: Understand the reasons for the denial and the required next steps.

- Gather additional information: Collect any additional documentation or information required to support the appeal.

- Submit the appeal: Send the appeal, along with the required documentation, to Allstate's designated appeals address.

What is the Allstate Critical Illness Claim Form?

+The Allstate Critical Illness Claim Form is a document used to notify Allstate of a critical illness diagnosis and initiate the claims process.

What documentation is required to support the claim?

+Policyholders will need to provide documentation from a licensed physician, including a diagnosis of a covered critical illness, medical records and test results, and a statement confirming the policyholder's inability to work due to the illness (if applicable).

How long does the claims process typically take?

+The claims process typically takes several weeks to several months, depending on the complexity of the claim and the required documentation.

In conclusion, the Allstate Critical Illness Claim Form is an essential document for policyholders to access the benefits of their critical illness insurance policy. By following the steps outlined in this guide and providing accurate and complete information, policyholders can ensure a smooth claims process and timely access to the financial assistance they need during a challenging time.