As the world of real estate and investments continues to evolve, it's essential for property owners and investors to understand the intricacies of tax-deferred exchanges. One crucial tool in this arena is the Accord 1035 Exchange Form, which facilitates the transfer of funds from one investment to another without incurring tax liabilities. In this article, we'll delve into the world of 1035 exchanges, exploring the benefits, mechanisms, and procedures involved.

What is a 1035 Exchange?

A 1035 exchange is a tax-deferred exchange that allows investors to transfer funds from one investment to another, typically from one life insurance policy or annuity contract to another. This process enables investors to reposition their investments without incurring tax liabilities, thereby preserving the growth and value of their assets.

Benefits of a 1035 Exchange

The primary benefits of a 1035 exchange include:

• Tax-deferred growth: By transferring funds from one investment to another without incurring taxes, investors can preserve the growth and value of their assets. • Increased flexibility: 1035 exchanges enable investors to reposition their investments in response to changing market conditions or personal financial goals. • Improved investment performance: By transferring funds to a new investment with potentially higher returns, investors can enhance their overall investment performance.

How Does a 1035 Exchange Work?

A 1035 exchange involves a series of steps, including:

- Identifying the replacement investment: Investors must identify a new investment that meets the IRS's requirements for a 1035 exchange.

- Notifying the insurance company: Investors must notify the insurance company or annuity provider of their intention to execute a 1035 exchange.

- Completing the exchange: The insurance company or annuity provider will facilitate the transfer of funds from the old investment to the new investment.

- Reporting the exchange: Investors must report the 1035 exchange on their tax return using Form 1099-B.

Accord 1035 Exchange Form: What You Need to Know

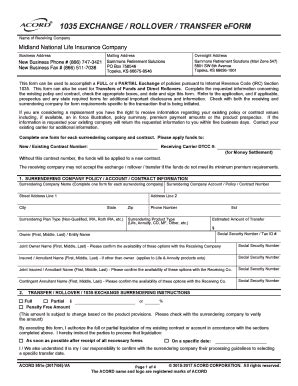

The Accord 1035 Exchange Form is a standardized document used to facilitate 1035 exchanges. The form requires investors to provide detailed information about the old and new investments, including:

• Policy or contract numbers • Investment values • Transfer amounts • Replacement investment details

Common Uses of 1035 Exchanges

1035 exchanges are commonly used in various situations, including:

• Replacing an existing life insurance policy with a new policy that offers improved benefits or lower premiums • Transferring funds from an annuity contract to a new contract with potentially higher returns • Consolidating multiple investments into a single, more manageable investment

Tax Implications of 1035 Exchanges

While 1035 exchanges are tax-deferred, there are certain tax implications to consider:

• Basis adjustment: The basis of the new investment will be adjusted to reflect the transfer of funds from the old investment. • Tax reporting: Investors must report the 1035 exchange on their tax return using Form 1099-B. • Potential tax liabilities: If the new investment is surrendered or withdrawn, investors may be subject to tax liabilities on the gains.

Best Practices for 1035 Exchanges

To ensure a successful 1035 exchange, investors should:

• Consult with a financial advisor: Seek the guidance of a qualified financial advisor to determine the best course of action for your specific situation. • Carefully review the exchange documents: Ensure that the Accord 1035 Exchange Form is completed accurately and thoroughly. • Monitor the exchange process: Verify that the transfer of funds is executed correctly and in a timely manner.

Common Mistakes to Avoid in 1035 Exchanges

Investors should be aware of common mistakes to avoid in 1035 exchanges, including:

• Incomplete or inaccurate documentation: Ensure that the Accord 1035 Exchange Form is completed accurately and thoroughly. • Failure to notify the insurance company: Notify the insurance company or annuity provider of your intention to execute a 1035 exchange. • Insufficient due diligence: Carefully review the replacement investment and ensure that it meets your financial goals and objectives.

Conclusion

In conclusion, 1035 exchanges offer a valuable tool for investors to reposition their investments without incurring tax liabilities. By understanding the benefits, mechanisms, and procedures involved in 1035 exchanges, investors can make informed decisions about their financial futures. Remember to consult with a financial advisor, carefully review the exchange documents, and monitor the exchange process to ensure a successful 1035 exchange.

What is a 1035 exchange?

+A 1035 exchange is a tax-deferred exchange that allows investors to transfer funds from one investment to another, typically from one life insurance policy or annuity contract to another.

What are the benefits of a 1035 exchange?

+The primary benefits of a 1035 exchange include tax-deferred growth, increased flexibility, and improved investment performance.

What is the Accord 1035 Exchange Form?

+The Accord 1035 Exchange Form is a standardized document used to facilitate 1035 exchanges, requiring investors to provide detailed information about the old and new investments.