Filing a life insurance claim can be a daunting task, especially during a time of grief and loss. However, with the right guidance, the process can be made easier and less stressful. AAA Life Insurance is a reputable provider of life insurance policies, and their claim process is designed to be straightforward and efficient. In this article, we will walk you through the 5 easy steps to file a AAA Life Insurance claim form, ensuring that you receive the benefits you are entitled to in a timely manner.

Understanding the Importance of Filing a Claim

Before we dive into the step-by-step process, it's essential to understand why filing a claim is crucial. A life insurance policy is designed to provide financial protection to your loved ones in the event of your passing. By filing a claim, you ensure that your beneficiaries receive the death benefit, which can help them cover funeral expenses, outstanding debts, and other financial obligations.

Step 1: Gather Required Documents

To initiate the claim process, you will need to gather several documents, including:

- A copy of the policyholder's death certificate

- A completed claim form (available on the AAA Life Insurance website or by contacting their customer service)

- A copy of the policyholder's identification (driver's license or passport)

- A copy of the beneficiary's identification (driver's license or passport)

It's essential to ensure that all documents are accurate and complete, as any errors or omissions may delay the processing of your claim.

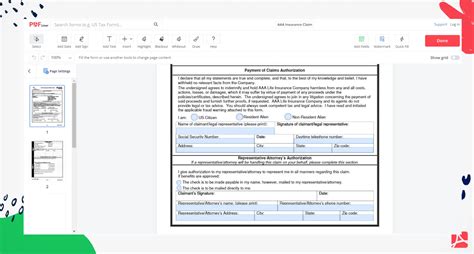

What to Expect from the Claim Form

The AAA Life Insurance claim form is designed to be user-friendly and easy to understand. The form will require you to provide information about the policyholder, the beneficiary, and the circumstances surrounding the death. You may also be asked to provide additional documentation, such as medical records or a police report, depending on the nature of the death.

Step 2: Submit the Claim Form

Once you have completed the claim form and gathered all required documents, you can submit the claim to AAA Life Insurance. You can do this by:

- Mailing the form and supporting documents to the address listed on the AAA Life Insurance website

- Faxing the form and supporting documents to the number listed on the AAA Life Insurance website

- Uploading the form and supporting documents to the AAA Life Insurance website (if available)

It's essential to keep a copy of the claim form and supporting documents for your records.

What Happens After Submitting the Claim

After submitting the claim, AAA Life Insurance will review the information and documentation provided. They may contact you or the beneficiary to request additional information or clarification on certain aspects of the claim.

Step 3: Wait for Claim Processing

Once AAA Life Insurance receives the claim, they will begin processing it. This can take several days or weeks, depending on the complexity of the claim and the speed at which they receive any additional information required.

During this time, you can contact AAA Life Insurance to check on the status of your claim. They will be able to provide you with updates on the progress and let you know if any additional information is required.

How Long Does Claim Processing Take?

The length of time it takes for AAA Life Insurance to process a claim can vary. However, they typically strive to process claims within 10-15 business days. If the claim requires additional information or documentation, it may take longer.

Step 4: Receive Claim Decision

Once AAA Life Insurance has completed processing the claim, they will make a decision regarding the payout. If the claim is approved, they will notify the beneficiary and provide instructions on how to receive the death benefit.

If the claim is denied, AAA Life Insurance will provide a written explanation of the reason for the denial and any additional information required to appeal the decision.

What to Do if the Claim is Denied

If the claim is denied, you have the right to appeal the decision. You can do this by:

- Reviewing the denial letter and understanding the reason for the denial

- Gathering any additional information required to support the claim

- Submitting an appeal to AAA Life Insurance, along with any supporting documentation

Step 5: Receive Death Benefit

If the claim is approved, AAA Life Insurance will provide the beneficiary with the death benefit. This can be paid in a lump sum or through an installment plan, depending on the policy terms and the beneficiary's preference.

It's essential to note that the beneficiary may need to provide additional documentation or information to receive the death benefit.

What to Do with the Death Benefit

The death benefit can be used to cover various expenses, such as funeral costs, outstanding debts, and living expenses. It's essential to use the funds wisely and consider seeking professional advice on managing the benefit.

By following these 5 easy steps, you can ensure that the AAA Life Insurance claim process is handled efficiently and effectively. Remember to stay organized, keep accurate records, and don't hesitate to contact AAA Life Insurance if you have any questions or concerns.

What is the AAA Life Insurance claim process?

+The AAA Life Insurance claim process involves gathering required documents, submitting the claim form, waiting for claim processing, receiving a claim decision, and receiving the death benefit if the claim is approved.

How long does it take to process a AAA Life Insurance claim?

+The length of time it takes to process a AAA Life Insurance claim can vary, but they typically strive to process claims within 10-15 business days.

What happens if my AAA Life Insurance claim is denied?

+If your AAA Life Insurance claim is denied, you have the right to appeal the decision. You can do this by reviewing the denial letter, gathering any additional information required, and submitting an appeal to AAA Life Insurance.

We hope this article has provided you with a comprehensive understanding of the AAA Life Insurance claim process. If you have any further questions or concerns, please don't hesitate to contact us.