In today's fast-paced business world, entrepreneurs and organizations need to navigate a complex web of regulations, contracts, and insurance requirements. One crucial document that plays a significant role in this landscape is the ACORD 25 form, also known as the Certificate of Liability Insurance. This fillable form serves as proof of insurance coverage, providing essential information about a company's liability insurance policies. In this article, we will delve into the world of ACORD 25 forms, exploring their importance, benefits, and how to simplify the process of creating and managing these certificates.

What is an ACORD 25 Form?

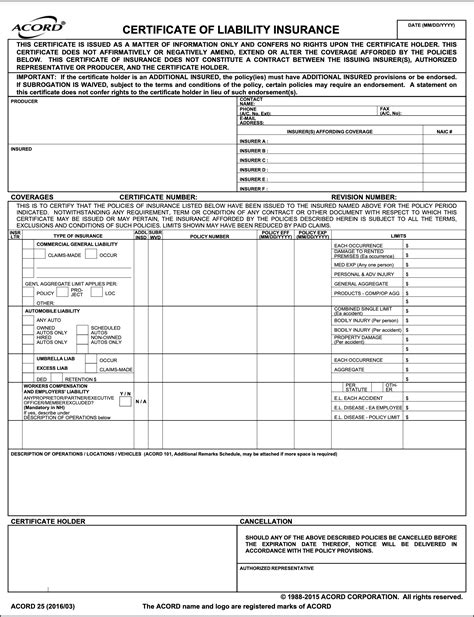

The ACORD 25 form is a standardized document used to provide proof of liability insurance coverage. It is typically issued by an insurance company or broker to a policyholder, verifying the existence of a liability insurance policy. The form includes essential details such as the policyholder's name, policy number, coverage limits, and the effective dates of the policy.

Why is the ACORD 25 Form Important?

The ACORD 25 form plays a vital role in various business transactions, serving as proof of insurance coverage. It is often required in contracts, agreements, and business relationships, ensuring that all parties involved are protected in case of accidents, injuries, or property damage. The form provides assurance that the policyholder has adequate insurance coverage, reducing the risk of financial loss and promoting a sense of security among stakeholders.

Benefits of Using ACORD 25 Forms

The use of ACORD 25 forms offers several benefits to businesses and individuals. Some of the most significant advantages include:

- Simplified Proof of Insurance: ACORD 25 forms provide a standardized and easily recognizable way to prove insurance coverage, eliminating the need for lengthy policy documents.

- Reduced Administrative Burden: By using a fillable ACORD 25 form, businesses can streamline their insurance certification process, saving time and resources.

- Improved Compliance: The use of ACORD 25 forms helps ensure compliance with regulatory requirements and contractual obligations, reducing the risk of non-compliance.

How to Simplify the ACORD 25 Form Fillable Process

To simplify the process of creating and managing ACORD 25 forms, consider the following steps:

- Use Fillable Templates: Utilize fillable ACORD 25 form templates that can be easily edited and customized to meet your specific needs.

- Implement Digital Signatures: Leverage digital signature tools to simplify the signing process, reducing the need for physical signatures and paperwork.

- Automate Certificate Issuance: Implement an automated system for issuing ACORD 25 forms, ensuring timely and accurate delivery of certificates.

Best Practices for Managing ACORD 25 Forms

To ensure efficient management of ACORD 25 forms, follow these best practices:

- Store Forms Securely: Maintain a secure and organized storage system for ACORD 25 forms, both physical and digital.

- Regularly Review and Update: Periodically review and update ACORD 25 forms to ensure accuracy and compliance with changing regulations and contractual requirements.

- Provide Clear Instructions: Offer clear instructions to policyholders and stakeholders on the use and interpretation of ACORD 25 forms.

Common Challenges with ACORD 25 Forms

Despite the benefits of ACORD 25 forms, several challenges can arise during the creation and management process. Some common issues include:

- Inaccurate or Incomplete Information: Inaccurate or incomplete information on the ACORD 25 form can lead to delays, non-compliance, or even policy cancellations.

- Delays in Certificate Issuance: Delays in issuing ACORD 25 forms can impact business operations, contracts, and relationships with stakeholders.

Conclusion: Streamlining Your Insurance Certificates with ACORD 25 Forms

In conclusion, ACORD 25 forms play a vital role in providing proof of liability insurance coverage, ensuring compliance, and promoting a sense of security among stakeholders. By simplifying the process of creating and managing ACORD 25 forms, businesses can reduce administrative burdens, improve compliance, and streamline their insurance certification process. By implementing best practices and leveraging digital tools, organizations can ensure accurate, efficient, and secure management of their ACORD 25 forms.

We invite you to share your thoughts and experiences with ACORD 25 forms in the comments section below. Have you encountered any challenges or benefits while using these forms? What strategies have you implemented to simplify the process? Your input can help others in the industry optimize their insurance certification process.

Take Action: Download a fillable ACORD 25 form template today and start simplifying your insurance certification process.

What is the purpose of an ACORD 25 form?

+The ACORD 25 form serves as proof of liability insurance coverage, providing essential information about a company's liability insurance policies.

How can I simplify the ACORD 25 form fillable process?

+To simplify the process, use fillable templates, implement digital signatures, and automate certificate issuance.

What are the benefits of using ACORD 25 forms?

+The benefits of using ACORD 25 forms include simplified proof of insurance, reduced administrative burden, and improved compliance.