As a responsible citizen, it's essential to understand your tax obligations and the various exemptions available to you. One such exemption is the Form 51A380, which can help you save a significant amount on your tax liability. However, navigating the complexities of tax laws can be daunting, and it's crucial to have a clear understanding of the exemption facts. In this article, we'll delve into the world of Form 51A380 and uncover the 5 essential tax exemption facts you need to know.

Understanding Form 51A380

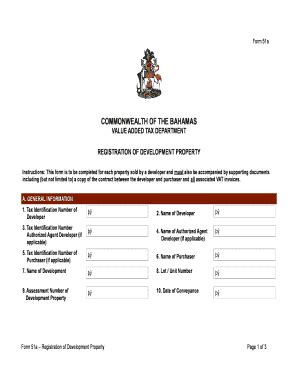

Before we dive into the exemption facts, it's essential to understand what Form 51A380 is and its purpose. Form 51A380 is a tax exemption form used by individuals and businesses to claim exemptions on their tax liability. The form is used to report income that is exempt from taxation, and it's an essential document for anyone looking to minimize their tax burden.

Fact #1: Eligibility Criteria

To qualify for the Form 51A380 tax exemption, you must meet specific eligibility criteria. The exemption is available to individuals and businesses that have a gross income below a certain threshold. For the current tax year, the threshold is $50,000 for single filers and $75,000 for joint filers. Additionally, you must have a tax liability of at least $1,000 to qualify for the exemption.

Benefits of Form 51A380

The Form 51A380 tax exemption offers several benefits to eligible individuals and businesses. Some of the benefits include:

- Reduced tax liability: By claiming the exemption, you can significantly reduce your tax liability, which can result in a lower tax bill.

- Increased cash flow: With a lower tax bill, you'll have more cash available to invest in your business or personal endeavors.

- Simplified tax filing: The Form 51A380 exemption can simplify your tax filing process, as you'll only need to report exempt income.

Fact #2: Exempt Income Types

The Form 51A380 exemption applies to specific types of income, including:

- Interest income from savings accounts and certificates of deposit (CDs)

- Dividend income from qualified stocks

- Capital gains from the sale of qualified assets

- Royalty income from intellectual property

It's essential to note that not all income types are eligible for the exemption, and you should consult with a tax professional to determine which types of income qualify.

How to Claim the Exemption

Claiming the Form 51A380 exemption is a straightforward process that requires you to file the form with your tax return. Here are the steps to follow:

- Determine your eligibility: Review the eligibility criteria and ensure you meet the requirements.

- Gather required documents: Collect all necessary documents, including proof of income and tax liability.

- Complete Form 51A380: Fill out the form accurately and completely, ensuring you report all exempt income.

- Attach supporting documents: Attach all supporting documents to your tax return, including Form 51A380.

Fact #3: Deadline for Filing

The deadline for filing Form 51A380 is the same as your tax return deadline. For individual taxpayers, the deadline is typically April 15th of each year. For businesses, the deadline is typically March 15th or April 15th, depending on the type of business entity.

Fact #4: Penalties for Non-Compliance

Failure to file Form 51A380 or accurately report exempt income can result in penalties and fines. The IRS may impose a penalty of up to 20% of the underreported tax liability, in addition to interest on the unpaid tax.

Fact #5: Tax Planning Strategies

The Form 51A380 exemption can be an essential part of your tax planning strategy. By understanding the exemption facts and eligibility criteria, you can make informed decisions about your tax planning. Some tax planning strategies to consider include:

- Deferring income: Deferring income to a future tax year can help you qualify for the exemption.

- Investing in qualified assets: Investing in qualified assets, such as stocks and real estate, can help you generate exempt income.

- Consulting a tax professional: A tax professional can help you navigate the complexities of tax laws and ensure you're taking advantage of all available exemptions.

Conclusion

In conclusion, the Form 51A380 tax exemption is a valuable benefit for eligible individuals and businesses. By understanding the 5 essential exemption facts, you can make informed decisions about your tax planning and minimize your tax liability. Remember to consult with a tax professional to ensure you're taking advantage of all available exemptions and to avoid any potential penalties.

What is Form 51A380?

+Form 51A380 is a tax exemption form used by individuals and businesses to claim exemptions on their tax liability.

Who is eligible for the Form 51A380 exemption?

+Individuals and businesses with a gross income below a certain threshold and a tax liability of at least $1,000 are eligible for the exemption.

What types of income are eligible for the exemption?

+Interest income, dividend income, capital gains, and royalty income from qualified sources are eligible for the exemption.