The lending process can be a complex and time-consuming endeavor for both lenders and borrowers. With the abundance of paperwork, verification processes, and credit checks, it's easy to get bogged down in the details. However, what if there was a way to streamline this process and make it more efficient for everyone involved? Enter the AAR Prequal Form, a revolutionary tool designed to simplify the lending process and save time for lenders and borrowers alike.

In today's fast-paced financial landscape, lenders are looking for ways to reduce the time and effort required to process loan applications. The traditional lending process can be cumbersome, with multiple forms, lengthy credit checks, and tedious verification processes. This not only slows down the lending process but also increases the risk of errors and miscommunication. The AAR Prequal Form is designed to address these challenges by providing a simple, efficient, and accurate way to pre-qualify borrowers for loans.

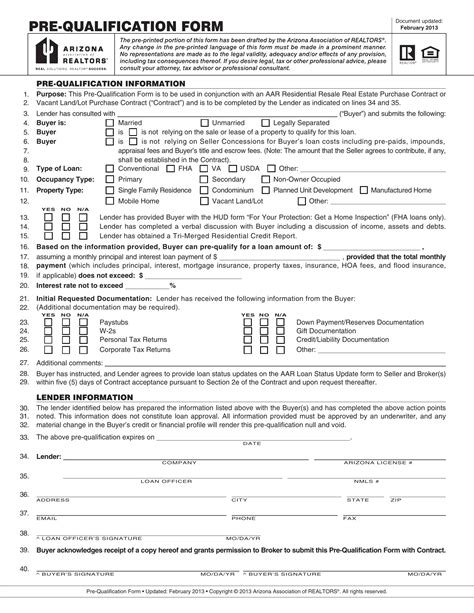

What is the AAR Prequal Form?

The AAR Prequal Form is a comprehensive and user-friendly tool that allows lenders to pre-qualify borrowers for loans quickly and efficiently. This form is designed to gather all the necessary information required to determine a borrower's creditworthiness and loan eligibility. By using the AAR Prequal Form, lenders can reduce the time and effort required to process loan applications, minimize errors, and improve the overall lending experience for borrowers.

Benefits of Using the AAR Prequal Form

The AAR Prequal Form offers a range of benefits for both lenders and borrowers, including:

- Reduced Processing Time: The AAR Prequal Form simplifies the lending process by gathering all the necessary information in one place, reducing the time and effort required to process loan applications.

- Improved Accuracy: By using a standardized form, lenders can minimize errors and ensure that all necessary information is collected, reducing the risk of miscommunication and errors.

- Enhanced Borrower Experience: The AAR Prequal Form provides a simple and user-friendly way for borrowers to provide information, reducing the stress and complexity associated with the lending process.

- Increased Efficiency: By automating the pre-qualification process, lenders can focus on higher-value tasks, such as underwriting and loan approval, increasing overall efficiency and productivity.

How Does the AAR Prequal Form Work?

The AAR Prequal Form is a straightforward and easy-to-use tool that can be completed by borrowers in a matter of minutes. Here's how it works:

- Borrower Completes the Form: The borrower completes the AAR Prequal Form, providing all the necessary information, including personal details, employment history, income, and credit information.

- Lender Reviews the Form: The lender reviews the completed form, verifying the information provided and assessing the borrower's creditworthiness.

- Pre-Qualification Decision: Based on the information provided, the lender makes a pre-qualification decision, determining whether the borrower is eligible for a loan and what terms and conditions may apply.

- Loan Application Processing: If the borrower is pre-qualified, the lender can proceed with processing the loan application, using the information provided in the AAR Prequal Form to streamline the process.

Key Features of the AAR Prequal Form

The AAR Prequal Form includes a range of key features that make it an essential tool for lenders and borrowers, including:

- Comprehensive Information: The form gathers all the necessary information required to determine a borrower's creditworthiness and loan eligibility.

- User-Friendly Interface: The form is easy to complete, with a simple and intuitive interface that makes it easy for borrowers to provide information.

- Automated Calculations: The form includes automated calculations, reducing errors and minimizing the time and effort required to complete the form.

- Customizable: The form can be customized to meet the specific needs of lenders, allowing them to gather the information they need to make informed lending decisions.

Benefits for Lenders

The AAR Prequal Form offers a range of benefits for lenders, including:

- Reduced Risk: By gathering comprehensive information, lenders can reduce the risk of lending to borrowers who may not be creditworthy.

- Increased Efficiency: The form automates the pre-qualification process, reducing the time and effort required to process loan applications.

- Improved Customer Experience: The form provides a simple and user-friendly way for borrowers to provide information, improving the overall lending experience.

- Compliance: The form helps lenders comply with regulatory requirements, ensuring that all necessary information is collected and verified.

Benefits for Borrowers

The AAR Prequal Form also offers a range of benefits for borrowers, including:

- Simplified Lending Process: The form simplifies the lending process, reducing the time and effort required to apply for a loan.

- Reduced Stress: The form provides a simple and user-friendly way for borrowers to provide information, reducing the stress and complexity associated with the lending process.

- Increased Transparency: The form provides borrowers with a clear understanding of the lending process and what information is required to make a lending decision.

- Faster Loan Approval: By automating the pre-qualification process, borrowers can receive faster loan approval, getting access to the funds they need quickly and efficiently.

Conclusion

In conclusion, the AAR Prequal Form is a powerful tool that simplifies the lending process, reducing the time and effort required to process loan applications. By gathering comprehensive information, automating calculations, and providing a user-friendly interface, the form offers a range of benefits for lenders and borrowers. Whether you're a lender looking to streamline your lending process or a borrower seeking a simpler way to apply for a loan, the AAR Prequal Form is an essential tool that can help you achieve your goals.

We hope this article has provided valuable insights into the AAR Prequal Form and its benefits for lenders and borrowers. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues, and let's work together to simplify the lending process.

What is the AAR Prequal Form?

+The AAR Prequal Form is a comprehensive and user-friendly tool that allows lenders to pre-qualify borrowers for loans quickly and efficiently.

How does the AAR Prequal Form work?

+The borrower completes the AAR Prequal Form, providing all the necessary information, including personal details, employment history, income, and credit information. The lender reviews the completed form, verifying the information provided and assessing the borrower's creditworthiness.

What are the benefits of using the AAR Prequal Form?

+The AAR Prequal Form offers a range of benefits, including reduced processing time, improved accuracy, enhanced borrower experience, and increased efficiency.