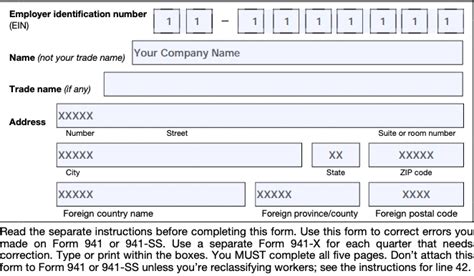

The 941x form is a crucial document for employers who need to make adjustments to their previously filed employment tax returns. It's used to correct errors or report changes in employment taxes, and it can be a complex and time-consuming process. However, with our fillable template, you can simplify the process and ensure accuracy.

The Importance of Accuracy When Filing 941x Forms

When filing a 941x form, accuracy is crucial to avoid penalties and interest. Even small mistakes can lead to delays and additional costs. Employers must ensure that all information is correct, including employee data, tax amounts, and payment dates. Our fillable template is designed to help you avoid common errors and ensure that your form is complete and accurate.

Benefits of Using a Fillable 941x Template

Using a fillable 941x template offers several benefits, including:

- Time savings: Our template is pre-formatted to match the official IRS form, saving you time and reducing the risk of errors.

- Accuracy: The template includes built-in calculations and validation rules to ensure that your form is accurate and complete.

- Easy editing: You can easily edit and update your form as needed, without having to start from scratch.

- Compliance: Our template is designed to meet IRS requirements, ensuring that your form is compliant and reduces the risk of rejection.

How to Fill Out the 941x Form

To fill out the 941x form, follow these steps:

- Gather required information: Collect all necessary documents and information, including your previously filed employment tax return, employee data, and tax amounts.

- Download our fillable template: Access our fillable 941x template and fill in the required information.

- Complete the form: Follow the instructions and complete the form, using the built-in calculations and validation rules to ensure accuracy.

- Review and edit: Review your form carefully and make any necessary edits before submission.

Common Errors to Avoid When Filing 941x Forms

When filing a 941x form, there are several common errors to avoid, including:

- Inaccurate employee data: Ensure that all employee information is accurate, including names, addresses, and Social Security numbers.

- Incorrect tax amounts: Verify that all tax amounts are correct, including withholding, Social Security, and Medicare taxes.

- Payment date errors: Ensure that payment dates are accurate and align with the IRS payment schedule.

Tips for Filing 941x Forms Efficiently

To file 941x forms efficiently, follow these tips:

- Use a fillable template: Our fillable template can save you time and reduce the risk of errors.

- Verify information: Double-check all information, including employee data and tax amounts, to ensure accuracy.

- Submit on time: Submit your form on time to avoid penalties and interest.

Conclusion

Filing a 941x form can be a complex and time-consuming process, but with our fillable template, you can simplify the process and ensure accuracy. By following the steps outlined above and avoiding common errors, you can file your 941x form efficiently and effectively.

We invite you to share your experiences and tips for filing 941x forms in the comments below. Your feedback can help others navigate this complex process.

What is a 941x form?

+A 941x form is used to make adjustments to previously filed employment tax returns.

Why is accuracy important when filing 941x forms?

+Accuracy is crucial to avoid penalties and interest. Even small mistakes can lead to delays and additional costs.

What are the benefits of using a fillable 941x template?

+The benefits include time savings, accuracy, easy editing, and compliance with IRS requirements.