As a taxpayer, you're likely familiar with the Form 8949, which is used to report sales and other dispositions of capital assets. However, the various adjustment codes on this form can be confusing, even for seasoned tax professionals. In this article, we'll break down the different Form 8949 adjustment codes, explain what they mean, and provide examples to help you navigate this complex tax landscape.

The Importance of Form 8949 Adjustment Codes

Form 8949 is a crucial document for taxpayers who have sold or disposed of capital assets, such as stocks, bonds, or real estate. The form is used to calculate the gain or loss from these transactions, which is then reported on Schedule D of the taxpayer's tax return. The adjustment codes on Form 8949 are used to indicate the type of transaction and any adjustments that need to be made to the reported gain or loss.

Common Form 8949 Adjustment Codes

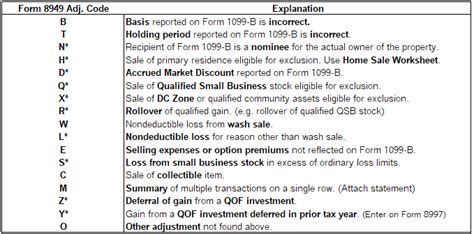

There are several adjustment codes that can be used on Form 8949, each with its own specific meaning. Here are some of the most common codes:

Code B: Adjustment for Net Short-Term Capital Loss

This code is used to report a net short-term capital loss from the sale of capital assets. A short-term capital loss occurs when an asset is sold for less than its original purchase price, and the loss is considered short-term if the asset was held for one year or less.

Example: John sells 100 shares of XYZ stock for $5,000, which he purchased for $10,000 six months ago. The loss of $5,000 is reported on Form 8949 with code B.

Code C: Adjustment for Net Long-Term Capital Loss

This code is used to report a net long-term capital loss from the sale of capital assets. A long-term capital loss occurs when an asset is sold for less than its original purchase price, and the loss is considered long-term if the asset was held for more than one year.

Example: Jane sells her primary residence for $200,000, which she purchased for $300,000 five years ago. The loss of $100,000 is reported on Form 8949 with code C.

Code E: Adjustment for Amounts Reported in Error

This code is used to report amounts that were previously reported in error on Form 8949. This can include corrections to the reported gain or loss, or adjustments to the reported basis of the asset.

Example: Tom realizes that he reported the wrong basis for a stock sale on his previous year's tax return. He files an amended return and reports the correct basis on Form 8949 with code E.

Code G: Adjustment for Wash Sale Loss

This code is used to report a wash sale loss, which occurs when an investor sells a security at a loss and then purchases a substantially identical security within 30 days.

Example: Rachel sells 100 shares of ABC stock for $5,000, which she purchased for $10,000 six months ago. Within 30 days, she purchases 100 shares of DEF stock, which is substantially identical to ABC stock. The loss of $5,000 is reported on Form 8949 with code G.

Other Form 8949 Adjustment Codes

There are several other adjustment codes that can be used on Form 8949, including:

- Code F: Adjustment for Loss Disallowed Under Section 1091

- Code H: Adjustment for Gain or Loss from a Section 1256 Contract

- Code J: Adjustment for Gain or Loss from a Section 988 Transaction

- Code K: Adjustment for Gain or Loss from a Section 1296 Transaction

Each of these codes has its own specific meaning and is used to report different types of transactions or adjustments.

Best Practices for Using Form 8949 Adjustment Codes

When using Form 8949 adjustment codes, it's essential to follow best practices to ensure accuracy and avoid errors. Here are some tips:

- Use the correct code for the type of transaction or adjustment being reported.

- Ensure that the reported gain or loss is accurate and supported by documentation.

- Use Form 8949 to report all capital asset transactions, including sales, exchanges, and other dispositions.

- Keep accurate records of all transactions, including dates, amounts, and codes used.

In conclusion, understanding Form 8949 adjustment codes is crucial for accurate tax reporting. By following best practices and using the correct codes, taxpayers can ensure that their capital asset transactions are reported correctly and avoid errors or penalties.

We hope this article has been helpful in explaining the different Form 8949 adjustment codes and how to use them. If you have any questions or need further clarification, please don't hesitate to comment below.

What is Form 8949 used for?

+Form 8949 is used to report sales and other dispositions of capital assets, such as stocks, bonds, or real estate.

What is the difference between code B and code C on Form 8949?

+Code B is used to report a net short-term capital loss, while code C is used to report a net long-term capital loss.

How do I know which adjustment code to use on Form 8949?

+Refer to the instructions for Form 8949 or consult with a tax professional to determine which adjustment code is applicable to your specific situation.