Understanding the 540 2ez Form: A Simplified Approach to California Probate

Probate can be a daunting and complex process, especially for those who are dealing with the loss of a loved one. In California, the probate process can be lengthy and costly, but there is a simplified option available for smaller estates. The 540 2ez form is a probate form used in California for small estates, and it's designed to make the process easier and less expensive. In this article, we'll delve into the details of the 540 2ez form, its benefits, and how to use it.

What is the 540 2ez Form?

The 540 2ez form, also known as the "Petition for Probate of Small Estate," is a simplified probate form used in California for estates that meet certain requirements. This form is designed for estates with a total value of $166,250 or less, and it allows the executor or administrator to manage the estate without the need for a full probate court proceeding.

Benefits of Using the 540 2ez Form

Using the 540 2ez form can offer several benefits, including:

- Reduced costs: The 540 2ez form is a cost-effective way to probate a small estate, as it eliminates the need for a full probate court proceeding.

- Faster processing: The 540 2ez form is typically processed faster than a full probate proceeding, which can take several months or even years.

- Less paperwork: The 540 2ez form requires less paperwork and documentation than a full probate proceeding.

- Greater flexibility: The 540 2ez form allows the executor or administrator to manage the estate with greater flexibility, as they are not required to follow the same strict guidelines as a full probate proceeding.

Eligibility Requirements for the 540 2ez Form

To be eligible to use the 540 2ez form, the estate must meet the following requirements:

- The total value of the estate must be $166,250 or less.

- The estate must not include any real property, such as a house or land.

- The estate must not include any pending lawsuits or disputes.

- The estate must not have any outstanding debts or taxes owed.

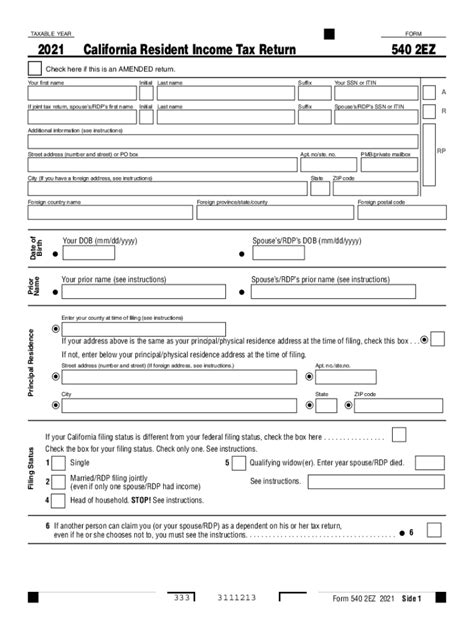

How to Complete the 540 2ez Form

Completing the 540 2ez form requires careful attention to detail and a thorough understanding of the probate process. Here are the steps to follow:

- Gather all necessary documents and information, including:

- The decedent's will, if applicable.

- A list of the decedent's assets, including their value.

- A list of the decedent's debts and taxes owed.

- The names and addresses of the decedent's heirs and beneficiaries.

- Fill out the 540 2ez form, making sure to include all required information and signatures.

- File the completed form with the California Superior Court in the county where the decedent lived.

- Pay the required filing fee, which currently stands at $435.

- Serve the petition on all interested parties, including the heirs and beneficiaries.

- Wait for the court to process the petition and issue a decision.

Common Mistakes to Avoid When Using the 540 2ez Form

While the 540 2ez form is designed to be a simplified probate option, there are still several common mistakes to avoid:

- Failing to include all required information and signatures.

- Failing to file the petition with the correct court.

- Failing to serve the petition on all interested parties.

- Failing to pay the required filing fee.

- Failing to follow the court's instructions and guidelines.

Alternatives to the 540 2ez Form

While the 540 2ez form is a viable option for small estates, there are alternative options available, including:

- Full probate proceeding: This is the traditional probate process, which involves a full court proceeding and can be more time-consuming and expensive.

- Small estate affidavit: This is a simplified probate option that allows the executor or administrator to manage the estate without a court proceeding.

- Trust administration: If the decedent had a trust, the trustee can manage the estate without the need for probate.

Conclusion

The 540 2ez form is a simplified probate option available in California for small estates. While it can be a cost-effective and efficient way to probate an estate, it's essential to carefully follow the instructions and guidelines to avoid common mistakes. By understanding the benefits and eligibility requirements of the 540 2ez form, you can make an informed decision about whether it's the right option for your specific situation.

We hope this article has provided valuable information about the 540 2ez form and the California probate process. If you have any further questions or concerns, please don't hesitate to reach out.

What is the 540 2ez form used for?

+The 540 2ez form is used for small estates in California, with a total value of $166,250 or less.

How do I complete the 540 2ez form?

+To complete the 540 2ez form, you'll need to gather all necessary documents and information, fill out the form, and file it with the California Superior Court.

What are the eligibility requirements for the 540 2ez form?

+The estate must meet certain requirements, including a total value of $166,250 or less, no real property, no pending lawsuits or disputes, and no outstanding debts or taxes owed.