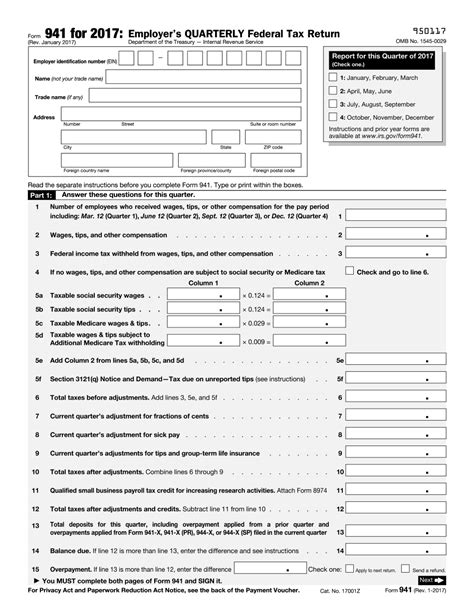

Employers who pay wages subject to income tax withholding or Social Security and Medicare taxes are required to file Form 941, Employer's Quarterly Federal Tax Return. This form is used to report employment taxes, and it's essential to fill it out accurately to avoid any penalties or fines. In this article, we'll provide you with 5 tips for filling out the 2017 Form 941.

The Importance of Accurate Reporting

Before we dive into the tips, it's essential to understand the importance of accurate reporting on Form 941. The IRS uses the information reported on this form to determine the employer's tax liability, and any errors or discrepancies can lead to penalties, fines, or even an audit. Therefore, it's crucial to take the time to ensure that the form is filled out correctly.

Tip 1: Verify Employer Information

The first section of Form 941 requires employers to provide their identification information, including their name, address, and Employer Identification Number (EIN). It's essential to verify that this information is accurate and up-to-date. Make sure to check the spelling of the employer's name, and ensure that the address is correct. If the employer has recently changed their address, make sure to update it on the form.

Tip 2: Calculate Tax Liability Correctly

Calculating Tax Liability

Calculating tax liability is one of the most critical parts of filling out Form 941. Employers must calculate their tax liability based on the wages paid to employees during the quarter. The tax liability includes income tax withholding, Social Security tax, and Medicare tax. To calculate tax liability correctly, employers must follow these steps:

- Calculate the total wages paid to employees during the quarter

- Calculate the income tax withholding based on the wages paid

- Calculate the Social Security tax based on the wages paid

- Calculate the Medicare tax based on the wages paid

- Add the income tax withholding, Social Security tax, and Medicare tax to determine the total tax liability

Tip 3: Report Adjustments and Credits

Employers may need to report adjustments and credits on Form 941. Adjustments include refunds, abatements, or credits that reduce the employer's tax liability. Credits include the credit for COBRA premium assistance payments and the credit for qualified small business payroll taxes. Employers must report these adjustments and credits in the designated sections of the form.

Tip 4: Complete Schedules and Attachments

Completing Schedules and Attachments

Form 941 requires employers to complete schedules and attachments, including Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors, and Schedule R, Allocation Schedule for Aggregate Form 941 Filers. Employers must complete these schedules and attachments accurately and attach them to the form.

Tip 5: File Form 941 On Time

The final tip is to file Form 941 on time. The due date for filing Form 941 is the last day of the month following the end of the quarter. For example, the due date for the first quarter (January 1 - March 31) is April 30. Employers who fail to file Form 941 on time may be subject to penalties and fines.

In conclusion, filling out Form 941 requires attention to detail and accuracy. By following these 5 tips, employers can ensure that they report their employment taxes correctly and avoid any penalties or fines. Remember to verify employer information, calculate tax liability correctly, report adjustments and credits, complete schedules and attachments, and file Form 941 on time.

What is the purpose of Form 941?

+Form 941 is used to report employment taxes, including income tax withholding, Social Security tax, and Medicare tax.

What is the due date for filing Form 941?

+The due date for filing Form 941 is the last day of the month following the end of the quarter.

What happens if I fail to file Form 941 on time?

+Employers who fail to file Form 941 on time may be subject to penalties and fines.