As the tax season approaches, millions of Americans are scrambling to gather their financial documents and make sense of the complex tax code. One of the most critical documents in this process is the 2019 tax form, also known as the Form 1040. In this article, we will delve into the intricacies of the 2019 tax form, explaining the various sections, deductions, and credits that you need to know about.

Understanding the basics of your tax form is essential to ensure that you take advantage of all the deductions and credits you are eligible for. This, in turn, can help reduce your tax liability and maximize your refund. In this article, we will provide a comprehensive guide to the 2019 tax form, including the changes and updates that you need to be aware of.

What's New in the 2019 Tax Form?

The 2019 tax form includes several changes and updates, including the Tax Cuts and Jobs Act (TCJA) provisions that went into effect in 2018. Some of the key changes include:

- Increased standard deductions: The standard deduction for single filers has increased to $12,000, while joint filers can claim a standard deduction of $24,000.

- Elimination of personal exemptions: The TCJA eliminated personal exemptions, which were previously $4,050 per person.

- Changes to itemized deductions: The TCJA limited state and local tax (SALT) deductions to $10,000 and eliminated miscellaneous itemized deductions.

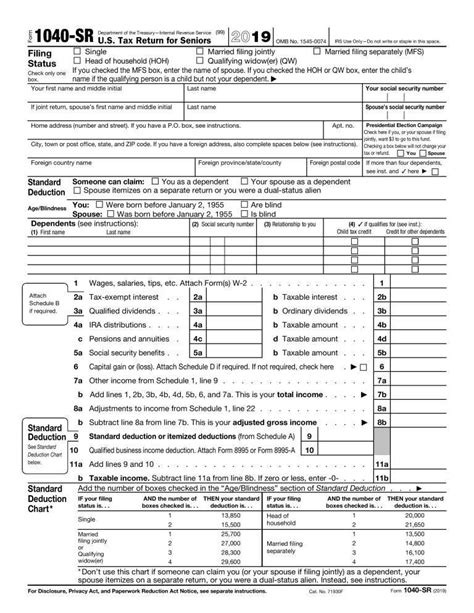

Understanding the Different Sections of the 2019 Tax Form

The 2019 tax form is divided into several sections, each with its own set of instructions and requirements. Here's a brief overview of each section:

- Section 1: Filing Status and Exemptions: This section asks for your filing status, which determines your tax rates and deductions. You will also claim your dependents and exemptions in this section.

- Section 2: Income: This section reports your income from various sources, including wages, salaries, tips, and self-employment income.

- Section 3: Adjustments to Income: This section allows you to claim adjustments to your income, such as student loan interest deductions and educator expenses.

- Section 4: Tax Credits and Payments: This section reports your tax credits and payments, including the earned income tax credit (EITC) and child tax credit.

Claiming Deductions and Credits on Your 2019 Tax Form

Deductions and credits can significantly reduce your tax liability and increase your refund. Here are some of the most common deductions and credits you can claim on your 2019 tax form:

- Standard Deduction: The standard deduction is a fixed amount that you can claim without itemizing your deductions. For 2019, the standard deduction is $12,000 for single filers and $24,000 for joint filers.

- Itemized Deductions: Itemized deductions allow you to claim specific expenses, such as mortgage interest, charitable donations, and medical expenses.

- Earned Income Tax Credit (EITC): The EITC is a refundable tax credit for low-income working individuals and families.

- Child Tax Credit: The child tax credit is a non-refundable tax credit for families with qualifying children.

How to Fill Out Your 2019 Tax Form

Filling out your 2019 tax form can be a daunting task, but with the right guidance, you can ensure that you take advantage of all the deductions and credits you are eligible for. Here's a step-by-step guide to filling out your 2019 tax form:

- Gather your financial documents, including your W-2 forms, 1099 forms, and receipts for deductions and credits.

- Determine your filing status and exemptions.

- Report your income from various sources.

- Claim adjustments to your income, such as student loan interest deductions and educator expenses.

- Claim tax credits and payments, including the EITC and child tax credit.

- Itemize your deductions or claim the standard deduction.

- Review and sign your tax form.

Common Mistakes to Avoid When Filing Your 2019 Tax Form

When filing your 2019 tax form, it's essential to avoid common mistakes that can delay your refund or trigger an audit. Here are some of the most common mistakes to avoid:

- Math errors: Math errors can delay your refund or trigger an audit. Double-check your calculations to ensure accuracy.

- Incorrect filing status: Make sure you claim the correct filing status, as this determines your tax rates and deductions.

- Missing or incorrect Social Security numbers: Ensure that you include the correct Social Security numbers for yourself, your spouse, and your dependents.

- Failure to report income: Report all your income from various sources, including wages, salaries, tips, and self-employment income.

Conclusion

Understanding your 2019 tax form is essential to ensure that you take advantage of all the deductions and credits you are eligible for. By following the guidelines outlined in this article, you can navigate the complex tax code and maximize your refund. Remember to avoid common mistakes, such as math errors and incorrect filing status, and seek professional help if you need assistance with your tax form.

What is the deadline for filing my 2019 tax form?

+The deadline for filing your 2019 tax form is April 15, 2020. However, you can file for an extension if you need more time to gather your financial documents.

Can I file my 2019 tax form electronically?

+Yes, you can file your 2019 tax form electronically using tax software or the IRS Free File program.

What is the penalty for not filing my 2019 tax form?

+The penalty for not filing your 2019 tax form can be up to 47.6% of your unpaid taxes, including a 22.5% late payment penalty and a 20% accuracy-related penalty.