Filing a benefits claim with Allstate can be a daunting task, especially during a time of need. However, with the right guidance, the process can be broken down into manageable steps. In this article, we will walk you through the 5 easy steps to filing an Allstate benefits claim.

Allstate is one of the largest insurance companies in the United States, offering a wide range of insurance products, including life, health, auto, and home insurance. With millions of policyholders, Allstate has established a robust claims process to ensure that policyholders receive the benefits they deserve. However, navigating the claims process can be overwhelming, especially for those who are new to filing insurance claims.

In this article, we will provide a comprehensive guide on how to file an Allstate benefits claim. We will break down the process into 5 easy steps, highlighting the necessary documents, information, and timelines required for a successful claim.

Step 1: Review Your Policy and Gather Information

Before starting the claims process, it's essential to review your policy to understand what is covered and what is not. Take a close look at your policy documents, including the policy terms, conditions, and exclusions. Make a note of the following information:

- Policy number

- Policy effective date

- Policy type (e.g., life, health, auto, or home)

- Coverage limits

- Deductible amount

- Claim filing deadlines

Additionally, gather all relevant documents and information related to your claim, including:

- Proof of loss or damage (e.g., police reports, medical records, or repair estimates)

- Receipts and invoices for expenses incurred

- Witness statements or contact information

Step 2: Notify Allstate of Your Claim

Once you have gathered all the necessary information, it's time to notify Allstate of your claim. You can do this by:

- Calling the Allstate claims hotline at 1-877-597-3393

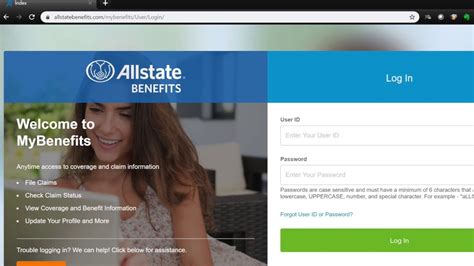

- Submitting a claim online through the Allstate website

- Visiting an Allstate agent or office in person

When notifying Allstate, be prepared to provide the information you gathered in Step 1. An Allstate representative will guide you through the claims process and provide you with a claim number, which you will need to reference throughout the process.

Step 3: Complete the Claim Form and Submit Supporting Documents

After notifying Allstate, you will need to complete a claim form, which can be obtained online or through the mail. The claim form will require you to provide detailed information about your claim, including:

- A description of the loss or damage

- The date and time of the loss or damage

- The location of the loss or damage

- The value of the loss or damage

In addition to the claim form, you will need to submit supporting documents, such as:

- Proof of ownership or proof of loss

- Medical records or police reports

- Repair estimates or invoices

Make sure to submit all required documents and information promptly to avoid delays in the claims process.

Step 4: Wait for Allstate to Review Your Claim

Once you have submitted your claim form and supporting documents, Allstate will review your claim to determine the extent of coverage. This process can take anywhere from a few days to several weeks, depending on the complexity of the claim.

During this time, an Allstate adjuster may contact you to request additional information or to schedule an inspection of the damaged property. Be patient and responsive to any requests from the adjuster to ensure a smooth claims process.

Step 5: Receive Your Benefits and Follow Up

If your claim is approved, you will receive a benefits payment from Allstate. Review your payment carefully to ensure that it is accurate and complete.

If you have any questions or concerns about your benefits payment, contact Allstate customer service promptly. Additionally, keep a record of all correspondence and communications with Allstate, including dates, times, and claim numbers.

Final Thoughts

Filing an Allstate benefits claim can be a straightforward process if you are prepared and follow the necessary steps. By reviewing your policy, gathering information, notifying Allstate, completing the claim form, and waiting for review, you can ensure a smooth and efficient claims process. Remember to stay patient, responsive, and organized throughout the process to receive your benefits in a timely manner.

We hope this article has provided you with a comprehensive guide on how to file an Allstate benefits claim. If you have any further questions or concerns, please don't hesitate to reach out to us.

FAQ Section

What is the Allstate claims hotline number?

+The Allstate claims hotline number is 1-877-597-3393.

Can I file a claim online?

+Yes, you can file a claim online through the Allstate website.

How long does it take to receive benefits from Allstate?

+The time it takes to receive benefits from Allstate varies depending on the complexity of the claim. Typically, it can take anywhere from a few days to several weeks.